Senior Living Update: The segment is in the midst of a long-term growth cycle, offering opportunities to commercial flooring producers – March 2024

By Darius Helm

No commercial segment is poised to grow faster than senior living over the next three decades, as Baby Boomers, the youngest of whom turn 60 this year, continue to age and rewrite the rules around what it means to grow older. In recent years, commercial flooring producers have taken note of this segment’s growth, but many aren’t as focused on developing targeted collections for senior living as they do for corporate, hospitality, acute care and education. That’s likely to change in the coming years.

There is not enough Clairol in the world to cover up the grey wave that’s poised to transform the U.S. landscape. It’s not just the Baby Boomer wave itself, but also advances in medicine and more awareness of healthy living that are swelling the ranks of seniors and driving demand for interiors in the segment. And in many cases, particularly among the more affluent, people are moving into retirement communities at younger ages.

Siobhan Farvardin, partner and global practice director for senior living at HKS, notes that 15 years ago the average age of those entering senior living communities was around the mid-80s, and now she sees more people coming in their mid- to late 70s. These days, with the rise of independent living and active-adult communities, and with all the amenities, choices and wellness focus, it’s more palatable, she says, adding, “It has more of a hospitality approach.”

MARKET GROWTH

The Pew Research Center reports that of the 62 million seniors in the U.S., 100,000 are centenarians, a number that is projected to more than quadruple in the next 30 years. And the first person to live to 150 has already been born, says genetics professor David Sinclair, director of Harvard Medical School’s Paul F. Glenn Center for Biology of Aging Research.

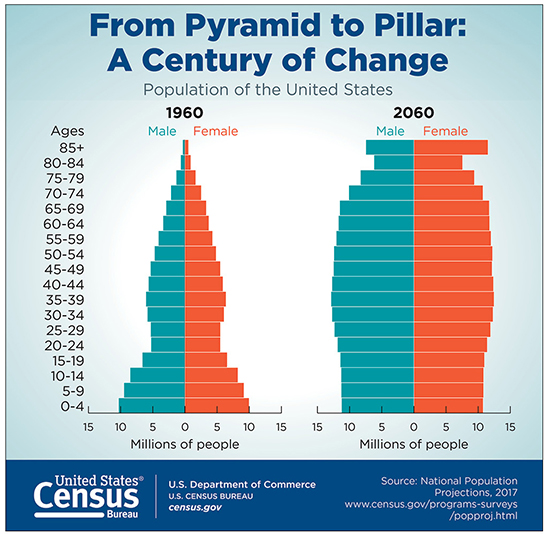

According to Perkins-Eastman Design Research’s The Longevity Revolution, citing World Health Organization data, “In the United States specifically, there will be more elderly than children by 2060.”

The paper notes that the traditional model is for the larger population of younger people to look after the smaller population of the elderly.

Seniorliving.org, a leading resource for the senior community, reports the size of the market is expected to grow by 4% annually.

However, not all seniors are in senior living facilites. Quite the opposite, actually. There are in the U.S. currently about 31,000 assisted living communities, the most common type of senior living, with about 1.2 million licensed beds and 80% occupancy, accounting for only 1.3% of seniors. And a study conducted by A Place for Mom, a nationwide organization that helps find solutions for seniors, notes that, through 2030, about 10,000 Baby Boomers will reach retirement every day, and the number of beds for seniors will need to nearly double by 2040. In addition, there are about 1,900 continuing care retirement communities (CCRCs), generally targeting a more upscale clientele, and 15,300 nursing homes with 1.6 million beds.

Also, the senior living population is largely women. About 70% of assisted living residents are women, per Seniorliving.org, so there are more than twice as many women as men in this type of housing.

What also stands out about the senior living market is that many of the projects out there cater to the more affluent, and currently there are not enough solutions for those further down the wealth spectrum, with the middle of the market presenting the most lost opportunity.

“Research is being done on that middle market because it has sort of disappeared,” notes Jennifer McDermott, managing principal and director of senior living interiors for Perkins Eastman. “We do have projects that are on the more affordable and rental side. So, we do see a range, but there seem to be just fewer in the middle market.”

“There’s a huge need for middle-market and lower-income housing for seniors,” says Luann Thoma-Holec, owner of Arizona-based Thoma-Holec Design. “There’s a huge shortage of housing for people who can’t afford what’s available today on the market.” Thoma-Holec points out that Arizona, with its mild weather, attracts a lot of seniors, many of whom are now homeless in the Phoenix area.

Emily Macht, partner and studio practice leader, commercial interiors, for HKS, notes that while developers are looking to do all sorts of projects, including those designed to be more affordable, the lower end has less choice, fewer amenities, less flexibility and less customization.

“Baby Boomers want to age in place,” Thoma-Holec points out, adding that, when they reach a point where they need some degree of assistance, they often need to be encouraged to leave their homes. And active adult communities have been developed “to offer them something that’s more affordable than the assisted living and full-service communities.”

Over a decade ago, HKS started its Sleepover Project, where architects and designers spend 24 hours at senior living communities to better understand the needs of seniors. Over the years, this has evolved and deepened. This includes having an ailment assigned to them, navigating around with wheelchairs and walkers and using weighted vests to simulate muscle loss.

The firm has been working with an optometrist to develop specialized glasses that its team can wear that will simulate some sort of vision loss or impairment. Says Macht, “We can look at patterns and dark colors, so we can be mindful of what we’re specifying on the floor.”

SENIOR LIVING TRANSFORMED

Baby Boomers are not just driving investment in the senior living market, they’re also driving change. Generally speaking, they’re a vibrant, robust, healthy group of people, Macht notes, though they still have to contend with the same issues arising from visual loss, impairments and other age-related conditions.

“They’re looking for warm, inviting, hospitable, often upscale-feeling spaces with choice and variety, especially when talking about common areas and amenity spaces, dining-and being able to age within a community,” Macht says. A third of Baby Boomers are single, and many are looking for social engagement.

Also, compared to previous generations, Baby Boomers are more tech savvy-or at least they’re not scared of tech-and they love to learn, says Thoma-Holec. She adds, “So, we’re doing university-based senior housing, multigenerational housing-this appeals to Baby Boomers.”

Importantly, Baby Boomers are a generation defined by autonomy more than any other-the leading edge of that generation redefined modern society and culture 60 years ago. Previous generations entering senior living largely ceded their autonomy-to both the children or caretakers placing them as well as to the limited senior living options-and as such, they had little voice in terms of their lifestyle or the amenities provided them. Baby Boomers upended that model; it is their demands that are driving the design of modern senior living communities.

When McDermott first started at Perkins Eastman 19 years ago, senior living was still stuck in the old model. “There would be one dining room,” she says, “and it needed to serve breakfast, lunch and dinner. That’s where you went for three meals a day. And it was probably a formal dining room because that was kind of the expectation back then.” In terms of amenities, there might have been an arts and crafts room, maybe a multipurpose room, a fitness room, a beauty/barber shop.

Now, notes McDermott, it’s a more customized experience. Seniors have wide-ranging interests and hobbies, and there’s a focus on the whole wellness experience, which includes lifelong learning and engagement outside of the confines of the community. And gone is the dining room, replaced by multiple boutique dining venues. These days, you might find WeWork-style spaces for people who might want to work part-time. And there’s also more personalization. She says, “It’s kind of a catered lifestyle, even when it comes to the apartments they’re moving into. They want more options. They want to personalize it, customize it.”

McDermott relates that on one of her projects, the client wanted to have a lifestyle consultant on the team to consider the lifestyle of the residents coming in and what their needs might be from a programming standpoint. “We’ve never had a lifestyle component as part of our teams in the past, so I think that again just speaks to the need for choice.”

And some residents want their pets, too. McDermott says, “We just finished a project in Arizona with a dog park and pet washing station. And speaking of unit personalization, if someone has a ground floor unit, they may want to fence off the area around their unit so they can let their pet out safely.”

The development of this new senior living landscape can perhaps be best understood through the lens of longevity. Senior living communities these days are not a place people go to fade away. While many seniors are well into their 80s when they finally stop living independently, some go much younger and could be there decades. And it’s worth remembering that, while seniors are technically 65 and older, most senior communities accept people a decade younger. So, for many, the senior living community they choose will be where they enter the third act of their lives, and for some, that act will be their longest.

DESIGN AND FLOORING

Today’s senior living communities include a range of environments-independent living units, restaurants, stores, fitness and wellness centers, worship and meditation rooms, managed outdoor spaces for walking and taking in nature, as well as substantial back-of-house areas and, depending on the type of senior living community, skilled nursing facilities-all with a variety of flooring needs.

Thoma-Holec, who has been in this line of work since 1995, recounts that when she began, Tuscan and Mediterranean design was popular-heavy furniture, heavy textures and materials, darker colors. She says, “When the recession hit, in general the entire population, not just senior housing, started to look at a simpler lifestyle, more affordable things-they didn’t like all the clutter, possessions, etc. At that time, we really went to a cleaner, more hospitality-based design. Fewer bells and whistles in terms of accessories. Furniture became simpler, with cleaner lines. Colors became a little more vibrant, more neutrals.”

Thoma-Holec still designs toward a hospitality look to a degree, noting that since day one, hospitality, medical and residential have all been used together in senior living design. And since Covid, the focus on medical has been critical, with the requirements to keep residents safe, to make sure surfaces are cleanable and to keep out illnesses of paramount concern.

She adds, “Midcentury modern has been super-popular, but I have clients that don’t want that look because they feel it doesn’t look comfortable. Clients want a more residential feeling and less the midcentury modern hospitality look.”

More than ever, biophilia drives design decisions. Studies have shown time and time again that interaction with nature, views of nature, even just photographs of nature, measurably improve health and wellbeing. And that includes using designs derived from nature for interior décor and incorporating forms, colors and color combinations found in nature.

Farvardin says, “My colleague Dr. Nanda published a study years ago that showed that simple exposure to biophilic art reduced both anxious behaviors and anxiety medication that psychiatric patients demanded, potentially saving the hospital thousands of dollars. And our work in UC San Diego Torrey Pines incorporated biophilic design elements that resulted in both reduction in energy use as well as a documented decrease in student-reported depression.”

Despite the diverse spaces and environments in senior living communities and the various flooring needs, like most other commercial segments, that largely means carpet and LVT, though in the case of senior living it likely won’t be carpet tile. The higher-end residential and hospitality patterned goods in demand are still largely the domain of broadloom.

At Perkins Eastman, McDermott uses both broadloom and carpet tile. “It comes down to the design and sometimes the cost,” she says. And if it’s cost, it’s broadloom. She reports that, lately, mills don’t seem to be coming out with new collections as often, which pushes her toward customization.

“I think we get more options with broadloom because carpet tile in some aspects still feels more commercial,” she adds. “And we really want that residential feel.”

Thoma-Holec tends to specify a hospitality-patterned carpet for various areas in senior living buildings, generally a custom broadloom, and will use carpet tile in hallways and certain amenity spaces. But she notes that carpet mills in some instances seem afraid to take a risk and are perhaps limited by thinking that senior living design has to be a certain way-subdued colorways with limited patterning, for instance-whereas interior décors these days are often dynamic and full of color.

Macht says that, while some operators insist on carpet in units, she’s seeing less of it. And Thoma-Holec reports that in a recent post-occupancy evaluation of a senior living community her firm designed, she found out that residents of this high-end community would rather have hard surface flooring than carpet because that’s what they’re used to. Their homes were hard surface, many still believe that carpet increases allergen exposure and they can’t be as mobile on it.

Hard surface flooring in senior living has seen more of a transformation. Sheet vinyl used to be fairly typical, as well as porcelain, reports Thoma-Holec. These days, she uses less porcelain and no sheet goods, with LVT now taking most of the square footage. She says, “Wood looks are still very popular, but there’s a multitude of other products on the market that look like fabric or stone or marble.”

All of the designers we spoke with agree that the thicker 5mm LVTs that obviate the need for transitions from carpet can be critical in senior living environments, where the risk of tripping and falling is much higher. But Macht says she’d like to see more 5mm products that can be easily laid out in different patterns, like herringbones and chevrons, as well as borders and accents for some visual interest on the floor.

Thoma-Holec reports that she still struggles with color palettes from flooring producers, where color variation can be very minimal. Plus, compared to fabrics, paints and wall coverings, flooring lags more behind the trends.

In general, the designers we spoke with can find what they need from flooring producers with a little legwork. On the carpet side, it’s often in the hospitality collections. As Macht points out, most carpet manufacturers don’t tend to produce carpet specifically for senior living, at least not yet.

LOOKING AHEAD

According to The Longevity Revolution, “As people live longer, it will become the norm to have several generations of people living on campus together. A centenarian may have 80-year-old children and 60-year-old grandchildren. There may need to be new configurations of homes on a campus to accommodate these extended multi-generational families.”

New living arrangements are likely, including units with multiple bedrooms for multi-generational living and “new unit types that provide a co-living option where several single people can choose to live together in a larger apartment as a family.”

Further, senior living communities will increasingly be integrated into their surrounding communities. And there’s a lot of interest in intergenerational communities, where seniors interact with, perhaps work with or mentor the younger generations. Senior living communities attached to higher education facilities-like Holy Cross Village in Notre Dame; The Village at Penn State; and Vi at Palo Alto, attaching to Stanford University-are in high demand.

About four years ago, Rohde started a nonprofit, Live Together, Inc., that focuses on intergenerational community models. She says, “I believe this is the only way out of our current aging and services situation-providing normal ‘neighboring’ with wrap-around services.”

Also, from The Longevity Revolution, “Adults who are living longer will no longer be resting, they will be active and a vital part of our society, and our living environments will need to reflect those seismic shifts.”

Jane Rohde, principal of JSR Associates, a healthcare and senior living design consultancy, notes that there is a continuing staff shortage in the senior living market. She says, “It was bad before the pandemic, then the stress, overwhelm and underpayment led to additional vacancies and folks getting out of healthcare and aging professions altogether.”

“We learned from Covid that staff retention was challenging,” says HKS’s Farvardin. “And some staff would maybe be taking on two or three jobs. The biggest expense when it comes to staff is turnover. How can you make sure the staff is happy?” One way, she notes, is by making the back-of-house appealing-it’s not going to be grey VCT. “It’s going to be vibrant, exciting, a place you want to be. There’s going to be a lot of daylight, a place they can call their own oasis.”

Design firms are increasingly taking into consideration the wellbeing of staff in their senior living designs. And that includes flooring that is comfortable underfoot, including carpet, as well as staff lounges, phone rooms and creating calming and relaxing areas for respite, says Macht. “We’re seeing this throughout healthcare and senior living facilities,” she adds.

Copyright 2024 Floor Focus

Related Topics:Coverings