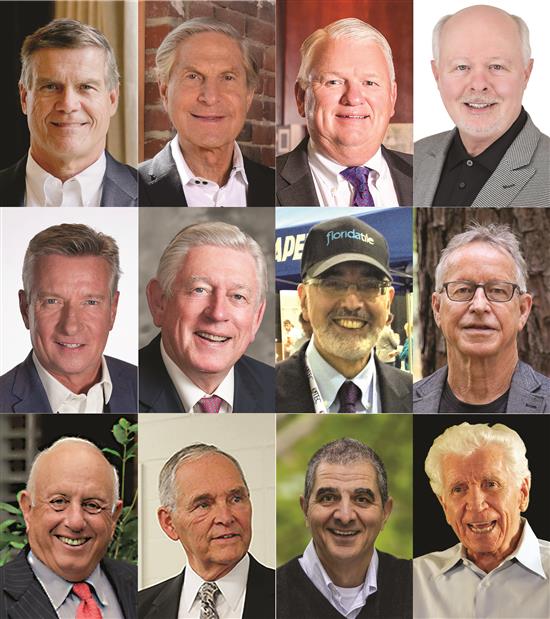

Defining Moments In The Industry: Industry veterans and former leaders weigh in on critical occurrences and key developments in the flooring industry - Aug/Sept 2022

By Darius Helm

What would you consider to be the two or three most pivotal decisions/occurrences that changed the face of the industry and led us to where we are today?

VANCE BELL: Starting in the early ’90s, the integration of fiber manufacturing capabilities and investment at the carpet producer level led to more product control by carpet manufacturers, the ultimate demise of independent fiber producers and brands, and the industry migrating to polyester fiber for residential carpet.

Also, large integrated carpet manufacturers [moved] into the hard surface space starting in the early 2000s. Mohawk started with ceramic (Dal-Tile) and laminate (Unilin), and Shaw with hardwood and resilient (US Floors). Both companies now have 50% or more of their revenues coming from hard surface, and both are market leaders in these categories. These moves expanded supply and availability of these products to the broader market and helped propel hard surface growth. Global sourcing expertise and infrastructure allowed for rapid growth in resilient, in particular.

Related to the above, rigid core LVT, originally driven by US Floors and Shaw, created a new product category that became an industry disruptor and the fastest growing and largest “new” product category since broadloom carpet came on the scene.

HAROLD CHAPMAN: Among the most pivotal are industry consolidation, the formation of buying groups and co-ops, and vertical integration-from manufacturers self-extruding fiber to owning retail and flooring contractors-as well as the development of luxury vinyl tile and plank.

HOWARD BRODSKY: Certainly, the consolidation at the mill level was a pivotal occurrence. When CCA started in 1985, there were about 350 carpet mills and now there are maybe 20. And there’s been consolidation at the dealer level as well. From that time to now, through the rise of the national home centers and businesses like Floor & Décor, independent retailers number around 9,000-it was closer to 23,000 or 24,000 back then.

DAN FRIERSON: Consolidation really changed the character of the industry. The Dixie Group itself is a consolidation of 13 or 14 acquisitions. And consolidation made Shaw and Mohawk the gorillas in the business (though of course later came the emergence of Engineered Floors). Another pivotal occurrence is the growth of hard surface and its impact on carpet. It was gradual for a number of years, then accelerated in the last decade. It really changed the trajectory of the industry and certainly impacted those that manufacture carpet. Another major occurrence was extrusion by the mills of fibers other than polypropylene, and then the impact of solution-dyed polyester. The industry has moved away from nylon and polypropylene.

RALPH BOE: One pivotal occurrence was the major consolidation in the carpet industry. Also, the tremendous growth of hard surface, beginning with laminate and ceramic tile and then LVT, having a major impact on shrinking the carpet industry. And the fiber dynamic changing from nylon to PET over the last 15 years, as well as the move to solution-dyed PET. And finally, carpet products moving from solid color to subtle multicolor cut pile with space-dyed and solution-dyed effects.

KEITH CAMPBELL: Over the last 30 years, we have seen a dramatic shift toward hard surface flooring. The growth of ceramic, both residentially and commercially, was the first to gain steam. Then hardwood came on next with solid and engineered frameworks with pre-finished surfaces. Laminates then came of age. But without a doubt, LVT has had the most dramatic impact through all facets of the industry.

JULIAN SAUL: The addition of ceramic and wood in what had traditionally been carpet stores is what started the decline of the use of carpets in homes, led by Mohawk’s purchase of Dal-Tile and then both Mohawk and Shaw getting into the wood business. And the current growth in LVT reminds me of the boom that carpet had in the ’60s. And I hope they aren’t going to cheapen LVT like we did carpet.

The number one reason for the decline of carpet is the industry willingly making and selling FHA-grade carpet. When young couples move into an apartment or rental home and their first exposure to carpet is cheap carpet; when they get older, they remember how poorly the product performed and don’t realize that better carpet performs better. So, they don’t put it in.

DONATO GROSSER: The most pivotal occurrence that changed the face of the tile industry was the one by Italian manufacturers who decided to set up plants in the U.S. The decisions were dictated by the then loss of value of the U.S. dollar, which made exports from Europe much more expensive.

JIM WALKER: The introduction of laminate/wood floor tile products has completely changed the flooring selection for the consumer. This category has replaced carpet in a manner that no one would have thought possible just a few years earlier. Also, the Internet and cellphones provide instant access to not only installers, customers, distributors and manufacturers, but also offer the industry with immediate information and problem-solving.

PIERRE THABET: The advancement of urethane finishes was critically important to make wood flooring a desired product in homes. Eliminating the maintenance requirements of a wax floor helped to spur the resurgence of the industry. The development and acceptance by the consumer of engineered wood flooring broadened the geography of where wood flooring was sold. Slab construction throughout the South and Southwest is dominant, and a gluedown application is mandatory. Of course, the development and refinement of factory staining made wood flooring a product that could be sold by full-line retailers and later big box stores.

DAVID OAKEY: Back in 1992, the major factors were fiber producers dominating and exerting influence on the industry-the big chemical companies, like BASF, DuPont, Monsanto-coming off the tail of Stainmaster. They were trying to control raw materials going to manufacturers and demand for their product through branding, salespeople, even getting into dealer networks. So, it was a battle between the fiber companies and the mills. Back then, the mills were afraid of being controlled by suppliers of raw materials. Leaders like Roger Milliken and Bob Shaw fought against it. Today, 30 years later, with mill consolidation and vertical integration of fiber production, all the chemical firms have gone away.

Also, over the last 30 years, the commercial customer has changed radically. Back in 1992, we usually designed for each project two types of carpet: one for open office and one for the executive floor. Back then, manufacturers would be making one style in 50,000 to 100,000 yards. In the early ’90s, the dotcom boom happened, which changed the direction of office space. Now, when you’re designing product, it’s about diverse selection-maybe 20 different products on one project. The complexity of doing all that is much greater than decades ago, and it’s definitely a challenge for producers.

PIET DOSSCHE: Stain-resistant chemistry brought solutions to the challenges of soiling and staining, which carpet had been battling forever. Also, new fiber and recycling technology brought polyester carpet to the forefront as a well-performing and competitive alternative to nylon. And scratch-resistant topcoats and finishes, as well as new glueless click installation methods, boosted the popularity and growth of both laminate and engineered wood flooring and replaced the traditional narrow strip solid wood as the hard surface flooring of choice, until rigid core LVT came on the scene with the launch of Coretec in 2013, which resulted in the biggest product shift and new category growth since tufted carpet took over from woven broadloom.

In what ways has the industry improved over the last 30 years?

GROSSER: The great improvement in product quality and technology and in installation methods.

SAUL: It has to be quality. Mohawk and Shaw, both public companies, have really improved the quality of the product and customer service.

CAMPBELL: Two areas that I believe have improved are quality and sustainability. The overall quality of products, from both an aesthetic and performance standpoint, has improved significantly. Overall, product constructions and wearlayers are more durable, maintenance is easier and, thanks to digital printing, the realism we are able to achieve in styling and design is incredible. From a sustainability standpoint, the industry has woven it into every facet of manufacturing, which is not something that was on everyone’s radar 30 years ago.

BELL: More focus on innovation and responding to consumer needs across all product categories. Tremendous advancements in waterproof products, overall performance, ease of installation-again, across all categories.

Also, as an industry, we have better and more diversified talent across the entire chain. This is giving us better insights and perspectives in all phases of the business and is improving the innovation mentioned above.

FRIERSON: The industry is more professionally managed, more consumer focused. There’s certainly more movement to understand what the consumer wants, and more movement to communicate with consumers electronically.

BRODSKY: It has become more professional, more sophisticated in marketing, in store design. Customers have demanded it, and competition has demanded it. At CCA, we brought a level of professionalism that the industry did not have. It elevated the level of professionalism at the specialty store.

BOE: Consolidation and the move to polyester have helped maintain the price point of carpet-until the recent events of 2020 to 2022 affecting all raw material pricing. Also, fiber integration into the carpet mills put more profit and control into mills versus large fiber companies. And buying groups have led to more professional and creative marketing at retail.

WALKER: The industry has improved in the last 30 years by allowing users easier and quicker access to information. In the case of installation, guidelines are instantly available on the jobsite by the use of a cellphone.

THABET: The wood flooring industry has improved its ability to reach most all market segments with the addition of various engineered technologies and huge assortments of widths, thicknesses, stains and finishes. This all helped to facilitate the transition away from sand-and-finish to prefinished flooring.

CHAPMAN: The development of low-VOC adhesive was a major improvement, as well as the development of environmentally friendly products-including the recycling of pre-consumer and post-consumer waste, the development of installer training centers and training materials, and forming and supporting the Floor Covering Industry Foundation.

OAKEY: Definitely tufting technology has improved over the last 30 years. In 1992, styling was all about the yarn going into the product-air entangled, twisted, space dyed, unique piece-dyed yarn, print. The yarn was dictating the color and design of the product. Tufting machines were pretty primitive back then. There was some shifting capability, for zigzag graphic designs, for instance. And 30 years ago, a tufting machine didn’t cost more than a few hundred thousand dollars, and it made it easy to set up a small mill and be in business. Today, that’s pretty much impossible.

DOSSCHE: From being a very scattered and fragmented industry in the ’90s, we consolidated into a mature and more stable category within the home furnishing segment. With that came an awareness to focus on long-term value creation, where profit is not a dirty word, but the crucial lifeline for investments, growth, innovation and shareholders’ and employees’ returns and rewards. Much has been done to pursue higher profitability by focusing on bringing innovations and solutions to our products, but we’re still so easily tempted to revert to lower pricing and margins as soon as volumes drop.

In what ways has the industry moved in the wrong direction?

CHAPMAN: The industry is too dependent on products made overseas.

CAMPBELL: You are asking someone whose family has manufactured flooring in the United States for 107 years. With that in mind, I note that there are significantly more imported products from the Far East and elsewhere than there were 30 years ago. This is not only true for flooring, but also for much of the durable goods consumed in the United States. This shift is not healthy for our industry or the American economy.

FRIERSON: The warranty wars have not been productive. There’s been a tendency to exaggerate the value of warranties, and the consumer doesn’t really understand them. Hand in hand with that is that product has been too price driven-not enough focus on producing exciting, beautiful products.

SAUL: I’d again say FHA carpet and also warranties. And the promise of waterproof performance these days reminds me of the lifetime carpet warranties-over-promising on performance. Also, there has been no marketing to consumers, other than Stainmaster and, to a lesser degree, Pergo and Karastan. And I’d say that the move toward polyester changed the equation. With the right twist, it does perform, but it also soils.

DOSSCHE: Rather than saying we moved in the wrong direction as an industry, I prefer to call it a missed opportunity! Despite the tens of billions of dollars our industry accounts for at the retail level, we have not created a true consumer brand and, with that, remain for the most part a commodity industry. Stainmaster brought awareness to flooring for a period of time but faded eventually. Since then, no company has had the vision, commitment or long-term willingness to spend the dollars to create a true consumer brand, despite many new innovations that could have been the catalyst.

Creating a consumer brand highlights and benefits not only the company it originates from, but also boosts the entire industry and lifts it to a much higher profile in the consumer’s mind. And it helps to validate and promote in many other ways, from being an attractive industry to invest in, to wanting to be part of as a young graduate looking to build a long-term career, to being respected and compensated well as a craftsman flooring installer. A missed opportunity…maybe someone will prove me wrong in the years to come!

BELL: Not sure I see much wrong. Again, the industry is evolving, innovating and investing for the future. However, commoditization has been, and will always be, an ongoing concern for the industry. Also, large “big box” retail entities with growing share can depress pricing and margins for the entire chain, which is a concern going forward.

BRODSKY: The home centers to some degree have made the product more of a commodity. By nature, most things in home centers are commodities. The smart specialty retailers have seized on that to capture the middle to high-end, where the consumer doesn’t view flooring as a commodity and it’s sold as a decorative item.

THABET: Overall, the industry has not done a good job of promoting wood flooring to consumers. There are various reasons for this, but there is a lot of room for improvement. The industry should better define exactly what a wood floor is and what it is not. I feel it is a disservice to consumers to call a product that is made primarily of plastic a wood floor.

BOE: Products generally are more mundane in styling, with less differentiation from one manufacturer to another, in part due to consolidation. This is in all categories of flooring. There is more emphasis on product capability, i.e. performance.

OAKEY: Consolidation has created a lot of sameness in terms of product offering-fewer products, all looking the same. It’s hard to distinguish one manufacturer from another-not bringing enough new creative stuff for their customers. And there’s a change in our customer; they want more unique products. And with the blur of residential and hospitality in commercial, all these needs will reflect a change to bring new, different products to the marketplace.

GROSSER: I do not know if you can call it a wrong direction by the industry, but the increase in production has not been paralleled by an increase in qualified installers.

WALKER: The industry has moved in the wrong direction due to the lack of required training for the installation segment. I still marvel that in the case of carpet installation, it appears all that is required is “fuzzy side up.” The demand for quality installation is expected, but the majority of installers have received minimal or no training. The requirement of “doing the job right” is almost non-existent. In today’s world, anyone can show up to install flooring.

How has the industry surprised you?

OAKEY: One thing that did surprise me was sustainability-for the flooring industry to become a leader in the sustainability movement. Ray Anderson was the driving force behind this. His mission was real; he wasn’t going to change his mind. And for this to change an industry, to change supply chains and then influence other industries, that was one of the biggest surprises to me. Back in 1992, everyone was just trying to make a profit. I don’t even know if the word sustainability was being used.

SAUL: One industry surprise has been LVT. I’ve never seen anything flourish like this. We got into carpet in ’69, and that was the hot product back then. My biggest concern with LVT is whether it will perform over the long term. Time will tell.

Another big surprise has been carpet tile on the commercial side. When that product was first developed in Holland, I thought it was a joke, but I’m a big proponent of carpet tile today. As installers get older, we’re losing our base of craftsmen who know how to really install broadloom. Young people are not going to do it. Tiles cost a little more, but they are easier to install-especially in high rises where it fits inside the elevator.

CAMPBELL: In today’s world of digital and virtual transactions, where many people do business without ever meeting each other in person, I am pleased that the industry remains relationship driven. I deeply love the relationships with customers and associates, and, yes, even some competitors. The fact that relationships remain the lifeblood of the industry is surprising, yet very pleasing at the same time.

BOE: One surprise was the rapid growth of luxury vinyl flooring to have equaled the sales volume of carpet. And the rapid movement to PET solution-dyed carpets, certainly accelerated by Engineered Floors. Also, the exit of Invista from the carpet industry.

WALKER: The industry has surprised me because after the 50+ years that we have been attempting to promote quality installation, very few manufacturers even mention and fewer even require it-it’s just getting the job done. They make a beautiful product and then avoid installation. Worse yet are the numerous retailers who only want the product installed-not installed correctly, just installed. They do not qualify the installers and just load up their trucks for another day of work, with minimal regard for the customer’s satisfaction.

BRODSKY: The speed of consolidation surprised me then, but not looking back. And after all the years, installation-it’s a blessing and the curse. In so many ways, there’s a constant need for more installers, but in some ways-because the product is complicated and needs to be professionally installed-it stops the Amazons and Walmarts from making it a true commodity. Any time you have a product that needs to be installed, mid- to high-end customers are more careful about where they go for quality product and professional installation.

FRIERSON: Number one would be during the pandemic, when the government decided that big boxes could stay open but not the retailers. I was pleasantly surprised at how innovative independent retailers have been at finding and serving customers in a very difficult environment. They found new ways of communicating with customers. It strengthened the retail community.

The other surprise is that the big boxes are not gaining carpet marketshare anymore. Reducing commitment to carpet and increasing commitment to hard surface has opened the door for the independent retailer to compete effectively.

GROSSER: The main surprise has been the success of some large distributors that have displaced many of the smaller ones. Today, we have many fewer distributors than we had 30 years ago.

BELL: Nothing surprises me anymore! It is a dynamic and ever-changing industry and surprises are to be expected.

THABET: It’s surprising that there is still such a wide gap between the percentage of people who say they desire a wood floor and the percentage that buys a wood floor. The influence of Asian suppliers over the past ten years has been significant, and it’s surprising how much marketshare they have taken.

Is there anything you thought would come to pass that hasn’t?

FRIERSON: I thought big boxes would continue to take marketshare in carpet, and that has not come to pass. They’ve done a good job in hard surface, and they have a position there that’s difficult for the independent retailer to compete with.

GROSSER: One problem is the scarcity of advertising for ceramic tiles, while competitive flooring manufacturers invest massive amounts to launch and promote their products.

BOE: I expected the larger, more well-financed textile companies would be consolidators, which didn’t come to pass. Also, I thought major fiber companies would have forward integration to support their fiber assets.

CAMPBELL: When I began calling on customers in 1977, the biggest problem was the lack of qualified installers. Good, qualified installers are critical to the long-term satisfaction that end users have with flooring products. I had hoped that the industry would have made more progress in that regard.

WALKER: I truly believed that by now, the demand for quality installation would be required, and unqualified individuals would not be allowed to install flooring. In my opinion, it appears that this problem is never going away. The manufacturers just want to sell more products, and the dealers want to sell more flooring. I know of few industries that hold such a low regard for the installation of their products.

THABET: Most industries have gone through significant consolidation in the past ten to 15 years. Many floorcovering segments have been consolidated but not wood flooring. At one point, Triangle Pacific had huge marketshare, and since its decline, the industry has become more fragmented. Asian imports have been a large factor with this phenomenon. Consolidation may still occur, but with so many private label brands, it will be more difficult to do. Thirty years ago, I thought that some brands would have been developed by now that had significant consumer brand recognition. That has not happened.

OAKEY: The only thing that I thought would happen was that we would stop selling grey carpet.

DOSSCHE: I go back to the missed opportunity I discussed earlier on. I had expected by now for one or more strong consumer brands to be the beacon of pride for our industry!

Copyright 2022 Floor Focus

Related Topics:RD Weis, Shaw Industries Group, Inc., The Dixie Group, Mohawk Industries, The International Surface Event (TISE), Engineered Floors, LLC, Karastan, Lumber Liquidators, Daltile