Marketing Minute: Where tariffs and flooring intersect – June 2025

By Paul Friederichsen

The marketing of floorcovering is not easy. It often becomes a directed sale at retail, suffers from low brand awareness in most cases and is subject to a variety of internal factors: M&As, regional preferences, competitors’ innovations, decor design trends, brand extensions, etc. Throw in the ominous possibility of a tariff war, and it’s time to hyperventilate. Just as we witnessed in the Great Recession, new flooring is classically a “deferred purchase,” meaning a replacement project may get bumped down the to-do list. Where does the tariff world intersect with the flooring world marketing-wise, and how do you manage?

THE PRICE IS RIGHT

Disruption in the supply chain coupled with speculation of tariff price increases is pumping the brakes on a flooring industry that is searching for some good news. As with any headwinds, flooring marketers are on the frontlines once again, tasked with protecting their brands in this uncertain economic climate. Here are some important considerations.

Political Demographics

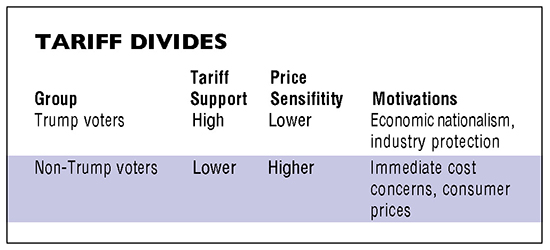

It’s safe to assume that, in most neighborhoods, roughly half your customers will be somewhat sympathetic to the tariff increase. According to Forbes, Republican voters, particularly those aligned with President Trump, favor tariffs more than other political groups. For instance, a 2025 Axios poll found that 76% of Republicans supported Trump’s tariffs, despite acknowledging potential price increases. Further, a Reuters report highlighted that many Trump voters were willing to endure short-term economic pain from tariffs, believing in their long-term benefits.

While this may be true, politics of any kind doesn’t belong in the marketing or sales process. You risk alienating customers, distracting them from your message and damaging your reputation. Instead, focus on American-made flooring that is tariff-free as well as the service and expertise you bring to the project or the professionalism of your installations.

Purchase Frequency

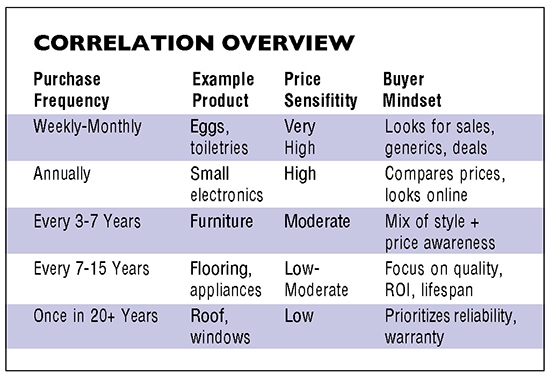

Unlike eggs, flooring for most people is an infrequent purchase of about ten years on average. This tends to diminish price sensitivity in the category. You may know what the price fluctuation of eggs is week to week, but recalling the price of the floor you purchased a decade ago can be difficult. Therefore, the tariff-driven price increase will be assuaged because of the inverse correlation of purchase frequency to price sensitivity.

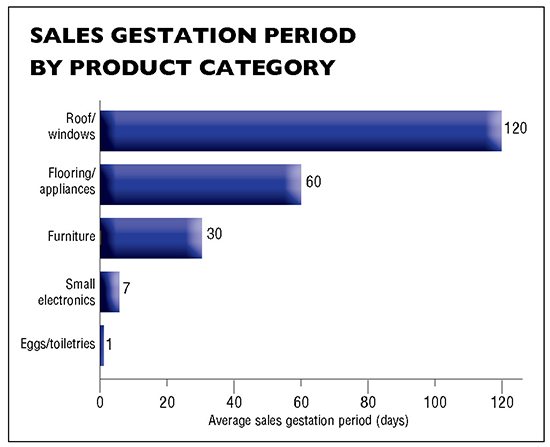

Sales Gestation Period

Flooring, as either part of a room makeover or as a re-flooring project by itself, can be a lengthy journey. Sixty days for a “high consideration” category like flooring will include planning and research, consultation and estimates and, finally, purchase. This excludes installation, since that cost totally depends on project size, product availability and scheduling. Room makeovers, such as a kitchen, will take 90 days or longer. In most cases, there is a considerable amount of time invested by the customer before the purchase is made, so the customer may be less likely to abandon the journey due to a tariff increase once fully committed at the consultation stage.

Being cognizant of ongoing tariff and inventory fluctuations, retailers would do well to urge customers to purchase sooner, rather than later.

Customer Priorities

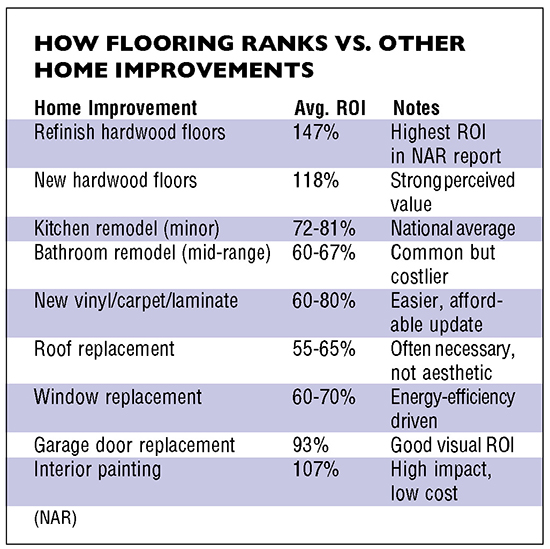

Regardless of tariff actions, flooring is likely to remain among the top three home improvement projects, according to a 2022 Houzz U.S. Renovation Study. And according to Statista and the Home Improvement Research Institute, flooring buyers skew higher in income and homeownership rate. Therefore, they can, and often will, afford what they need and want for their homes. In order to facilitate this, retailers should emphasize the investment value of new flooring over its lifespan and provide ways to make ownership even easier through financing options or deferred-payment plans. Hardwood flooring ranks highest in ROI for home improvement projects, according to the National Association of Realtors (NAR).

Transparency

Regardless of certain mitigating factors, tariff policy will inevitably impact pricing. Recently, the world’s largest retailer, Walmart, announced it will have to raise prices. Thus, the brand most focused on lowering the cost of living took the first step in controlling the damage to its brand reputation by employing transparency through PR. A CEO in the flooring business told me that his way of handling the tariff increase is to list it as a separate line item on his invoice, based on the tariff rate on the date the invoice was issued. This is also being transparent, as well as practical, since we all find ourselves in a fluid, transitional period. His policy has been well received. In uncertain times, customers want the clarity that transparency provides.

In a recent episode of her podcast, “High Purpose Marketing Strategy,” economist Ashley Conway observed, “Silence isn’t golden, it’s confusing. Customers don’t expect you to have all the answers, but they do expect you to be real with them.”

Copyright 2025 Floor Focus

Related Topics:The International Surface Event (TISE)