Retailing: Then and Now: A look at how retailing has changed in 25 years - Aug/Sep 2017

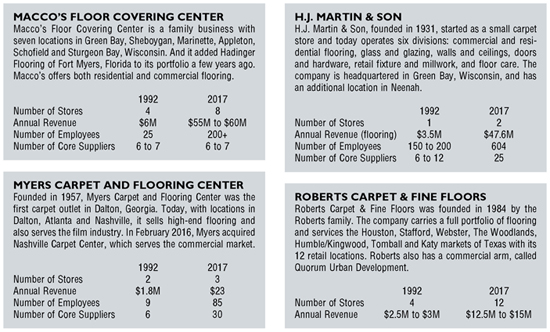

We asked four veteran specialty flooring retailers to compare their 1992 and 2017 operations and share their observations. Here, David Martin of H.J. Martin and Son, Jeffrey Macco of Macco’s Floor Covering Center, Rick Myers of Myers Carpet Company, and Sam Roberts of Roberts Carpet and Fine Floors offer an insightful look at how the retail flooring business has changed over the last 25 years.

Q: What are the most significant changes in your retail operation today compared to 1992?

Myers: Technology. In 1992, we wrote invoices and took inventory by hand. We had one tiny IBM computer that we used only for pricing. In 2017, we have websites for each of our three stores with Google AdWords for pulling in marketing leads from across the country. We use an RFMS computer program to manage our inventory and sales, and have multiple security cameras in each of our stores.

Martin: In 1992, there was no automation or computers in retail flooring stores. We had paper price sheets, and everything had to be entered by hand. It was not sophisticated, and it wasn’t good for customers, as we couldn’t track their previous orders. We did not have a software system, and there was apprehension in the industry against the use of technology.

Today, we are constantly connected with our customers and suppliers through the use of cell phones and technology, which seems more time consuming, but it is actually much more efficient for our business. With technology and the Internet, our retail operation has an infinite number of options for customers. On the back end, every division has its own inventory and estimating software.

Macco: For us, the biggest changes in retailing have to do with the consolidation of vendors, the implementation of computer software and our size. We are a lot larger today.

Roberts: All the vendor display systems are significantly better today than they were in 1992: 27”x54” blanket waterfall displays showed the carpet very well, but they were very difficult to work on the floor, hard to keep neat and orderly, challenging to check out samples from, and they couldn’t take the volume of long color lines. Hard surface displays are also remarkably improved. Today, the individual samples are very attractive, efficient and durable.

Q: What is your business mix today compared to 1992?

Macco: In 1992, we were 100% retail. Today, 65% of our business is commercial, 20% is new residential construction and 15% is replacement retail.

Myers: Our business was much more retail- and homeowner-based in 1992. Today, we still do retail but dramatically more builder and commercial business. That includes having custom carpet produced for commercial buildings, retirement homes and high-rise apartments. We also make custom area rugs for commercial use.

Martin: In 1992, we had roughly 40% builder sales, 40% commercial and 20% retail/residential remodeling. Today, we are 18% single-family builders, 25% multi-family construction, 12% retail and 45% contract commercial.

Roberts: We’ve always been a primarily better-end goods retail-oriented company with some negotiated commercial and custom builder work. Today, we also do a significant amount of business that I characterize as “urban development.” This is largely new, luxury high-rise condominium and townhouse work.

Q: How were your marketing dollars allocated in 1992 versus now?

Roberts: We advertise very differently today and mostly via vehicles that didn’t exist in 1992. Cable television, digital/Internet and full-color, large LED signs are central to what we do today. Web sites, lead generation, banner ads and pay-per-click are now very significant elements in any comprehensive marketing effort. In 1992, we relied on newspaper advertising and affiliate television spots.

Martin: In 1992, direct mail was 20%, television was 50%, and radio and print were 15% each. Today, we use primarily digital advertising-approximately 80%-with the remaining 20% comprised of radio and print. While we still advertise in a traditional manner, our focus now is to engage with returning customers and potential customers through a variety of methods, especially social media channels. We want them to be able to visualize our flooring products in their home, whether a remodel or new construction.

We have invested heavily in Internet search engine marketing, search engine optimization and remarketing. All of our promotional campaigns have a website landing page that is associated with our sale so we’re able to track success. We also work to have a website that is easy for our customers to use and to generate ideas before their store visit.

Macco: In 1992, our mix was 75% local TV, 20% radio and 5% newspaper. In 2017, it’s 55% TV, 35% radio and 10% Internet.

Myers: We spent less than $10,000 on marketing in 1992. In 2016, for all three stores, we allocated $141,000 for marketing efforts.

Q: How has the consumer changed in the last quarter century?

Roberts: There was virtually no research done by customers prior to the actual in-store shopping experience in 1992. At that time, customers went to carpet stores, furniture stores or department stores and spoke with the salesperson about what they wanted or needed. Advertising to drive customers into those stores and word-of-mouth were the predominant outside influencers then. The Internet changed that entirely.

Martin: Overall, the customer is much more educated today about their options, and there are many flooring stores and resources they can choose from to gather knowledge. The customer also has more ways to get inspired today, through social media sites like Instagram, Houzz and Pinterest, as well as design-based apps. And HGTV and other similar home-improvement channels have done a great job of making the space-planning, design and remodeling process more fun.

Today, the value of time is one of the most important aspects to the customer. Major online retailers have trained consumers to not spend time in a store but instead on their phone or computer. Although flooring is somewhat a unique purchase, we are still cognizant of the customer’s time. We are constantly evaluating our process to make it the most efficient it can be.

Macco: The consumer of today shops online before hitting the store and is better informed-or sometimes better misinformed.

Myers: In 1992, customers who entered Myers Carpet were much more influenced by their neighbors and word of mouth. Now, the Internet provides customers unlimited access to information about all the floorcovering choices. Interestingly, our business with decorators has increased.

Q: How has the role of the retail sales associate changed in 25 years?

Macco: The role of the retail sales associate is still very much the same: to gain the consumer’s trust in a market with so much varying information. Once the consumer feels that they have found their trusted advisor, they are ready to make a purchase.

Martin: The expectation today is that sales associates will see the project through from the design phase to installation. They are also the main point person for questions and working with the various trades throughout the installation.

Our design team and installers are the face of our company, and we are lucky to have had people who have been with us for 40-plus years. When a customer has that kind of consistency, there is a strong, ongoing relationship between our people and the customer, which translates to a stronger relationship and repeat business.

Myers: The retail sales associate must be more knowledgeable about the products that they sell because of the increase of floorcovering products available-in both hard and soft surface.

Q: Who owns the brand to the end-user today versus 25 years ago?

Roberts: On the carpet side, the biggest change from 1992 to today in the ownership of brands, and even control of the category, has shifted from yarn suppliers-principally DuPont, Monsanto and Allied-to the carpet manufacturers, as they have always yearned for it to be.

Brand ownership on the hard surface side is more complex. The shift from distribution dominance with largely American-made product to the influx of imports selling into all channels, as well as the emergence of Shaw and Mohawk as huge hard surface players, has totally changed the landscape. In 1992, neither Shaw nor Mohawk were even in the hard surface business.

With the proliferation of products and manufacturers, especially in the sales of better goods, the brand of the dealer is as important as it has always been.

Myers: In the early ’90s, most of the carpet manufacturers promoted themselves through home magazines and point-of-sale displays. Today, all flooring suppliers and retailers have a presence on the Internet. I believe that there are more high-end brand suppliers today than there were 25 years ago, and the Internet gives them a better tool to get their message to consumers.

Myers Carpet Company has become the largest wool carpet retailer in the southeastern United States and one of the top ten in the country. We have created our own brand for higher-end products.

Macco: We own the Macco’s brand, and that is very important. In 1992, very few brands worried about direct consumer contact. Stainmaster was one of the first brands to have an 800-line so that consumers could contact them directly. Today, a lot more manufacturers are concerned with direct contact. Not all but most have very sophisticated ways to touch consumers directly.

Martin: Sheet vinyl manufacturers like Armstrong and Mannington have historically been the only ones doing customer outreach. Because of their longevity-50-plus years-people came to know those brands. Other floorcovering manufacturers didn’t seem to place as much importance on it. Customers by and large have not been overly brand-centric. Beyond the major brands mentioned, people really didn’t know much about brand labels.

Our customers trust us to select the appropriate flooring for their space, based on their environment and lifestyle. They therefore look to us to select the brand and product type that best fits their space. We rarely have customers who are brand specific when requesting flooring. Their other expectation is that we will recommend the best product, properly install the product, then take care of it for years to come with our floor care division.

Q: Has the proliferation of flooring products on the market made it easier or harder to make a sale?

Myers: The diversity of products makes flooring more difficult to sell and requires a fairly long learning curve for our employees.

Roberts: The proliferation of product has definitely made selling more difficult. Variety is wonderful, but the selection process has become far more difficult for the consumer.

Macco: The increase in product offerings has made no change, but Internet sales and consumer awareness certainly have.

Martin: It’s easier because today’s consumers want to differentiate themselves. Back then, most of the houses were similar in layout with the same types of flooring. For example, a three-bedroom home often had the same carpet in all of the bedrooms, just in a different color. Our sales team today is design-based, so they are able to direct and educate the customer on the options available, helping to steer them in a direction that will best fit their lifestyle and their overall space.

Q: In 1992, what percent of your products were purchased direct versus through distribution? How does that compare to today?

Martin: Any vinyl, wood or ceramic tile came through a wholesaler back then. We bought most of our carpet direct through Carpet Max, which gave us better pricing and a private label. We still work through distribution today for many hard surfaces-it keeps freight and delivery-time down. Carpet and specialty products now are purchased direct.

Myers: Today, we buy from fewer distributors than in the past, and I believe that there are fewer distributors in the marketplace today.

Roberts: We’ve never purchased a significant amount of our carpet from distributors, but we used to buy almost all of our hard surface from them. Today, we buy the great majority of our hard surface products directly from the manufacturers.

Macco: In 1992, we were 75% direct; today, we’re 95%.

Q: Who did you consider your competition in 1992? Who is it today?

Myers: Twenty-five years ago, Dalton had around 130 carpet retailers. Today, there are probably fewer than 25. Other than the local retailers in Dalton, Atlanta and Nashville-the markets in which we have stores-I think the Internet has become more of a competitor.

Martin: In 1992, our largest competitor was another locally owned flooring store with multiple locations, and it was the early beginnings of the big box stores entering our market. There also were warehouse operations that basically just sold materials-leftovers with really low prices. We were trying to compete against that.

Today, it’s a combination between the big box retailers, family-owned flooring stores and outlet centers. Warehouse operations have largely disappeared. Big box stores’ flooring departments have shrunk. We now compete against Internet sales.

Macco: In 1992, our competition was other retailers; today, it’s Internet sales and the big boxes.

Q: Do you find the specialty retail flooring business to be easier or harder today?

Macco: I find it different-not easier or harder. We have issues today, like reputation awareness online, that we never had before, but also consumers are better educated than ever before. I don’t think it’s any harder other than making sure consumers know that just because someone said it online doesn’t mean it’s true. A well-educated retail sales associate still needs to offer the correct information and gain the consumers’ trust-that has not changed.

Myers: Although being a floorcovering retailer doesn’t seem to get any easier, Myers Carpet celebrates its 60th year in business this year. Twenty-five years ago, a retailer’s sales time consisted mainly of time on the showroom floor and a few newspaper and magazine ads. Today, the consumer, emails and cell phones play a much larger role.

Martin: People value their time more today and want things done faster. A retailer used to have much more time from start to finish on a project. Today, schedules are pushed because of the demand on skilled labor, but the deadline never changes, only the sequence. In the end, while schedules have condensed considerably, the expectation of the customer still remains high, and they generally believe that they should not have to wait.

Q: Are consumers choosing a better product today than they were 25 years ago?

Roberts: Except at the low end, fashion has always been important in flooring. The dramatic improvements made in yarn technology, dyeing and tufting have created the ability for manufacturers to make dramatically more beautiful and varied fabrics. In 1992, LVT and laminate barely existed. Hardwood products were mostly fiber block parquet and 2-1/4” and 3” in oak, oak or oak. Ceramic tile was 8”x8”, 12”x12”-mostly solid color for the floor. The printing and texture technologies of today did not exist in 1992.

Martin: The customer overall is more educated, which immediately takes the dialogue to a much more detailed level. Our design and sales staff also provide our customers with industry insights for better buying. We’ve always believed in buying better brands so that the product would last longer, even though it might be a higher price.

With the availability of things like HGTV, along with Pinterest and Houzz, people want to achieve the looks that they see on those platforms. Function somewhat becomes an afterthought for them. Where function comes into play today, though, is in instances where people run ceramic tile throughout their whole house. They’re doing it for fashion and because it is also easier to care for. This was unheard of in 1992, when carpet was the primary product of choice.

Macco: Not necessarily, though some definitely are. Older consumers who may have had a bad experience with a cheap product or now have the money to afford better goods will buy higher-end material, but younger consumers or those on a strict budget will still buy lesser values. Don’t get me wrong, everyone wants the best, but some realize that their five kids and three dogs might be a little rough on high-fashion, solid white carpet.

Some production builders are quoting very low-end, base-grade material, but others are going after the upgrades.

Myers: Myers Carpet made a decision many years ago to go higher end. We focus on wool, sisal, seagrass, custom rugs and custom staircase runners. We offer the highest quality products in the floorcovering industry. Twenty-five years ago, we mostly sold nylon and polyester cut-pile carpet-the vast majority being brown.

Copyright 2017 Floor Focus

Related Topics:The International Surface Event (TISE), Armstrong Flooring, Mannington Mills, Mohawk Industries, Lumber Liquidators, Shaw Industries Group, Inc.