Consumer Borrowing Falls by Record Amount

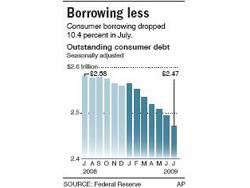

Washington, DC, Sept. 8, 2009--Consumers curtailed their borrowing in July by the largest amount on record as job losses and uncertainty about the economic recovery prompted Americans to rein in their debt.

Economists expect consumers will continue to spend less, save more and trim debt to get household finances decimated by the recession into better shape. However, such action is a recipe for a lethargic revival, as consumer spending accounts for 70 percent of economic activity.

The Federal Reserve reported Tuesday that consumers ratcheted back their credit by a larger-than-anticipated $21.6 billion from June, the most on records dating to 1943. Economists expected credit to drop by $4 billion.

Wary consumers and hard-to-get credit both factor into the scaled-back borrowing. But economists are split on which force — lack of demand by consumers or lack of supply from banks — is having the bigger influence.

A report earlier this year by FICO, the company that produces the most widely known credit scores, found that companies slashed limits for an estimated 58 million card holders in the 12 months ended in April, even though a high percentage had good credit scores when their limits were cut.

The cuts affected about a third of consumers. But most people did not see a big impact on the credit scores because lenders often cut limits on cards that were unused or lightly used.