Wood Cuts - June 2009

By Ed Korczak

The U.S. wood flooring industry, like the U.S. economy, has struggled through some very difficult times during the past two years. That’s because 40% to 50% of all hardwood flooring in the U.S. is used in new home construction. Therefore, as the U.S. economy, and specifically new home construction, has experienced a significant decline, the wood flooring industry has felt the effects acutely and continues to struggle.

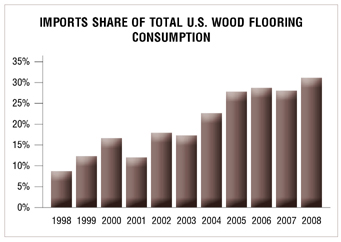

In 2008, U.S. wood flooring consumption dropped 24%, and this was on top of a decline of 12% in 2007. Still, wood flooring imports in 2008 were down only half the percentage of the total market.

In the early part of this decade, U.S. manufacturers began to look for supplemental products to bolster the low end of their offerings. This led many of them to Asia, especially China. A few even built plants there, though most simply negotiated supply arrangements with local manufacturers. U.S. producers that currently have wood flooring manufacturing plants in Asia include Mohawk, in Malaysia, and Shaw and Armstrong in China.

During the past ten years, imports of wood flooring into the U.S. market have grown nearly four-fold, as shown in the following chart:

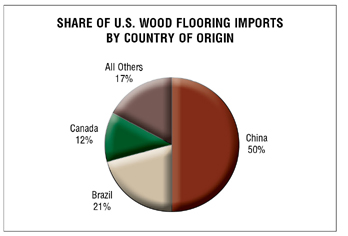

One of the prominent reasons for this growth in imports was a shift in décor preferences by Americans for exotic species of wood flooring. This trend led many U.S. brands to South America and Asia to procure the tropical species their customers were demanding. All of this subsequently led to a significant increase in imports. Last year, it is estimated that imports accounted for more than 30% of total U.S. consumption. Three countries account for the majority of imports, as shown in the following chart:

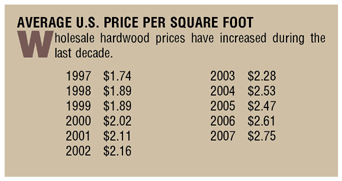

The growth of imports has been fueled by a desire for U.S. producers to acquire lower cost products while fulfilling consumer demand for more preferable tropical species. This resulted in a slight decline of wholesale prices during this period of tremendous import growth, but wholesale prices generally have increased during the past decade.

In the last year or so, several factors have worked against this growth, including a weakening U.S. dollar and rising shipping costs due to a significant rise in fuel prices. Also, many U.S. firms don’t have key skills like currency hedging and logistical capabilities to successfully master international trade.

Another inhibitor will be the Lacey Act amendment recently passed by the U.S. Congress that will implement policies governing the importation of tropical hardwoods. U.S. firms now will need to stipulate that the tropical hardwoods they import have been harvested in ways that satisfy the Act’s limitations for legal import. This essentially means that they must prove that the wood they import was procured in compliance with the laws of the country of harvest. Severe fines and sanctions can be imposed against U.S. firms that improperly import products covered by the Act. It remains to be seen if this legislation has any enforcement teeth and what impact that enforcement will have on the growth or decline of imported products, but all indications are that the Act will serve to decrease the current growth rate of imports.

The situation with endangered tropical species has fostered projects among many U.S. producers to recreate tropical hardwood looks using domestic species. Techniques to accomplish this span the gamut; however, the most compelling method employs the printing of a tropical grain on top of a domestic board such as beech to achieve the desired look. The first firm that can master the commercial viability of such a technique will be able to offer tropical hardwood looks without the stigma of deforesting tropical hardwood stands, and have the added advantage of providing these products at lower prices (or higher margins). To date, no firm has announced a break-through in this effort.

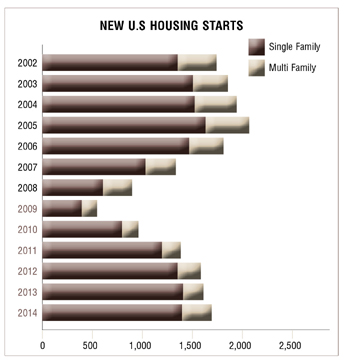

Although experts predict that 2009 is expected to end with volumes for the year lower than in 2008 (current estimates are -14%), the decline year to year will be less than it was in 2008. The main driver of this continued weakened situation is the sustained low rate of new home construction in the U.S. With foreclosures and existing unsold home inventory at record levels, the demand for newly constructed homes is severely curtailed and is not expected to fully recover until 2011.

With U.S. federal government stimulus programs causing record U.S. budget deficits, it is likely that the U.S. dollar will continue to be hampered for the foreseeable future. This will make imports more costly while making domestic production more desirable.

All indications are that the U.S. wood flooring market will return to its former glory in short order, most likely by 2011. This is premised mainly on the fact that wood flooring continues to be the most desired of all flooring options. In fact, it is estimated that the market for households that desire wood flooring is 30% larger than the actual wood flooring market. Thus, as wood floors become more affordable, wood flooring sales will rise. American consumers have a strong desire for the look and image wood flooring brings to a home and that shows no signs of weakening, even in a weak economy.

Copyright 2009 Floor Focus

Related Topics:Lumber Liquidators, Shaw Industries Group, Inc., Mohawk Industries, Armstrong Flooring