Tariff Report: The impact of proposed Trump tariffs on U.S. Flooring – February 2025

By Santo Torcivia

From the early days of our nation in the late 1700s until after WWII in the mid 1900s, tariffs-a tax on international commerce-were a major source of income and the primary source of funds used to sustain our federal government. The switch to funding the government using income tax didn’t happen until well into the 20th century. In fact, the 16th amendment allowing for an income tax wasn’t passed until 1909 and wasn’t ratified until four years later.

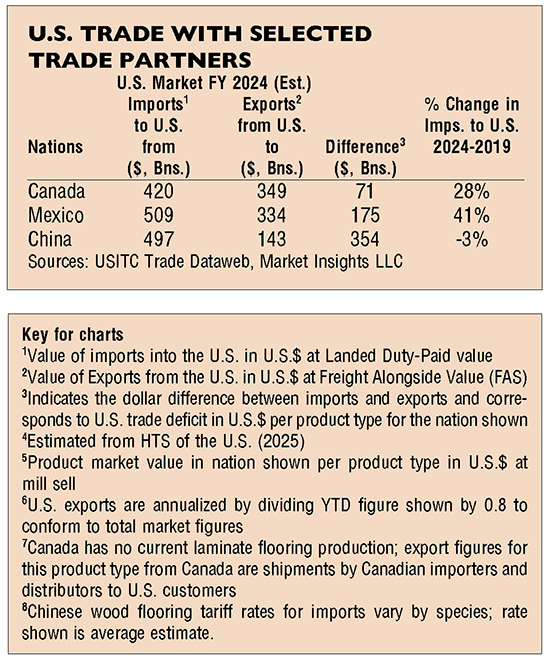

It appears that Trump and his advisors are seeking to turn this revenue spigot back on in his second term as president. At the onset, Trump is considering a 25% tariff on Canada and Mexico and 10% on China in addition to any tariffs already in place. This article examines the overall trade situation with Canada, Mexico and China; the state of affairs by product category; and alternative supply sources should tariffs actually be imposed.

THE POTENTIAL IMPACT ON FLOORING

There are several risks to flooring, and all product types should the tariff threat become reality. Obviously, the imposition of tariffs will cause prices of import product to the U.S. from the affected nations to rise and U.S. export prices to those nations, should they impose retaliatory tariffs, will also rise. These price hikes will likely cause firms to absorb some of the tariff costs, diminishing margins and raising prices to consumers, causing inflation and shifting consumer demand to other product types such as domestic products. Such a shift to domestic alternatives is fine for imports to the U.S. but not so good for U.S. exports, should U.S. firms have no foreign production in the affected nations.

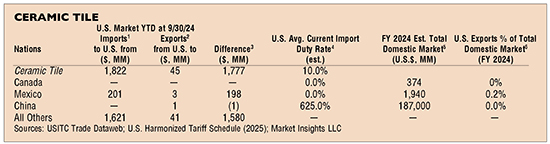

Supply chains will also be threatened, product procurement dislocated and inventory levels will become stretched. During the imposition by the United States International Trade Commission (USITC) of punitive tariffs on ceramic tile imports from China, it took three months for new sources of supply to be established from Spain, Mexico, Turkey and India sufficient to replace former Chinese supply. It should be noted that this occurred in a product category that is globally well-established with ceramic tile firms around the world capable of producing adequate product type at the prices required. Other categories will not be as fortunate.

Any tariff actions against Canada and Mexico would risk legal action as a violation of the U.S.-Mexico-Canada Agreement (USMCA) on trade. It thus remains to be seen how and to what extent changes to the USMCA will be accomplished.

EXAMINATION OF THE SITUATION BY PRODUCT CATEGORY

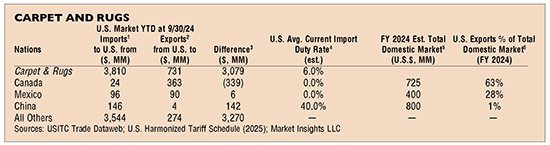

Carpet & Rugs: Since the U.S. is a significant importer of flooring and, in all but one case, not a major exporter, there is little threat that U.S. flooring exports will be impacted. The one exception is carpet and rugs exports to Canada. Year-to-date at September 30, 2024, the U.S. exported $339 million of carpet to Canada and an estimated $424 million at year-end. U.S. exports to Canada will represent 63% of the total Canada carpet and rug market in 2024. In all other flooring categories, the U.S. possesses a trade deficit (U.S. imports more than it exports). The U.S. is vulnerable to any retaliatory tariffs by Canada on U.S. carpet and rugs exported to that nation.

The primary sources of U.S. exports to Canada are Mohawk and Shaw. However, Interface and Beaulieu International both have domestic production in Canada and would benefit significantly along with the few remaining Canadian carpet producers, if Canada were to react to U.S. tariffs on Canadian flooring imports to the U.S. with its own tariffs on U.S. imports to Canada.

Exports of carpet and rug to the U.S. by the threatened nations are not significant, thus any tariffs by the U.S. on such product would easily be filled by excess capacity in domestic U.S. production.

Ceramic Tile: The tariff impact as regards ceramic tile imports is centered around one nation in this discussion, Mexico. China is precluded from the U.S. market due to previous punitive tariffs, the result of trade violations, and Canada is not a ceramic tile producer. Complicating this issue is the fact that several U.S. producers have manufacturing facilities in Mexico or joint ventures with Mexican producers. Still, Turkey, Brazil, Vietnam and India all have sufficient capacity at the required price points to replace Mexican shipments. Of some concern is the fact that Indian imports are currently under investigation by the USITC for trade violations. Also of concern is the fact that Mexico’s proximity to U.S. markets make logistics and transportation costs significantly lower and faster than those of foreign sources of supply.

Considering the U.S. market, ceramic tile is not an area of any serious negative impact from the proposed tariffs. There are ample qualified alternative supply sources, and U.S. exports are small.

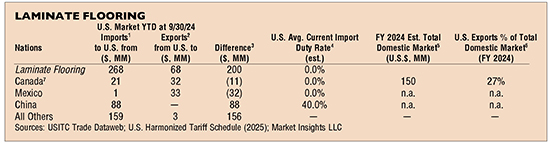

Laminate Flooring: Laminate flooring is the flooring category with the lowest share of market accounted for by imports. Only 33% of the U.S. laminate flooring market value is imports. This is a category that could benefit from its high proportion of domestic production with consumers choosing this flooring versus higher-priced alternative products burdened by tariff price hikes.

Laminate flooring could be poised to benefit from the imposition of the proposed Trump tariffs due to its major domestic production capabilities.

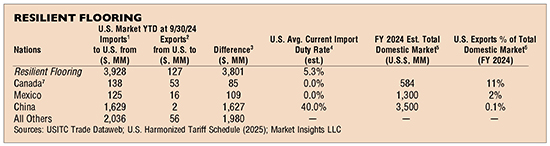

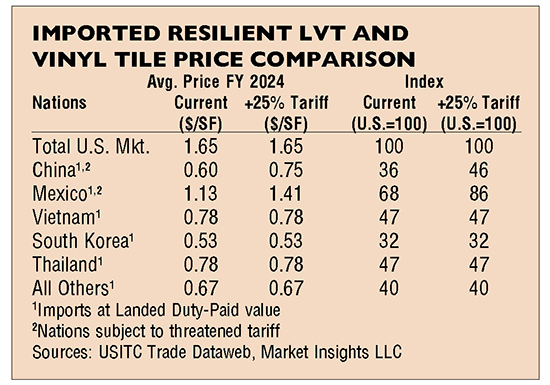

Resilient Flooring: Resilient flooring, the majority (92%) of which is luxury vinyl tile (LVT), could be quite problematic for U.S. producers, distributors and retailers trying to replace the volume currently derived from China. Chinese resilient flooring imports represent 22% of the market value of the estimated 2024 U.S. resilient flooring market and 30% of the U.S. LVT market. Vietnam and South Korea are growing sources of LVT imports to the U.S., as is Mexico. However, if Mexico is included in any tariff impositions, this market could become less attractive and threaten the Mohawk operations there.

Also, the question remains whether Vietnam, South Korea, and U.S. domestic production have capacity sufficient to fulfill the rigid LVT volume represented by Chinese product should the reported additional 25% tariff be imposed on these imports and competitively pricing them out of the U.S. market. It appears that flexible LVT has sufficient U.S. capacity to meet any demand shortfalls resulting from the threatened tariffs and logistic dislocations.

There are many questions and concerns that make LVT vulnerable to the U.S. imposition of additional tariffs. Given the involvement of Mohawk in Mexico, tariffs on Mexican imports could diminish this likely alternative source of product. Another question is whether alternative sources of LVT possess sufficient capacity at the proper price points and quality to be viable alternatives.

As the resilient LVT and tile category is the most critical in total resilient flooring imports, the threatened additional 25% tariff on these products will allow imports from nations not so threatened, specifically Vietnam, South Korea and Thailand, to be more price competitive and threaten China’s product share and supply chain in the U.S.

Logistical disruptions, production capacity and product quality differences notwithstanding, it appears that the three alternative nations could displace the Chinese product volume.

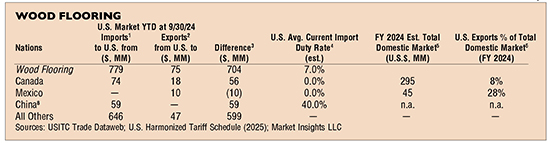

Wood Flooring: Nearly 50% of all imports of wood flooring arrive in the U.S. from Vietnam and Cambodia, nations not mentioned in the proposed Trump tariffs. Another rising source of U.S. wood flooring is Thailand. The previously noted Southeast Asian nations have totally supplanted the wood flooring imports once derived solely from China. Canada accounts for 11% of U.S. imports, much of it maple wood. Still, the U.S. has maple wood forests sufficient to fulfill U.S. demand for maple and other hardwood flooring. Mexico is not a player in wood flooring, nor does it possess a major market for the product, so it is not a factor regarding the threatened tariffs as they affect this flooring category

Quantity figures from the USITC are not consistent enough in this product category to accurately perform even a cursory price comparison by nation.

Given that previously many Chinese firms had either transferred production of wood flooring to Southeast Asia or acquired production contracts with firms located there, a source of supply sufficient to continue to fulfill U.S. imported wood flooring demand already exists in nations outside the purview of threatened or existing major tariffs. Wood flooring, therefore, should see only minimal if any impact from the threatened tariffs as presented. However, the threatened 25% tariff could erode China’s price competitiveness causing nations such as Vietnam, Cambodia, Indonesia and Thailand to erode Chinese share. This, in turn, could cause temporary supply chain disruptions. Also, any tariff increase that inordinately raises wood flooring pricing risks the expansion of the shift in market demand to alternative products such as LVT and laminate flooring.

CONCLUSIONS

There are many questions regarding the impact of the additional 25% tariff if it were to come to fruition, i.e., whether they will be applied to all of the three reported nations, and what the Trump Administration would deem sufficient concessions to not impose the tariffs. For instance, will the Administration simply be satisfied with Canada more significantly enforcing its border, halting open immigration and smuggling? Or if Mexico should endeavor to be more aggressive in its border security and deal more harshly with smuggling by cartels in its jurisdiction, will that be enough to call-off the imposition of the threatened tariffs? If so, this could very well be enough to not impose the 25% tariff on Canada and Mexico.

The situation with China is a complicated one, involving trade practices and geo-political concerns. I would expect that some form of blanket tariff will be levied against Chinese imports to reverse the Trump Administration’s perceived laxness by the prior administration in their trade and political dealings with China.

This whole situation with trade and tariffs is fraught with unintended consequences and many unknowns. Time will tell how this plays out and who, if anyone, benefits from these machinations. In the end, any change presents opportunities to those who can see an effective strategy through the fog of unknowns. The goal of this article is to provide some cursory analysis of the risks and context of this situation and potential alternatives.

Copyright 2025 Floor Focus

Related Topics:Interface, Beaulieu International Group, Shaw Industries Group, Inc., Mohawk Industries