Independents Versus Big Boxes: Independent retailers face change in order to stave off challenges from larger competitors - July 2020

By Meg Scarbrough

In neighborhoods across the country, independent flooring retailers are battling giants: big box stores, aptly called “category killers.” It’s a conflict that has been brewing for nearly six decades, and the challenge for retailers has been keeping up-with pricing, changes in consumer preferences and economic influences.

Most recently, there’s been a shift in demand from soft surfaces to hard. As a result, big box stores like Home Depot and Lowe’s have adjusted their flooring strategies to reflect those needs and are beefing up their hard surface offerings and shifting away from carpet. The COVID-19 shutdowns across the country have also taken a toll on independent retailers, which were largely deemed “non-essential” while big boxes were permitted to keep their doors open. But even in the face of adversity and amid challenges, retailers could be poised to see some fruitful changes by focusing on the two things that set them apart: service and advice on choosing the right product.

SHIFTING FROM CARPET

It’s no secret that carpet has been losing share of the flooring market since at least the late 1980s. Thanks in large part to the growing popularity of luxury vinyl tile and other hard surfaces, the domestic carpet market fell 5.3% from 2018 to 2019, and its share of the flooring market fell to 35%; for comparison, in 1995, carpet had a 60% share.

Home centers have reported double-digit increases in sales of hard surfaces, reflecting a trend across the flooring industry as a whole. Craig Webber, vice president of merchandising for Lowe’s, and Dan Huffman, divisional merchandise manager for flooring at Home Depot, have been tracking the change. In response, big box stores like theirs have retooled their flooring departments, expanding their LVT, hardwood and tile selections while downsizing carpet displays.

But just because fewer people are buying carpet doesn’t mean no one wants it; it’s still the largest flooring category, accounting for just under $8 billion in sales at wholesale value. Soft surfaces, having ceded the common areas of the house to hard surface flooring, may have found a more secure niche in the shelter areas of the home, such as bedrooms. And since consumers are filling less of their homes with carpet, they are willing to spend more money on the investments they do make. So as big box stores transition their focus away from the carpet category, there may be room for independent retailers to pull in customers with their soft surface offerings and win hearts, minds and sales.

Independent retailers have always known they have one tool their big box competitors can’t compete with. “It’s all service; it’s not some big unknown,” says Maryanne Adams, president and CEO of Avalon Flooring based in New Jersey.

That’s why Mike Nelson of Coeur d’Alene, Idaho-based Great Floors has been investing in his sales team. The unparalleled service and knowledge are what he hopes will keep customers coming back. But keeping a skilled team isn’t cheap and can’t be done quickly, and with an aging workforce, it’s critical to start building the knowledge within a new crop of staffers, he says, adding, “We need to bring in more people. We’ve been focusing a lot on training and investing so we have a staff 10, 20, 30 years from now.”

As part of that knowledge base, Adams notes that retailers also have to know what products they have and how to sell them. “You’ve got to know the price points,” he says. “You’ve got to strategically know what’s on your floor. And who the customer is.”

Michael Longwill, owner and president of Airbase, adds it’s also important to be able to offer an immense amount of upgrades in each category, more than what big boxes can, and then communicate that to the customer. “Sure, we’ve got that low-priced stuff, too, but here’s really what you want,” he says.

Retailers also have to provide a space for consumers to explore ideas and make tough decisions. Some are investing hundreds of thousands of dollars to make their showrooms more accessible. One company that has been making investments in its showroom is ICC Floors in Indiana. Earlier this spring, co-owner Cameron Haughey said his company identified the need to have a substantial number of displays within a large space, but amid efforts to diversify their product lineup and services, as well as adding additional staff, costs were adding up. But with the help of manufacturers, he was able to offset the cost of installing attractive displays.

Diversification of products and services is another area in which some retailers have been investing; this includes things other than flooring, like countertops, cabinets, kitchen and bath remodels, draperies and cleaning services. It’s an acknowledgement that consumers are tackling entire rooms and may have needs other than just floorcovering. It’s another costly avenue, but some say it’s becoming an increasingly critical component in the fight to stay competitive, not just with big boxes, but among one another. For some retailers, diversification isn’t new-Guy’s Floor Service in Colorado added countertops to their lineup decades ago-but others are just making the transition. Those who have been successful looked at the market’s needs and filled the void.

But retailers must also acknowledge that consumer preference sometimes comes down to money. Some independent retailers staff their own installation and maintenance teams, but the bulk subcontract the work. However, they often have long-term relationships with their crews, and many attempt to pay more than the competition in order to attract a higher caliber of installer. Big box stores also typically subcontract their installation work, and they often run promotions offering free removal and installation for purchases over a certain amount. Independent retailers say competing with free services like that can be challenging.

Longwill admits the big box installation program has been aggressive and very successful in recent years. And after years of pushing back on the idea, his firm also began offering free installation.

Adams contends that “free” installation offers from big box aren’t free at all. “It’s a slide of numbers of where they are loading the money into,” she says. “It’s not free.”

Additionally, consumers visiting independent retailers may see some of the same brands and products that they would find in Lowe’s or Home Depot; it’s not uncommon for each to offer the same or similar collections.

This is where a “don’t let big box win” strategy comes into play. “We try not to let them win with promotional price points; we match or beat them on their advertised prices,” Longwill says. While lowering prices might be a viable option for larger retailers, not all retailers can match big box pricing.

A NEW HURDDLE

In March, governors and mayors across the country scrambled to stymie the spread of COVID-19 and began announcing they would be issuing temporary stay-at-home orders and force businesses to close or limit service. The mandates varied in severity and complexity and centered around what was considered “essential” versus “nonessential.”

In the “essential” list for most states were places like pharmacies, grocery stores, gas stations, healthcare facilities, banks, post offices, manufacturing and transportation services. Big box stores like Walmart, Target, Home Depot and Lowe’s were also included.

“Nonessential” locations included restaurants (although this was modified to allow for delivery and pick-up in some cities), gyms and parks, salons, spas and event venues. Those ordered to close or limit capacity included most of the country’s independent flooring retailers. There was an almost immediate backlash from business owners in all industries, denouncing the mandates as unfair to local business and said they gave a competitive edge to their corporate rivals.

Michigan governor Gretchen Whitmer, whose state issued some of the nation’s more stringent restrictions, allowed home improvement stores to remain open with a caveat: flooring, garden and furniture departments would be cordoned off and could not be purchased.

Longwill of Airbase pushed back against Delaware’s order and demanded he be allowed to remain open. “I defined myself as a home center, a seller of building supplies,” he says. “I argued with the police, the governor. My biggest argument was, ‘If you close Lowe’s and Home Depot, I’ll close. If they stay open, I stay open.’” He never closed his doors.

Many of Avalon Floorings locations were also ordered to close, but some of the larger stores were allowed to keep a couple of workers behind the back counter, Adams says.

The shutdown had varying impacts across the Great Floors chain, with the hardest hit being felt in Washington state, where there were stringent mandates in place. Its stores there were closed for a number of weeks but were able to partially open later after some of its existing contracts were deemed essential, like tax-based projects (schools), housing authorities and property management. New construction projects to create eight temporary COVID-19 health facilities also gained approval.

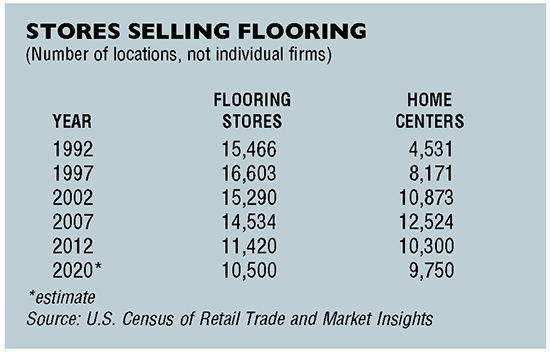

Big box stores are a common part of everyday life, and 50,000-square-foot-plus buildings-some even as large as 250,000 square feet-dot America’s landscape. As of 2017, there were an estimated 10,300 home centers in the U.S., according to U.S. Census data. The country is now home to the largest share of the world’s big box stores, offering a variety of goods from groceries and clothing to home improvement and decor.

Prior to the 1950s, laws were in place that prohibited large retailers from undercutting minimum prices set by manufacturers. But a 1951 Supreme Court decision ruled in favor of a Louisiana liquor chain that wanted to sell liquor at a discount, allowing for discount retail, and the battle against mom-and-pops was underway, according to Marc Levinson, historian and author of The Great A&P and the Struggle for Small Business in America. Their popularity really began to spread in the ’80s.

SHUTDOWN SPURS DIY

At the same time as that debate was raging, essential companies that were able-especially those in the corporate sector-began sending their employees home to work and social distance. Suddenly, much of America was home all at once.

Weeks began to tick by with families unable to leave home. Employees were adjusting to life working away from the office and began setting up longer-term workspaces or home offices. Parents became teachers and worked to balance at-home jobs with occupying anxious and bored children. Some started looking around their homes and making mental lists of projects that needed to be tackled, knowing it would be weeks, possibly months, before they could leave the house again for something other than a pharmacy run. Then came the stimulus checks aimed at injecting money into the lagging economy and helping citizens weather the slowdown. Homeowners with time on their hands and to-do lists now had a little more money with which to do them.

But there were some things to consider. For starters, no one wanted strangers, potentially virus-carriers, coming into their homes to install flooring. Secondly, big box stores temporarily stopped offering installation services, so that wasn’t even an option. Most homeowners aren’t skilled flooring experts, so what products could they buy that would look good but be easy to install? And where would you buy those products during a shutdown?

As for flooring choices, consumer preference has been shifting toward hard surfaces in recent years. And thanks to advanced manufacturing technologies that have improved installation systems, there are products on the market that offer high-quality appearance at affordable prices and can be installed by a homeowner with relative ease. Big box stores and independent retailers both offer these, but with many retailers shut down or limiting service during the shutdown, consumers most likely headed to big box stores. As an added bonus, the cash-and-carry programs at big box stores meant consumers could potentially shop, buy and take home flooring the same day.

The combination has been a boon for the big box. For the first quarter, Home Depot reported net sales at $28.3 billion up 7.1% from $26.381 billion for the same quarter in 2019, according to company data; the boost beginning in March as shutdowns when into effect. Similarly, Lowe’s saw a 10.9% increase, from $17.741 billion in 2019 up to $19.675 billion this year; web traffic was up 80%.

Floor & Decor was deemed “nonessential” in some areas and found itself among the independent retailers that were forced to close or limit hours. Some locations offered online purchases with curbside pickup and delivery options. Despite the setback, net sales in the first quarter were up 16.3% to $554.9 million from $477 million in 2019. “We are pleased that our first quarter ... met our expectations, considering we were dealing with the impact from the COVID-19 pandemic, which forced us to limit our store operations, and in some cases close stores,” says CEO Tom Taylor.

Meanwhile, many smaller businesses were hemorrhaging money, even the ones that were still open. Longwill attributes Airbase’s losses to a couple of factors. While locations remained open, he says customers didn’t know about it. Because of the confusion around what was “essential” and “nonessential,” he feels that many assumed he wasn’t. “We didn’t do much business,” he says, “but we were able to keep people working and take care of whatever work we were able to get,” he admits, adding that the decision to stay open wasn’t welcomed by all and some existing customers weren’t happy about it.

He says the business he did get during the mandated shutdown was definitely spurred by the DIY mentality.

“We survived with that business. That’s how we got through April and May,” Longwill says. “Contractors and DIYers. Our stores are large home center-type stores, so we had a lot of in-stock goods that people were able to come and take with them. We did curbside pickup and would load it into their cars.”

Nelson also says traffic to Great Floors locations in Idaho and Montana consisted of a lot of cash-and-carry and DIY business, adding that business did remain strong in new home construction and commercial sales, as well. He also says the company used the time to accelerate its digital platform, “We leaned on technology. We happened to be going through an improvement on our website, so we kicked that into high gear and started offering more virtual appointments and curbside pickup and sample delivery.”

While the shutdown cut business in half, he says the dynamic of the business they were bringing in was much different than in weeks prior. Others in the industry have also said that even though business was down, almost everybody that was shopping was buying. Where four people might come in and only two make a buy, now two people were coming in and both were buying.

GETTING BACK TO NORMAL

Recovery appears to be coming, according to economists. States began to slowly reopen in May, and now big box and retailers are adjusting and preparing for the “new normal,” whatever that may be.

In June, Avalon Flooring’s stores began reopening to full capacity. With its locations missing out on walk-in traffic, Adams says it’s not clear how much of her business they could see in the future from shutdown-related DIY projects. “All we can hope is that people have been looking at some really ugly floors for 90 days,” she says with a laugh.

In the meantime, her stores have been working to get things moving again, but in a socially distanced way. “We have been doing some things by phone, like with builders who have been calling in orders or need to pick up materials,” Adams says. Avalon has also created a virtual consultation to help customers narrow down decisions before entering the store in an effort to limit contact. They are also asking customers to not touch samples, but samples that do get handled are sanitized before being put away again. In the long run, she says, it may help build trust among customers. “When [the customers] realize you’re taking this seriously, I think there’s a security that makes it feel safe to go into the store,” she adds.

But some stores may not ever reopen, irreparably damaged from the extended shutdown and ensuing economic slowdown. “It has been really tough for small businesses,” Adams says. “We are on the fortunate side because we are on the larger end of ‘small,’ but it’s hard to watch. There’s no doubt you’re going to see so many people going out of business, and it’s a shame.”

While she’s hopeful, she’s also trying to be realistic and says they’re looking at projections. For a $100 million company, even being off only off 1% amounts to a $1 million loss. “What if we’re 10% off, what if we’re 15% off, what if we’re 20% off? … We could be off $30 million; that’s a big number.”

Airbase’s Longwill says his stores were able to ramp back to full capacity relatively quickly, but he’s also worried he may have lost some customers over his decision to stay open.

And as of mid-June, Great Floors’ Washington locations had only been approved to reopen to do existing contracts, but no new projects. But Nelson was hopeful approval would come soon, and when it does, there would be a large advertising push.

Longwill says there’s a tough road moving forward, “It’s going to be a battle between big box and independents. Who do you trust more? Who is going to keep you safer in the store? Who can service you in a cleaner environment?”

There’s also a growing concern about what customers will be left in the aftermath of the shutdown. “How many people got laid off and are not going to chance redoing a house and are going to be careful with their money?” Adams asks. “It’s a lot of people.” And some people still aren’t ready to have strangers in their homes, she adds.THE BIG GUYS

Lowe’s is not far behind. The North Carolina-based company has established more than 1,700 locations across the country and with $72.1 billion in sales in 2019. While it launched in 1946, it didn’t really take off until the early ’50s, but by 1964, it had attracted more than one million people annually, according to company data. Its stores cover an estimated 208 million square feet of retail space. That’s nearly 7.5 square miles of store.

But home improvement stores like Home Depot, Lowe’s and Menards aren’t the only players at the table. Atlanta-based specialty retailer Floor & Decor has earned its name as a “category killer” by solely focusing on hard surface flooring like tile, laminate, hardwood and stone. It currently operates more than 120 stores in 30 states and reported $2.05 billion in revenue in 2019 with plans of expanding with new locations.

Copyright 2020 Floor Focus

Related Topics:Lumber Liquidators, Great Floors