NWFA Expo 2025: The annual expo showcases new species and other product trends – May 2025

By Jennifer Bardoner

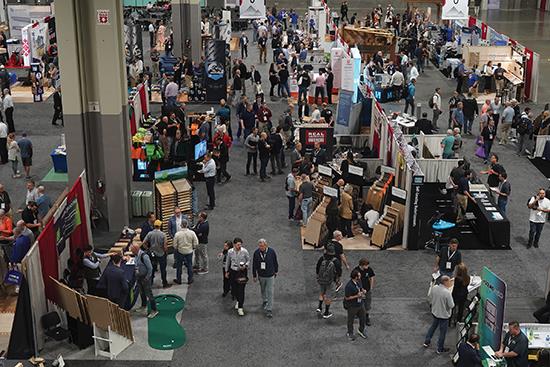

In mid-April, the National Wood Flooring Association (NWFA)’s annual Wood Flooring Expo drew 2,500 attendees to Charlotte, North Carolina, putting the 2025 event on par with pre-pandemic expos. Exhibitor space was sold out with 232 companies on the show floor, and energy was high.

The higher end of the flooring market has been less affected by economic conditions since more affluent consumers have discretionary cash, and when polled about their sales outlook for 2025, 69% of NWFA members said they expect to be up this year, with 27% anticipating growth of 8% or more. While tariffs were a topic of conversation on the show floor, which welcomed a host of Canadian and other foreign exhibitors in addition to American suppliers, attitudes were still generally optimistic but with some level of uncertainty.

The event marked the NWFA’s 40th anniversary and, fittingly, the theme was “Go the Distance.”

In attendance was actor Gary Sinise. For ten years, the NWFA has partnered with his Gary Sinise Foundation to provide wood flooring for smart homes for severely wounded veterans and first responders through the foundation’s R.I.S.E. program. Sinise thanked the NWFA and its members for their generosity, which has supplied real wood flooring, logistics and installation services for 86 R.I.S.E. homes throughout the United States.

Next year’s expo will take place April 21 to 23 in Orlando, Florida.

PRODUCT TRENDS

Introductions that allow for patterned installations were present in just about every booth -in an NWFA poll, the majority of members (52%) reported installing more herringbone/chevron. Members also said they anticipate continued growth in premium engineered offerings featuring long, wide planks.

This year, AHF is adding unfinished engineered products to its portfolio. Armstrong dropped unfinished offerings 30-some years ago but their new owner, AHF is now returning to the category.

“Just like engineered is the fastest-growing wood category, there is a belief that unfinished engineered will do the same,” said AHF vice president Milton Goodwin. “You can put it anywhere in the house, and formats can go wider and longer.”

“The unfinished market used to be decent, but it evaporated because of vinyl and had to redefine itself,” said Mullican president Pat Oakley, pointing to Mullican’s Shenandoah unfinished solid introduction, which comprises 2-1/4” red and white oak.

A fair amount of NWFA members reported that they expect to see growth in solid wood options, as well as factory-finished products.

There was a general trend toward additional species, with many exhibitors rolling out hickory and maple introductions.

“Maple is coming back, especially in California-there’s so much white oak in the market,” said Mirage marketing communications manager Anne-Marie Quirion.

Those species are also more prevalent in North America, helping alleviate supply chain issues and concerns. Similarly, many producers continue working to perfect methods that make red oak, the predominant North American species, look more like white oak by muting the pink undertones.

As suppliers seek alternatives for white oak, there were several Brazilian exhibitors highlighting tauari, or Brazilian oak, which has a similar appearance. Jason Elbert, vice president of North American sales and marketing for Brazilian manufacturer Indusparquet, reported that Brazilian importers are seeing an uptick in interest amid Trump’s trade war with China. And he noted that, while Asian producers can sometimes offer a better price by exporting the wood for production in Asia, when it acclimates in its home environment, it dries into a denser construction, making it stronger and less likely to experience installation issues.

Tariffs were a trending topic of conversation, though most emphasized that wood-based products are currently exempt, and they’re hoping cooler heads will prevail.

“Most people don’t recognize that some of the lumber being manufactured in Canada is coming out of the U.S.,” said Wade Bondrowski, director of U.S. sales for Canada-based Mercier, which “still believes in U.S. distribution,” he added.

Mullican’s Oakley reported that the Tennessee firm is seeing more interest because of its domestic production, which allows for more timely service, more consistent pricing and a worry-free supply chain.

Kährs, a Sweden-based manufacturer, recently began U.S. operations, though that was before tariffs became the talk of the town. Kährs Americas president Sean Brennan noted the service and environmental benefits of being closer to key customers. Since President Trump’s tariffs proposals, the company has been strategizing. Brennan reported that the firm could import white oak veneers within a couple of months if needed to shore up its U.S. production.

PRODUCT HIGHLIGHTS

AHF’s new unfinished offerings are available in red and white oak. The solid formats are 100% select grade, and the engineered formats will gain select-grade offerings this summer. The engineered formats are waterproof for up to eight hours through Hydropel technology, and customers can opt for

additional protection for up to 36 hours. Whereas unfinished offerings generally top out around 5” wide, AHF’s can go up to 9” with its Cambodian production and 7-1/2” with its Kentucky production. In July, the company purchased two sawmills, so it is now vertically integrated.

Preverco is focusing on making red oak more fashionable looking through combinations of different staining processes. And in February, the Canadian producer launched a 1/2” engineered addition to its flagship Flex line, which follows the contours of the subfloor-a challenge with drop-lock products that can lead to failures. Because the product is contoured, it also helps with acoustics.

Kährs showcased new launches from both Europe and America, the latter of which represents the first real investment in planks from the United States. The U.S.-made Estate collection features mid-toned oaks plus a wide-ranging assortment of hickory and maple, new species for the Sweden-based producer. The Renaissance collection out of Europe features planks composed of intersecting boards, which creates a modern parquet pattern when installed.

Somerset/Boen has partnered with Sherwin-Williams and developed “Red Out” technology to give red oak a similar look to white oak, addressing availability and cost concerns. The hope is to compete pricewise with LVT while utilizing a species prevalent in the U.S. to give consumers the clean grains and hues they’re seeking. The firm has also created a refined set of on-trend stain colors, and Somerset will begin an annual process of updating its color palette with feedback from the paint producer. The stains will also be made available in Sherwin-Williams stores to support installers and grow Somerset’s brand awareness with that key demographic, as well as with consumers.

Mirage showcased its new DurAlive finish, which will be standard on two collections: Lively, an oak offering; and Autumn, a maple with a smooth finish. Both include options for herringbone and natural coloration, but the super-matte finish does not muddy even darker stain colors, a common complaint with traditional matte coatings. It provides enhanced scratch resistance without adding a subtle shine. The Canadian producer has cleaned up and restructured its lines to simplify the sales process-each collection now has one species, finish and texture, allowing customers to focus on picking their color, grade (character or exclusive) and platform.

Bjelin showcased a new clickable patterned offering whose 5G drop-lock allows for DIY installations. The Woodura introduction offers multiple pattern options, including herringbone and parquet, in a single SKU. And its densified composition allows for use in commercial settings-it was installed in the Dogwood restaurant in the Westin across the street from the convention center. Currently available as 3-1/2”x21-1/2” in Bjelin’s three most popular colors, it will expand in 2026.

Mullican’s new Mystic Grove collection offers a tight assortment of lightly brushed solid hickory, a relatively new species for the Tennessee producer. The 3” wide planks are up to 84” long and target an accessible price point.

Mercier-celebrating its 45th anniversary this year-showcased products with its new Generations+ finish, which provides enhanced cleanability and ten times more scratch resistance while maintaining color clarity. The UV-cured finish consists of densified polymer molecules, which prevent stains and dirt from settling in. Offered for both residential and commercial applications, Generations+ matches the Canadian producer’s existing Generations finish, so that boards can be seamlessly swapped in or out.

Johnson Hardwood displayed two new 3/8” wide collections, Texas Timber and Countryside Oak, which target a price point that is hoped will help transition builders from SPC. The European oak collections are Texas focused, with some fuming and depth, but approachable for the wider market. Johnson is going direct again in the state, versus through distribution, and it represents a large market.

Lauzon added patterned offerings in white oak in three different platforms and constructions. Available in two colors-but with the option for custom with a minimum order of 400 square feet-the new Lauzon Collection products are available in both character and select grades. The French producer began updating its color palettes in January to encompass earthy colors and beige browns.

Though BTP Floors is 30 years old, this was the Brazilian producer’s first time exhibiting at the expo. The second-generation, family-owned company is integrated from the forest to the products, which are made from native species. Having added engineered offerings last year to its lineup of solid wood and decking, BTP highlighted its engineered Brazilian oak collection. Distributors can order through BTP’s New Jersey warehouse or import direct from Brazil.

MP Global showcased its new AquaLayer underlayment, which wicks away moisture from both the subfloor and top surface and disperses it over time so that no damage is done to the floor. President Al Collison noted the benefits particularly in the homebuilder market, which is often challenged by timelines that don’t allow for proper cure time of the concrete slab.

Indusparquet was at the expo seeking new OEM and distribution partners. Based in Brazil, where it has two mills, the producer works with indigenous South American species and has private label offerings with the National Floorcovering Alliance (NFA), which were on display. The NFA’s program recently expanded to include Brazilian oak, in addition to traditional exotics. The manufacturer promises product exclusivity, whether through the tweaking of colors and/or gloss levels, for example, or by region for distribution. It has partnerships with UCX, Herregan and Galleher.

Members were recognized during the opening ceremony for both service and craftsmanship.

2025 NWFA Service Awards

Ambassador Award: Jorge Perez, Epic Hardwood Floors

Community Service Award: Ashley and Jeff Do Carmo, Brown Oaks Flooring

Hall of Fame Award: Sprigg Lynn, Universal Floors

Hall of Fame Award: Neil Moss

Vanguard Award: Steven Skutelsky, PID Floors

2025 NWFA Wood Floor of the Year Awards

Best in Circles/Curves/Bent Wood: J.L. Vivash Custom Wood Floors

Best in Color/Finish and Textured Wood: Custom Floors Unlimited

Best Historic Restoration: Universal Floors

Best in Marquetry/Inlays: Custom Floors Unlimited

Best Parquetry: All American Floor Sanding and Installation

Best Use of Technology: MP Caroll Hardwood

Best Staircase: Henschen Hardwood

Manufacturer Spotlight: Woodwright Hardwood Floors

Members’ Choice: Grain Design Flooring

Copyright 2025 Floor Focus

Related Topics:AHF Products, NWFA Expo, National Flooring Alliance (NFA), RD Weis, Mirage Floors, Armstrong Flooring