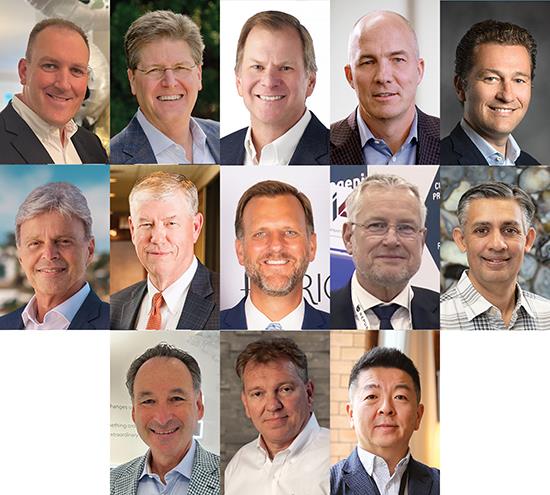

Looking Ahead With Today’s Leaders: Current leaders offer their thoughts on the strengths, opportunities and future of the flooring business - Aug/Sept 2022

By Jessica Chevalier

What developments would you like to see in the industry within the next five years, and what changes are needed to get there?

BENJAMIN BACHMAN: Our industry needs to become more progressive and less traditional. When I started 25 years ago, it wasn’t progressive at all, and no one was questioning it. We have made some significant strides in that, but it takes a decade or two to see something significant happen. We need to make these changes to be more attractive to a new generation; this includes creating an inclusive environment, incorporating technology and generating significant disruption. We need to be doing business in a very different way. And accepting that reality is key to moving forward.

THOMAS TRISSL: While the world around us has changed in so many ways, the flooring industry seems very often to be stuck in the ’90s, ’80s or even back in the ’70s.

There is still a need for top-quality, service-oriented distributors who work hand-in-hand with manufacturers. In addition, the use of state-of-the-art technology must become the norm. Order processing, logistics challenges, delivery schedules-all those things can be provided with more technology, apps and digital influences.

Lastly, manufacturers too often shadow their competition, focusing on imitating what their neighbor is doing, taking very little risk or spice, rather than creating new and exciting things. New sustainable products and systems are of need.

CARL DELIA: The installer trades that support our segment are retiring or coming to retirement age without a strong influx of new craftspeople to take their places. Technical solutions that provide simpler and faster ways of installing tile could open the labor pool options. In addition, it would be beneficial to the category if the manufacturers and industry partners worked together with a consolidated effort to provide vocational training coursework at the high school and community college or trade school level, perhaps even partnering with the National Tile Contractors Association on the creation of specialized training centers.

The health of the flooring community is only as good as our ability to install our many fine products. A rotating advisory committee should be established to lead this objective and solicit all relevant industry partners to subsidize these activities.

ERIC DALIERE: As an industry, we’ve made good progress with innovating flooring products that benefit both people and the planet, but we have more work to do. Tarkett’s goal is to source 30% of its raw materials from recycled content by 2030-that’s on a global scale.

HARLAN STONE: I would like to see the industry have a greater focus on sustainably in all of its various forms-from initial materials to recycling to reducing transportation costs. We should be thinking of sustainability as something that is integral to the design of our products. Our industry should focus on this both to capture future customers and take responsibility for building materials’ impact on the environment.

JOHN WU: I would like to see our industry focus more on a circular economy, which has a direct and significant impact on minimizing our impact on climate change. Novalis has been fortunate to be in a growing industry and the fastest-growing product category for the last ten to 15 years; our products are durable, but they end up in the landfill today. As an industry, we need to work more closely together and develop faster solutions to help us get to cradle-to-cradle recycling for LVT, SPC and WPC.

RAJ SHAH: The major development would be continuing to improve the sustainability and environmental profile of most flooring types today. Most flooring materials are heavy users of non-renewable raw materials. In addition, the transportation cost of flooring is high due to the weight. Numerous innovations need to come in the form of using renewable materials and educating the consumer on the value of this. In addition, to the extent we can reduce the weight of materials through innovation, transportation costs reduce. A lot of work is going into this today, so I’m hoping there will be many announcements as it relates to environmental innovation over the next five years.

BRIAN CARSON: Notwithstanding the softening we are seeing right now, the residential business is going to see growth for the next five years, driven by population growth. While we are currently building, America will still be structurally underbuilt for the next five years. And though interest rates may affect cost, home equity values will be a high level, so the residential market will grow. In commercial, Covid was devastating. But the market is coming back-office more slowly than healthcare and education-and the commercial side will have steady growth from here, because it fell off so much. Where will the flooring capacity come from to support this growth? China isn’t the clear answer anymore with its freight issues and tariff uncertainties.

RUSSELL GRIZZLE: I would love to see a return to normalcy, some calm: fewer fluctuations in pricing; a return to stability with supply and labor; a leveling in market demand; the ability to focus on product, serving our customers and caring for our employees like we did a few years ago.

Over the longer haul, with regard to LVT, while there is always a place for sourcing, I think manufacturing in the U.S. will be a trend. We have great supply partners, but very long supply chains make things harder in an environment like this. Onshoring provides security and allows us to provide jobs and support our communities.

TIM BAUCOM: We’ve seen flooring take a higher profile in commercial spaces, squeezing out some other fixtures and finishes. I’d like to see residential flooring take share from other building materials: countertops and backsplashes, doorbells and entry fixtures, outdoor space, for example. As an industry, how do we compete with other industries? We need to create the desire for flooring to be a showcase.

JOHN RIETVELDT: All industries are competing for the same dollar every day. We need to keep working to make our industry more attractive compared to other industries, such as home appliances and furniture.

Continuous innovation, unlimited design possibilities, easy replaceability, a focus on sustainability and partnerships are the key words. Bringing new products to the market with new technologies at an accelerated pace will be vital, and, of course, the easier and faster you can replace your product, the bigger the chance that you will obtain a higher percentage of the consumer spend.

When it comes to sustainability, there is a big task at hand. Several areas need to be addressed and worked on by the flooring industry as a whole. This includes the development of more sustainable material compositions, material savings in general, reduction of carbon footprints and the ability to recycle products, both in the way the product has been designed as well as in the process for how to collect “old “ products.

The only way to get there is close collaboration between all parties in the value chain. We need to keep bringing down walls and barriers in order to work together as a unified industry. In principle, every company should have its own individual objectives and goals, but we also need a few industry-wide targets. We should move away from the traditional supplier-customer relationship to partnerships with shared objectives.

TM NUCKOLS: In the soft surface segment, I would like to see the industry do a better job promoting and marketing the benefits of carpet to the consumer. Carpet has so many great attributes; it is softer, quieter, warmer, more comfortable and less prone to cause injuries from slips and falls. And today’s carpets are beautiful and can complement any home décor. Most retailers prefer selling carpet. If we can promote the benefits of carpet and help the consumer visualize how beautiful today’s carpet will look in their home, I believe carpet can regain a little bit of the floor share that has been lost over the past ten years or so.

In hard surfaces, I hope to see a continued expansion of domestically manufactured products. “Made in the USA” can promote a sense of pride through the value chain all the way to the consumer. And increased domestic capacity will help ease the impact of tariffs and logistics challenges we have all faced in the post-Covid world. To get there will take time and require investment on the part of manufacturers.

What are the biggest challenges to the future health of this industry, and what are some strategies to overcome these challenges?

PAUL DE COCK: One of the greatest challenges our industry faces is the aging of the store owners/operators and the skilled laborers who provide installation services. One of the most impactful ways to overcome this challenge is to rejuvenate our industry by applying new technologies and implementing strategies to make our work more productive, fully embracing digitalization. It is also critical to implement and improve our digital sales strategies to continuously improve how products are being found by consumers and purchased online.

In relation to that, we must consider the Gen Z consumers coming into the market. There is a significant age gap between the consumer of the future and many of the individuals that heavily influence the products the flooring industry has to offer and how they are offered. We have to strike the balance of retaining invaluable legacy knowledge in our industry while positioning our business for the next generation of consumers.

CARSON: The biggest challenge over the next five is the same as the last five: skilled labor, trades folks who install and make a living that way. There is only so much of the market that is DIY. We have to do a better job drawing people into installation.

Challenge number two is the need for additional flooring manufacturing capacity around the world. Homes in the U.S. are getting older, so the needs are greater. Where do manufacturers invest to support growth in the business? With all the uncertainty with tariffs and the like, it keeps growth in freeze frame, and that lack of clarity is not helpful for the growth of the industry. It takes years to get ROI on capacity-and the industry will need it.

WU: More end users and consumers today are demanding to know the truth about each product, not only from the safety/health perspective but also the long-term environmental impact. That’s why EPDs and Declare labels are becoming so important. If we ignore this demand, we will become irrelevant as a product category. The industry must act together and act fast.

STONE: Commoditization. We must create high-performing products to overcome the tendency toward commoditization, keeping quality standards high. How do you fight inflation while maintaining quality and performance? Innovation is the recipe to face that challenge. What will commoditize? Carpet, laminate, ceramic and maybe even hardwood and stone, even though they are natural products. What won’t commoditize are segments of the industry that rely on innovation.

BACHMAN: One of the biggest challenges we see now is getting people to work in manufacturing and on jobsites as installers. The construction industry has had this difficult situation for a while, and, unfortunately, everyone is wondering why. I don’t have the answer, but I believe it’s many things combined. One is immigration, which has slowed considerably for two years.

Do I think this challenge will remain? Yes, it isn’t new. The industry has invested in training installers and turning students into installers, but we are now seeing that we haven’t done enough to make a career in construction and manufacturing appealing. The way we, from a strategy perspective, work to overcome that includes creating a cleaner product that is easier to install. If it is clean to install, simple and doesn’t have a terrible smell, we are moving in the right direction to attract more people.

In addition, a circular economy isn’t an option anymore. Everyone should embrace it and invest heavily.

DELIA: The greatest challenge continues to be the skilled labor shortage for installation. We see some movement to LVP not necessarily due to preference or price, but due to the ease of installation and the ability to utilize non-skilled labor. In addition, there is an opportunity for the industry to develop easier-to-install products while also helping to build the labor force. The economic situation and the rise in interest rates have already influenced new-home contracts and will also start to affect the remodel market. It may be offset by multifamily and build-to-rent opportunities, but they tend to be lower-margin, basic products and more likely to include LVT/LVP.

Another challenge is that there are manufacturers and contractors competing solely on price. Our industry is complex, and it is critical that service and knowledge are also provided to ensure a successful long-term installation.

SHAH: The biggest challenge remains the installation side of flooring. In most cases, the total cost of flooring is approximately 75% installation and 25% material costs. This is dictated by a very tight labor market as it relates to installers. Ultimately, the way to improve on this is to find easy-to-install technologies with flooring and increase the size of the labor pool. To do this will require changes in education, training, immigration policies and more.

TRISSL: Outside the flooring industry, the economy is undergoing a significant reset, mostly with regard to inflation rather than with labor markets. Prices are being impacted by the money pumped into the economy, most notably in recent years but over the past decade as well. The cost of energy is affecting everything, of course. The U.S. is once again relying heavily on oil production from countries that do not have U.S. interests top of mind. Labor shortages are also hampering the ability of product suppliers to fuel supply chains. The economy will impact the flooring industry, but flooring projects will remain at high levels. On the residential side, there are still shortages of housing inventory for homebuyers, and, as a society, people are spending more time at home and focusing on renovation projects. On the commercial side, we are seeing robust project levels as well. We’ve seen a record year thus far and anticipate the momentum to continue.

BAUCOM: We are fighting for consumers’ share of wallet. We can help consumers understand all the value our products bring by aligning resources-as manufacturers, retailers, installers and RSAs-to better support them.

What are the biggest opportunities for the industry within the categories you serve?

BACHMAN: The industry’s best opportunity is to offer more value and better solutions in product and service. With so many customers to sell to, we need to innovate and try to be different. I’m a big believer in upscaling the industry. For too long, flooring was not sophisticated enough and too cheap. LVT is being commoditized now. Before that, it was VCT and cheap carpet. No one was innovating for many decades, but LVT has been an excellent wakeup call that it’s possible to innovate and please customers. And these new solutions don’t automatically need to be cheap. When you look at the price to get LVT installed, it’s expensive compared to cheap carpet or VCT.

NUCKOLS: Ultimately, we have to focus on understanding the needs of the consumer, and we have to improve the consumer experience. Buying flooring is confusing, and we lose a lot of consumers because they get confused, then frustrated, and finally quit before they make the final purchase. Getting better connected with the consumer at the early stages of their buying process and guiding them toward a product that meets their needs, sold by a retailer whom they trust-this is a key opportunity that can grow the whole flooring market.

DELIA: Since Covid, outdoor spaces remain a huge opportunity, With the recent changes in economic conditions, the multifamily and build-to-rent areas should represent new opportunities. Commercial, hospitality and retail projects have started up again and we hope to see those plans continue into next year.

But the reality is that there are always opportunities if you can deliver the right products at the right price and offer fantastic support and service to both the customer and end user.

BAUCOM: There is an opportunity to elevate design-in definition and in execution. It’s so much more than a visual. Functional, durable, sustainable, safe and healthy designs can elevate the value of flooring to consumers.

DE COCK: Consumers want a product that performs in relation to their lifestyle and meets a certain visual aesthetic. The hard work and investment we put into research and development ensures our products achieve the highest level of beauty and innovation to perform better: to be waterproof, to have maximum durability, to stand up to pets, to provide everyday wear-and-tear protection from our daily lives, including children and wine spills. This never-ending process for improvement means we are only ever halfway there, because innovation can never stop. We can always improve beauty and performance in every category throughout every market segment.

DALIERE: Health and safety are leading industry drivers. Our customers are looking for durable solutions that are easy to clean without the use of harsh chemicals or antimicrobials. More than ever, we’re seeing emphasis placed on healthy materials that support better indoor air quality and long-lasting solutions that provide years of service with lower maintenance costs.

LVT and sheet vinyl are our fastest-growing product categories, as the need for highly durable, easy-to-clean floorcoverings continues to rise. The healthcare, workplace and education segments offer us the most significant growth opportunities right now. All three segments are focusing heavily on creating healthier, more inclusive spaces.

WU: We need to develop a take-back program for resilient flooring amongst all manufacturers, both residentially and commercially. Preventing perfectly good products from ending up in a landfill will be a key differentiator for us as a product category.

STONE: The biggest opportunity for the industry is being fashion forward. If you look at other decorative materials, they become more valuable and frequently purchased by embracing technology, including digital printing, transformative design processes, lower minimum order requirements and all the other things technology offers that enable a manufacturer to respond more quickly to consumer demand-even considering the future of personalization in the final form. That’s the ultimate goal. If you look at where markets are improved for other design-driven products, it’s all about personalization and getting to market quickly.

What are your thoughts on consolidation?

BAUCOM: Consolidation is inevitable. Success is based on eloquent execution (solving the right problems) and integration (aligning the pieces to solve the right problem). If we get the integration part right, results are favorable. If we get it wrong, it can hurt the industry.

DE COCK: Consolidation happens when growth abates. As we are currently seeing in the carpet industry, growth is and has been eroding, and this part of the industry consolidated into a couple of big players. You will see that happen, to some extent, in the resilient/LVT business as exceptional growth abates and some market participants join forces to improve their costs and expand their businesses.

TRISSL: Consolidation is a normal process that everyone in the industry has to live with. As more consolidation is happening and companies become bigger, very often they lose the focus on the initial objective: to serve the customer. This provides opportunities for newer start-up companies and entrepreneurial-driven organizations to fill the void.

BACHMAN: Consolidation isn’t a new issue. When I started in this industry in Europe, it was already happening, and I don’t think it is any more today than it was then. Consolidation can benefit a lot of stakeholders if done correctly. It can generate a greater return on value and more opportunities. But size alone isn’t enough. Everyone wants to grow. Acquisitions speed up that process. But it only matters when customers see the ability. Companies don’t get better simply by offering something different. Big only is big. There has to be a value proposition. That’s what matters.

We have a tendency to believe that a one-stop-shop value proposition will be enough to get the customer, but it doesn’t matter for the end user, because the size of a corporation isn’t what the customer is looking for. They are looking for expertise, quality, service and many other things. Of course, consolidation will continue, and Gerflor will make acquisitions too. But we want to get better, not just bigger.

GRIZZLE: If you look at other industries, like building products, many are more consolidated than we are, so our trend will probably continue. But when it does, opportunities for entrepreneurs always emerge.

NUCKOLS: Going forward, I expect to see continued consolidation throughout the industry, especially in the specialty retail channel, as a lot of consolidation has already occurred at the manufacturer level, and many small-business owners are nearing retirement without succession plans in place.

STONE: It’s coming. There is no doubt. There is no reason LVT will be different from any other sector that has consolidation. There will be winners and losers.

Within the channel, there will be greater diversity. Consumers will get more power. End users-whether they are architects, commercial contractors, pro contractors or homeowners-will have more choices, including Internet choices. And that will decentralize the power of the few, and we will see a couple of big guys coming up out of nowhere.

SHAH: Technology and globalization are not a “trend du jour” but rather a permanent change in business. Due to this, consolidation will continue, as scale advantages will continue to benefit the larger players. Margins overall continue to become thinner in the industry, and efficiency/productivity is the primary way of combating this.

DELIA: Consolidation is a common dynamic that occurs in time across all industries. If done with the right intent of creating synergies that better service the customer, then true value can be recognized. If the intent is simply to grab more, leading to further inefficiencies, and associating this greater volume with better negotiating power on concessions and price, then the resulting outcome will be detrimental. There is no value add at that point, and it creates unhealthy turnover throughout, higher costs for all and diminishes diversity across the industry.

CARSON: Over the last five years, we have seen historically low interest rates. The cost to borrow was less than inflation, so it was very easy to get into industries. That drove the expansion of plants, inventories and programs. Today, the cost of running a business-even outside of inflation-is going up dramatically, so we will see fewer folks coming in because the cost and risks are greater, and you have to make money faster because you have to pay the bank.

As for consolidation in our business, it’s important for providers to be able to offer multiple product categories to the customers. With so many different flooring categories, when you are just providing one of them, no matter how excellent you are, your customers have to go to other folks to get supply. Providing more makes you easier to do business with, and I think that we’ll see a broadening of products among manufacturers.

Where do you anticipate further commoditization and why?

CARSON: Every commodity at one point was a groundbreaking innovation. One hundred years ago, steel was one of the greatest inventions ever; today, it’s a commodity. Things inherently commoditize over time. What offsets commoditization is innovation, and that can come from style, features and benefits, a new category, reduced cost to produce, and efficiencies to sell and service. Is there commoditization today? Yes. But when I started 30 years ago, it was the same conversation.

BAUCOM: Anything can become commoditized, but it’s not inevitable. LVT is the fastest-growing category and is changing rapidly. The choice is ours as an industry. By understanding the customer and elevating the definition and execution of design, LVT will remain a premium option for which there is no substitute.

NUCKOLS: Low-cost suppliers will always push toward commoditization, because that is where they win. At The Dixie Group, we are always working against commoditization, because that is where we lose! We are focused on creating differentiated products in the segments of the business that we serve. We have been and continue to be recognized as a leader in high-end nylon carpet.

TRISSL: Commoditization is a natural outcome in sophisticated economies where buyers find solutions for project needs, increase their consumption in those areas, and suppliers react accordingly. Commoditization produces sameness or similarity across products. It’s efficient for buyers but can be frustrating for sellers. Innovation is the antidote for commoditization. Categories and products must be redefined and redesigned in ways that make them intensely relevant to customers.

DE COCK: Commoditization is everywhere, and anything you create can be commoditized. The minute you stop innovating and creating differentiation, you expose yourself to commoditization. I expect commoditization where there is no more innovation coming into the industry.

What are some of the industry’s greatest strengths and drivers?

BAUCOM: Flooring is a durable opportunity. Flooring will exist for as long as indoor spaces and gravity exist. We have great, hardworking people in this industry at every level. There is healthy competition-industry stakeholders care, are invested and want to continuously improve. The entrepreneurial spirit at every level of our industry helps drive ongoing success.

DE COCK: If I reflect on the past two years, I watched our whole business crash as the result of Covid. Then we recovered as consumers drove our business to unprecedented demand levels post-Covid. Moving so quickly from one extreme to the other required innovative, persistent and hardworking people rowing in the same direction. This drive for excellence is one of the industry’s greatest strengths.

TRISSL: The flooring industry combines aesthetics and performance as well or better than any other industry. Innovation in both of those areas has defined the success of flooring industry manufacturers. Fashion, color and décor trends guide floorcovering aesthetics, while research, development and science enhance the manufacturing process and resulting product performance. Delivering on aesthetics and performance constitutes one of the industry’s greatest strengths. Innovation in those areas propels the industry forward, providing outstanding options for customers. We continue to see innovation in the important area of sustainability. The flooring industry has led many other industries in this area; it’s an industry strength, and one we should continue to expand.

There are over 122,000 flooring installation businesses in the U.S. employing around 190,000 installers. The flooring industry produces around 24 billion square feet of flooring annually. This means that each of those installers is installing around 127,000 square feet of flooring each year or 2,600 square feet per week. These are rough numbers, but the message is clear: flooring installers work hard. They work over nights and weekends. Flooring installation professionals are a great asset in the industry, an asset we must value and support.

CARSON: Flooring is a necessary product. Pretty much, if you aren’t walking on grass or concrete, you are walking on something that someone developed, made, distributed and installed. And while there may be disruption in the market, 100 years from now people will need flooring.

SHAH: The floor is one of the most-seen parts of a home. The industry has done a great job of understanding the passion consumers feel for their floors. Due to this, the industry has stayed extremely dynamic as it relates to trends. We continue to see the cycle time of trends decreasing. In addition, the technology being used is increasing the choice available to customers without significantly increasing costs. Today, homeowners can truly feel the personalization of their floors.

NUCKOLS: This industry has a history of strong relationships, from raw material suppliers to manufacturers to retailers. Over the years, this has allowed the entire industry to better meet the needs of the market. And it has created an industry that is a lot of fun, which is why most of us never leave!

This industry also has a strong history of innovation. Here are several examples: advances in fiber and stain/soil resistance; new tufting technology for beautiful patterns and differentiated carpet styles; new sizes and visuals in ceramic tile; advances in resilient flooring, including innovative constructions like WPC, SPC and digital print. There are many others, as well. And they all have the common theme of addressing an unmet need for the consumer. This has been a great strength of the flooring industry for a long time.

BACHMAN: Flooring is both technical and design-driven. That’s why it is an interesting industry and product. It’s both business-to-business and business-to-customer with diverse applications, from retail to healthcare, residential to commercial. In flooring, we touch all those applications and channels, and that is rare. Not many industries are like that. In addition, there is a certain level of sophistication in flooring, and the industry is profitable and remains attractive for investments.

STONE: The industry’s greatest strength is the fact that it is diverse, and competing ideas come through rapidly. We need to be an industry more driven by the marketplace than by manufacturers. Market-driven is more responsive and innovative than capital-driven. If we are creating products that meet the needs of the customer and create joy, we will get more profits, as opposed to focusing on profits and hoping the customer likes the product.

GRIZZLE: The flooring industry’s people are its greatest strength. I’ve been in the flooring industry a long time, but I’ve been in some others too, and I love the people in this industry: coworkers, competitors, customers, designers, the media. It is a strong group of principled, talented people who are great to do business with.

In addition, this industry continues to evolve, working to make the interiors of buildings and homes better through design, improved installation methods and adaptation-and doing it all sustainably, as well.

How can the flooring industry attract more women and people of color to positions of leadership, and why is this important?

STONE: Diversity is an absolutely necessary element of success: diversity of thought, diversity of experience and diversity of people. But this is not a check-the-box opportunity. What you have to start with and what we, at our company, are starting with today is creating a culture of inclusion, where diverse thought, diverse people, diversity in gender and sexual orientation are not only welcome but just normal. It’s like blue eyes or brown eyes, left-handed people or right-handed people-it’s just normal, just part of the mix.

And that culture of inclusion isn’t as easy to achieve as one might think. We’ve been working on it now for several years, and it starts with a very long, hard look in the mirror. And when we look in the mirror, we see that we have inherent biases, a comfort with familiarity, a tendency to repeat what we’ve done before, so getting a little bit uncomfortable is key to having a culture of inclusion, and you can create something that is much longer lasting.

RIETVELDT: I find it very important that our organization mirrors society. Without any doubt, the right blend of genders and cultures will facilitate a more balanced discussion in any organization and result in better decision-making.

Inclusion is the key word. Independent of where they come from or who they are, team members need to feel valued and respected. The way to attract this diversity is to make it an important topic on the strategic agenda of a company.

Copyright 2022 Floor Focus

Related Topics:Tarkett, Novalis Innovative Flooring, Coverings, The International Surface Event (TISE), The Dixie Group