Recycling Update: Despite long odds, carpet recycling is on the brink of viability - Aug/Sep 19

By Darius Helm

Over the last decade, carpet recycling has faced down one major crisis after another-and has often seemed on the verge of collapse-yet it looks like it may now be about to successfully navigate the gauntlet. Game-changing new technologies are being scaled up to generate stronger and cleaner streams of recycled polymers, targeting viable end-use markets for a range of materials, including problematic polymers like PET.

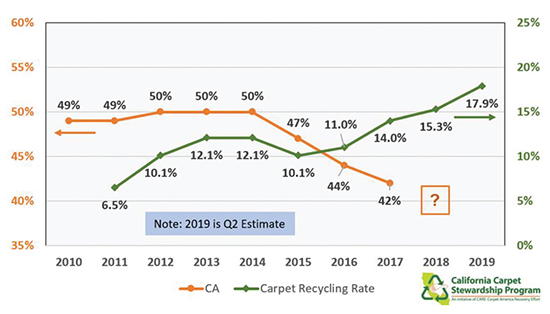

And it looks like they’re turning the corner in California, the nation’s dominant market for recycled carpet. With a Q2 2019 recycling rate of an estimated 17.9%, it looks like California’s carpet recycling program, stewarded by CARE, the Carpet America Recovery Effort, may well achieve the 24% recycling rate mandated by the state by January 2020.

In the best of times, recovering and recycling carpet would be a challenging affair. First it has to be diverted from the landfill, so a whole collection system must be created. Then it must be sorted into different waste streams, and processed to remove impurities, and channeled into new materials, for which there must be robust end-use markets. To be successful, it not only requires the efficient operation of a whole set of related businesses and stable demand up and down the value chain, but it also requires an unwavering commitment to the underlying goals and the will to succeed.

CHALLENGES TO SUCCESS

Reality has taken a different path, presenting obstacles that seem to follow the script of a disaster movie. Back in 2010, everything was moving in the right direction-more or less. The network of collectors, sorters, processors and recyclers grew by 40% that year, diversion and recycling numbers were climbing, and California was voting on AB2398, the carpet stewardship law. But that year also saw PET rise from 7% to 12% of total recycled fiber volume. Within two years, that number had climbed to about 30%, and there was no end-use market for recycled PET carpet, so collectors either avoided it or paid to dump it. And collectors started going out of business.

Over the intervening years, PET levels have soared, driving scores of collectors, sorters, entrepreneurs and recyclers out of business. CARE found itself unable to meet the goals mandated by CalRecycle (the California Department of Resources Recycling and Recovery), which steadily rejected one CARE plan after another and levied fines for non-compliance. At times it has felt like the whole endeavor has been teetering on the brink.

However, CARE and the recycling industry proceeded doggedly ahead, sustaining the reclamation and recycling businesses through fees for selling carpet in California to generate a range of subsidies and to fund grants for the development of end-use markets for recycled carpet.

Along the way, there have been other body blows, like China’s shifts away from importing waste plastics, first through Green Fence in 2013, and more recently-and significantly-through National Sword at the beginning of 2018. While California appears to have been the largest U.S. exporter of waste to China, none of it was carpet. However, all of the plastic-based waste California is no longer sending to China instead competes against carpet-derived plastics in the U.S. market.

It’s worth noting that the loss of China as a customer has significantly affected California’s overall recycling rate, which, after years of holding at around 50%, has been falling since 2014-while carpet’s recycling rate in California has been climbing since 2015.

Also, various developments have had significant impacts on virgin polymer prices, which in turn have wreaked havoc on the carpet recycling business, like a year and a half ago, when a huge wave of new Chinese caprolactam capacity started to come on line, collapsing nylon 6 prices. Also, over a dozen force majeure nylon 6,6 events over the same stretch sent nylon 6,6 prices rocketing and driving the use of nylon 6 as an alternative in many applications. Then nylon 6,6 supply went back up and prices plummeted from about $2.80 a pound to closer to $1.65.

These shifting costs of virgin polymers have created turmoil in the post-consumer recycled fiber market. After all, in terms of the mechanical side of processing, it costs about the same no matter the fiber type, so prices are heavily based on what can be moved in the market, margins be damned.

Today, PET is the dominant face fiber used in carpet manufacturing. It makes up about 40% of all face fiber sold, and when it comes to the residential market, it’s closer to two thirds. And since PET carpet has a shorter lifecycle than nylon carpet, it has flooded the waste stream at an accelerating rate, and load ratios as high as 70% PET are now common.

With so little in the way of end-use markets for post-consumer PET carpet, collectors avoid it when they can-more so outside of California, whose subsidies make it easier to move all carpet materials-and this has driven diversion rates down nationally. So as great as these subsidies are for the state of carpet recycling in California, having a single state as the locus has the unfortunate affect of reducing opportunities in the other states.

EPR PROGRESS IN OTHER STATES

Currently, carpet recycling in the U.S. operates through two systems. In California, there’s extended producer responsibility (EPR) legislation that assesses fees of $0.35 per yard for carpet sold in California and offers a range of subsidies for the recycling to end-use markets of various recycled materials. And for all the other states, there’s a far less robust system, a voluntary product stewardship (VPS) program that gets around $4 million dollars per year from the carpet mills to help sustain the reclamation network.

Several other states have been attempting to create EPR systems but haven’t been able to get very far. One group that has been promoting EPR legislation across a range of categories since 2002 is the Product Stewardship Institute, which reports that it has been working closely with stewardship councils in Illinois, New York and Minnesota to “promote effective EPR bills in their states and lead conditions to support their passage,” including technical assistance, model bill language, educational resources and support in lobbying.

In March of this year, the Illinois General Assembly, citing a carpet recycling rate of less than 1% compared to California’s rate of 15.4% for the first half of 2018, offered an amendment to SB0557 to create a robust statewide carpet stewardship plan that will include assessment fees of $0.04 per square foot of wool, nylon and polypropylene carpet and $0.06 for PET and PTT carpet, to be enacted “on or after January 1, 2020,” as well as mechanisms for the dispersal of grants and a range of other initiatives.

A similar initiative is being pursued in Minnesota, which has been actively seeking some sort of EPR for at least six years. HF2267, a house bill sponsored by Representative Rick Hansen, would expand producer responsibility legislation to include used carpeting. The companion senate bill, SF2300 is currently awaiting action by the Senate Environment and Natural Resources Policy and Legacy Finance Committee.

And in New York, a bill introduced by state senator Brian Kavanagh at the beginning of 2018 has passed the senate and assembly and is moving through committees. The current incarnation, S2327, is in the Environmental Conservation Committee through the end of the 2019 legislative session. The plan has a range of recycling goals that start at a recycling and reuse percentage rate of 25% in 2021 and 2022, gradually going all the way up to 95% by 2029 and thereafter. And rather than a strict fee system like California, each manufacturer or the carpet stewardship organization representing them will be assessed a fee to be used in the administration of the program’s goals.

UPDATE ON RECYCLING TECHNOLOGIES

Over the last couple of years, there have been significant developments from many different quarters. Most are scaling up or on the verge of launching, so it won’t be until 2020 that their impacts begin to be felt, and perhaps not until late in the year.

One firm leading the way is Loop Industries, based in Montreal, Canada. The firm has developed a technology for depolymerizing PET in order to create a stream of pure recycled PET that is identical to virgin polymer. Loop has partnered with Indorama, a Thai firm that is a world leader in the production of petrochemical products. In South Carolina, a facility is currently being constructed for the operation, which will launch next year. With the technology proven through successful trials, and with the weight of Indorama behind it, there is every expectation that this venture will succeed. And since Loop will be using reclaimed PET carpet, the operation is likely to utilize a big chunk of the waste stream.

Then there’s Tennessee-based Eastman Chemical Company, which has two projects. One is a carbon renewal technology that currently uses coal to make chemical building blocks for cellulosics, and Eastman has announced that it will convert to using plastic waste. Like the Loop technology, this is a proven process. The two combined will likely require hundreds of millions of pounds of PET.

Eastman has also announced its commitment to pursue PET depolymerization through methanolysis, which promises the possibility of true closed-loop recycling, though it may take a while before the technology is rolled out.

In addition, Virginia-based Verdex Technologies, a CARE grant recipient that has developed a specialized nozzle for nonwoven production that can accommodate fibers with higher levels of impurities than existing nozzles, has entered into a joint venture with an engineering firm and is moving to Atlanta, Georgia to scale up its operations.

North Carolina State’s Nonwovens Institute, recipient of a three-year grant, is also pursuing processes for spinning PET fibers into nonwovens.

Arropol, which received a CARE grant earlier this year for the purchase of equipment for fiber densification, has developed technology to break down PET into component molecules that can then be used to make urethane for a range of applications. Led by Ralph Boe, who has a PhD in physical chemistry and is also the former president of Beaulieu America (as well as Carpets International, Diamond and Horizon), the firm is currently running a reactor with a capacity of three million pounds a year, and has a second, larger reactor poised to come online as capacities ramp up. A stumbling block right now is finding PET streams with 97% purity. Meanwhile, the firm has made good progress in identifying markets for its product.

Worthy of special note is Circular Polymers, based in Lincoln, California, which collects and processes all types of broadloom using what could be game-changing technology. The firm, in the midst of a dramatic expansion that will make it the second largest recycler in California, after LA Fibers, and has invested in rotary impact separator units to split carpet into its component materials. The technology, developed by Ohio-based Broadview Group International, separates shredded carpet into component streams, maximizing the yield and recovering 95% of the total product. The end result is waste streams of backing fiber, face fiber and calcium carbonate. The recovered face fiber-nylon 6, PET or nylon 6,6-is produced for both lower-grade (with some polypropylene mixed in) and higher-grade applications. The higher grade PET, for instance, has less than 2% polypropylene and a small percentage of ash.

Circular Polymers does everything from collection to processing and creating raw materials for end-use markets and advanced chemical recyclers. Other major operations like LA Fibers and South Carolina-based Wellman (acquired in 2015 by China’s Shanghai Pret Composites) also do most everything themselves. The biggest recycler in the country, Dalton, Georgia’s Columbia Recycling Corporation, does everything but its own collection.

A relatively new player in the market is Aquafil, best known for its 100% recycled Econyl nylon 6. Last year, Aquafil built its first recycling facility in Phoenix, Arizona, which processes nylon 6 and ships the pellets to its depolymerization facility in Slovenia. A second facility near Sacramento, in Woodland, California, is expected to start up next month.

The Phoenix facility is still running at reduced capacity, in part due to supply issues, but also because it is still working out the kinks, and it anticipates, after a round of improvements next month, a shift toward more efficient, higher capacity.

Currently, Aquafil is practically the only end-use market for nylon 6, though firms like LA Fibers that develop products from blended polymers can also use nylon 6.

As things stand now, nylon 6,6 remains the most valuable post-consumer recycled fiber, largely going to thermal applications, particularly in the automotive industry, because of its higher melting point. A far smaller market exists for nylon 6, based on demand from Aquafil. And then there’s PET, which currently has negligible value but the bulk of the recycled carpet volume.

Hopefully, as new technologies like that of Loop ramp up, PET will gain value, conferring some badly needed stability to the U.S. carpet recycling industry and improving the fortunes of the businesses in the network. There’s a lot riding on 2020. Stay tuned.

Copyright 2019 Floor Focus

Related Topics:Beaulieu International Group