Tariff Report: Impact analysis of U.S. tariffs on Chinese produced flooring - Dec 2018

By Santo Torcivia

In 2001, China was admitted to the World Trade Organization (WTO) but over the years has not complied with many of the stipulations of membership that the WTO requires. The response from the WTO and member nations has been more in the way of criticism than confrontation, largely because of the benefits of access to lower-cost Chinese products.

In an attempt to persuade China to honor its commitments, the Trump Administration on September 24 levied a 10% tariff on $200 billion worth of Chinese goods that includes all flooring categories.

The U.S. Trade Representative, in a January 2018 report to Congress, listed some of China’s violations and unfair practices. These include:

• State-sponsored currency manipulation

• Product dumping and government subsidies for domestic producers

• Maintaining a state-led economy with regulatory support

• Limited access to Chinese markets for foreign firms

• Extraction of foreign technologies

• Foreign investment restrictions

• Inadequate foreign intellectual property rights protection

• Bad faith trademark registration

• Widespread counterfeiting of foreign goods

• State-sponsored computer hacking

The actions taken by the U.S. are mainly designed to aid technology-related industries such as aerospace, defense, electronics, artificial intelligence and pharmaceuticals. These industries have been specifically targeted by China, but all U.S. firms operating in China have been affected in various ways.

In 2017, China shipped over $500 billion in manufactured goods of all types to the U.S. In return, the U.S. shipped $130 billion in manufactured goods to China. Flooring made in China and shipped to the U.S. in 2017 represented $2.6 billion at landed duty value, or 45% of all U.S. flooring imports. Conversely, in 2017, exports of flooring from the U.S. to China were valued at $26 million.

On January 1, 2019, imposed tariffs are scheduled to rise from 10% to 25% and could be expanded to an additional $267 billion worth of imports. If China chooses to retaliate against U.S. agricultural products shipped to China, the U.S. reserves the right to impose a 25% tariff on all $500 billion of Chinese imports.

THE IMPACT BY CATEGORY

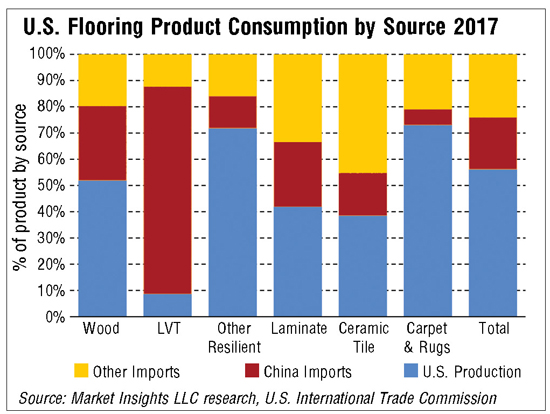

These tariffs will affect the various flooring product categories in different ways, changing their price competitiveness. For instance, luxury vinyl tile (LVT) is heavily exposed to the tariffs with 80% of all LVT and over 95% of rigid LVT sold in the U.S. produced in China. Currently, there are precious few alternatives for rigid LVT outside of China. On the other hand, less than 10% of carpet and rugs are made in China. See U.S. Flooring Product by Consumption Source 2017 for flooring product category exposures to Chinese imports.

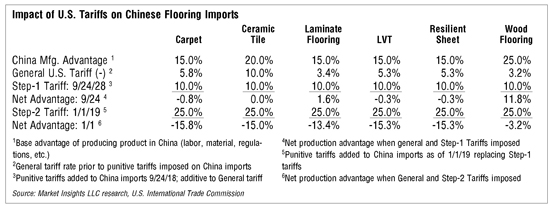

While individual products have various levels of exposure to Chinese flooring imports, the 10% tariffs imposed on September 24 (Step-1 tariffs) do not markedly change the advantage held by Chinese-produced flooring shipped to the U.S. However, when the second round of 25% tariffs come into effect on January 1, 2019 (Step-2 tariffs), China will be at a distinct disadvantage in all flooring categories except wood flooring (re: Impact of U.S. Tariffs on Chinese Flooring Imports).

CHINESE PRODUCT SUBSTITUTES BY CATEGORY

Besides how the tariffs will reshape the pricing of Chinese flooring imports, it is important to also evaluate the ability to substitute flooring produced in nations that are price competitive with China and not impacted by the punitive tariffs.

Soft surface flooring has no real Chinese exposure regarding broadloom or tile, so this category will only be impacted with area rugs. Area rugs from China can easily be substituted at competitive price points by India, Egypt or several other Middle Eastern countries.

Most of the exposure within ceramic tile is in the low-end price area (China accounts for about 15% of the total U.S. ceramic tile market). This volume can easily be replaced cost effectively by tile from Brazil, Mexico or Turkey without a lot of trouble.

Laminate flooring in the U.S. market derives about 25% of its volume from China. Some of this volume can be replaced by production from Austria, Russia or other eastern European nations. However, U.S. importers may experience some price increases trying to replace Chinese laminate flooring volume.

Luxury vinyl tile (LVT) has a more problematic situation. About 79% of the U.S. LVT market is imported from China. Additionally, virtually all rigid LVT comes from China, and rigid LVT (SPC & WPC) comprised 73% of the U.S. LVT market in 2017. Although several U.S. producers of flexible LVT are attempting to produce rigid LVT in their flexible LVT plants, to date none have reportedly been successful at mastering the process consistently enough to be commercially viable. South Korea is an alternative source for rigid LVT, but it has limited capacity. Unless a suitable alternative and price competitive source is found, the continued growth of LVT in the U.S. could be stymied if the price of rigid LVT rises significantly.

Resilient sheet and vinyl composition tile (VCT) have limited exposure to competition from Chinese imports so the impact will be minimal.

Wood flooring is facing both a positive and a negative dilemma. On the negative side, the tariffs imposed on Chinese wood flooring will basically bring U.S. producers (representing 52% of U.S. market) to parity with Chinese-made product (representing 28% of the U.S. market). U.S. producers will see no price advantage versus Chinese competition.

On the other hand, the tariffs will raise prices for rigid LVT, a nemesis of wood flooring growth in the U.S. and virtually all sourced from China. This will allow wood flooring to gain back some price competitiveness and market sales.

A trend currently underway is the re-location of Chinese wood flooring plants to Vietnam and Cambodia. These nations have a ten-percentage point better production advantage versus China. The quality of wood flooring from Vietnam is reportedly not as consistent as that from Cambodia or China. Such a relocation move will allow formerly made-in-China wood flooring to circumvent U.S. tariffs. Still, it is not believed that an authoritarian nation like China, which covets control over its industries, will allow any significant number of Chinese plants to move out of the country. Such relocation would create unemployment in China and a loss of control over these firms by provincial and federal Chinese authorities.

TARIFF RATE COMPARISON

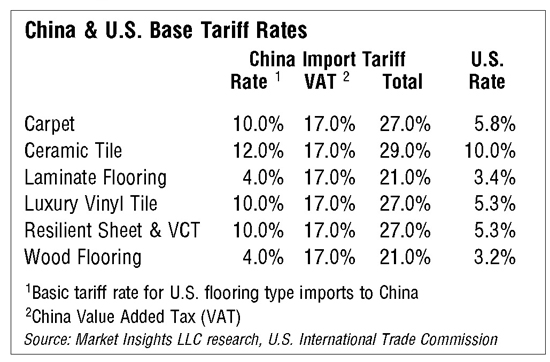

Flooring tariff rates are very lopsided when comparing the movement of goods into China versus out of China. Although on the surface, Chinese tariffs on flooring seem comparable to the basic tariffs in the U.S. (i.e. rates in the U.S. prior to September 24, 2018). A major point of discrepancy is the fact that China charges a 17% value added tax (VAT) on all imports. This VAT is on top of the basic tariff rate it charges various flooring types. The U.S. has no such added tax (re: China & U.S. Base Tariff Rates). China is considering adding 25% retaliatory tariffs to U.S. imports, which would make the rate comparisons even more lopsided against the U.S.

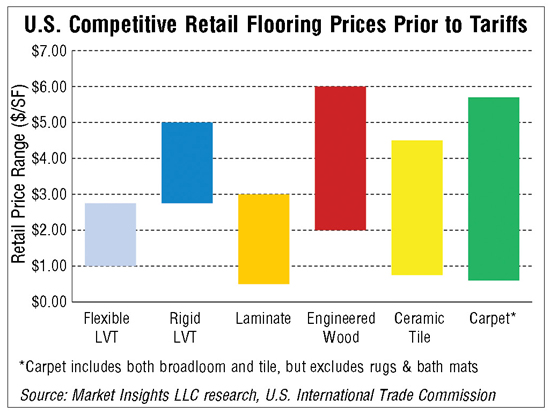

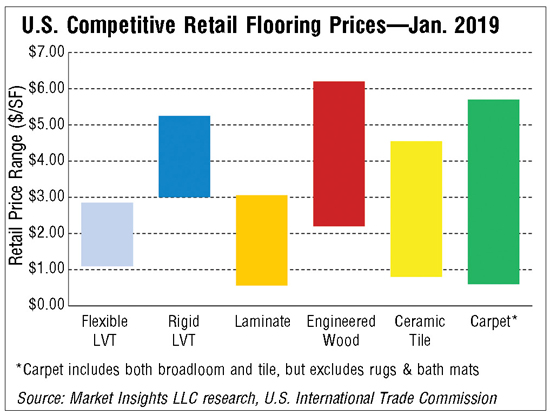

The latest round of U.S. tariffs, especially the imposition of the 25% tariff planned for the beginning of 2019, will create some disruption in product category price competition and market consumption. U.S. Competitive Retail Flooring Prices Prior to Tariffs depicts category pricing prior to any punitive tariffs, excluding installation.

In U.S. Competitive Retail Flooring Prices-Jan. 2019, category pricing with both steps of punitive tariffs imposed assumes no price increases by non-impacted product categories to reap margin and excludes installation.

WHAT TO EXPECT

Expect several things to occur because of the imposition of punitive tariffs, most of which will diminish the overall flooring market.

The tariffs being imposed have already impacted $250 billion worth of Chinese imports and another $267 could be added. Tariffs are really a tax on imports; therefore, those tariffs levied on $250 billion of Chinese imports is estimated to depress the Gross Domestic Product (GDP) by 0.5% (percentage points). Stated simply, higher prices will result in less spending by consumers and businesses, which means downward pressure on flooring sales. Also, expect sales that do occur to shift down to lower price points.

Studying the dynamics of the prior steel industry tariffs on U.S. imports, it is likely prices charged by domestic producers and imports from nations not affected by the tariffs will also rise. Most companies will seek to reap additional margins rather than hold back prices to gain share, the net result being higher profits for companies at lower market sales volumes. The result of margin reaping (price increases) by many firms will be to reconfigure the former price relationships established between product categories before the imposition of punitive tariffs at a higher set of price points (re: U.S. Competitive Retail Flooring Prices Prior to Tariffs adjusted upwards). It is the classic conflict between the short-term and long-term strategic view. The degree to which the U.S. flooring market will be curtailed by widespread price increases depends on the number of firms reaping margins and the degree to which they raise prices, currently a major unknown.

Carpet and ceramic tile will gain some resurgence (in terms of share of the market) as they are least effected by the imposed tariffs and their prices are not markedly impacted. As U.S. flooring sales move downmarket, relatively lower priced products like carpet and entry-level ceramic tile will benefit, especially in builder markets. Laminate flooring will gain some share as well among consumers.

Chinese importers may attempt to sell product produced in China via Cambodian, Vietnamese or Korean trading companies to circumvent tariff imposition. They may also attempt to trans-ship product via Canada or Mexico and then truck into the U.S., again to circumvent the U.S. tariffs.

It is expected that China will negotiate to become more WTO compliant and open its markets to a greater degree. As a semi-state-controlled economy, China can ill afford to subsidize its firms to keep its domestic industries viable and unemployment down. China is a nation that requires growth; it cannot endure large numbers of unemployed factory workers roaming its cities looking for work. Expect this matter to be moving toward a conclusion by mid-year 2019, especially if the European Union joins the U.S. in its efforts versus China. Reports from China indicate that leaders there are confounded by the United States’ actions; they were not prepared for such direct actions as the U.S. is imposing.

If China opens its market to fair trade and provides reciprocal tariff rates, those firms that are prepared will reap a significant opportunity. This will require prior planning and research of the logistics, nuances and resources needed to be successful in that or any market.

WHERE WE’RE HEADED

If history has taught us anything it’s this: “There is opportunity in every change.” To be sure, these tariffs will create opportunity for some who are insightful enough to see it and plan to take advantage.

Copyright 2018 Floor Focus

Related Topics:Lumber Liquidators