Impact of the Federal Stimulus - January 2010

By Brian Hamilton

Will a trickle turn into a deluge? With all the talk about the federal stimulus package and so-called “shovel-ready projects,” so far the $787 billion American Recovery and Reinvestment Act has seen little flow of funds to the construction industry, other than companies that work on roads and bridges. That has translated into almost no business for the flooring industry.

“Most everything we’ve seen has involved environmental issues and we have not seen any projects involving carpeting,” said Donald Hooper, leader of Milliken’s government and institutional business.

However, there are so many facets to the stimulus package that federally funded construction this year and next could help prop up what is widely expected to be a weak non-residential construction environment. Kermit Baker, chief economist for the American Institute of Architects, says the government/institutional sector is likely to be one of the bright spots in construction over the next year or so, even without a stimulus package. However, at best, he said, the stimulus might add a few percentage points to the total.

“I think a lot of folks, because there’s been so little work in the normal channels, were thinking there would be a lot of opportunity,” Baker says.

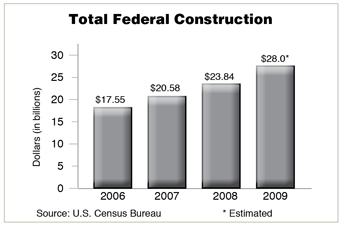

McGraw Hill Construction estimated that the stimulus will add about 10.6% to total construction this year, up from 7.6% last year. It also anticipated that total construction from the bill will amount to about $131 billion, but that includes things like airport baggage screening and other capital improvements that will have little impact on flooring.

Nevertheless, there’s a growing pipeline of projects, but just how big is hard to get a handle on. Flooring industry consultant Santo Torcivia of Market Insights describes the package as a very “convoluted” situation.

Last July, the General Services Administration, which is charged with managing 1,500 federal properties—making it the largest landlord in the country—and has been appropriated $5.5 billion from the stimulus package, awarded the first $1 billion toward 120 construction projects across the country. They ranged in size from a couple hundred thousand dollars to $157 million for the Herbert Hoover Building in Washington, D.C. Many of the projects, in fact, involve renovations of federal courthouses. GSA has said it would award another $1 billion by the first deadline at the end of 2009, and roughly 90% by September 30, 2010. However, as of November, not even $100 million had been paid out, according to a Bloomberg News report, so most of the money hasn’t made its way into the economy.

Compounding the issue is that the construction industry tends to move slowly under the best of circumstances, and the flooring segment is always one of the last to benefit. It can take eight months or more to come up with architectural drawings, and depending on the size of the project well over a year or two to complete construction. So any significant benefit from the stimulus package probably won’t hit the flooring industry until next year.

Strictly speaking, the GSA’s $5.5 billion is to be used for converting federal buildings into “high-performance green buildings,” and build new energy efficient federal buildings, courthouses and ports of entry. While flooring may not be a central feature in all of these projects, it will figure into many of them. For example, a project that is replacing an HVAC system may well have to rip up flooring to complete the project.

That, however, is just one component of the stimulus package. Another $11 billion has been allocated for both 2009 and 2010 specifically for the Qualified School Construction Bond program. It’s a zero-interest bond program in which school districts only pay back principal, while the bond holder gets a tax credit. Forty percent of the funds are to be used in the nation’s largest 100 school districts, and 60% goes directly to the states, which would decide where to send the money. So far, there’s little information as to how many projects have actually secured funding or gotten started. However, the Chicago Board of Education said it plans to sell $254.2 million of taxable Qualified School Construction Bonds.

Beyond that, another $200 million has been allocated for both 2009 and 2010 for school construction and renovation through the Bureau of Indian Affairs.

An even larger program, which doesn’t have a cap, is the Build America Bonds program, which provides a way for municipalities and other governmental entities to offer taxable bonds. This, in theory, will give the bonds broader interest among investors who might not benefit from the interest write-off of a tax-exempt bond. The federal government subsidizes 35% of the interest cost.

Last April, the University of Virginia sold $250 million in construction bonds for 19 building projects and became the first higher education institution to offer the bonds. Among the university’s projects is an $89 million research building and a $74 million clinical cancer center. If this bond issue is any indication, the program is likely to be very popular, as the lead underwriter, J.P. Morgan, received more than $1.2 billion in orders for the bonds. The University of California system is also using Build America Bonds to expand and renovate several of its campus medical centers.

J.P. Morgan believes that new issues of Build America Bonds could total $110 billion in 2010.

The Department of Defense is also getting in on the act. It has been allocated $6.6 billion, of which $4.2 billion will be used for the restoration and modernization of facilities. The Veterans Administration was allocated $1.25 billion, which will likely be used for hospital projects.

There are a whole host of small allocations, which the Associated General Contractors has outlined on its website under a feature “Where The Opportunities Are.” For example, $2 billion has been allocated to Community Health Centers, $1 billion for various Bureau of Indian Affairs projects, and $500 million for Social Security Agency facilities.

Practicalities

Anyone who’s interested in stimulus work will likely find it difficult sledding, even companies that are experienced in pursuing government work. Many successful companies have professionals dedicated to securing government work.

Ralph Grove, vice president of the commercial group of Alexandria, Virginia-based Commercial Carpets of America, one of the top ten governmental flooring contractors, said that the competition for government work is fierce in a down economy, especially in bid situations. He said the companies that win the stimulus jobs through a bidding process are likely to be “the companies that make the biggest mistakes.” What he’s referring to is that a lot of struggling companies with little government experience are pursuing the sector, but they are also prone to underbid, and will regret it later.

“On every job it’s going to be important to maintain supervision and scrutiny,” Grove says. “There’s no money on callbacks, so you’ve got to get it right the first time.” The GSA has, in fact, said that initial bids are coming in about 8% under budget.

The stimulus act also specifies that contracts funded under the program will be fixed-price contracts, so cost overruns are likely to be difficult to deal with.

Finding the work isn’t easy. Jobs for bidding are posted on the Fed Biz Opps website. However, much of the work for flooring contractors will come through general contractors rather than direct bidding, and it will come through the states rather than directly from the federal government. And that’s where companies that are familiar with the government terrain have a big advantage.

General contractor Brasfield & Gorrie’s Birmingham, Alabama office won a bid for a $7 million federal courthouse project in Little Rock, Arkansas.

“The work came from GSA through our existing relationships with their District 7 office in Fort Worth,” says senior project manager Kevin Conway. “We have completed several projects for them and we were one of three or four firms who were asked to answer a [request for proposals].”

The work includes a historic preservation component, in which an original cork floor is being restored. The new flooring includes 70% carpet, 20% terrazzo, and 10% ceramic, with a little bit of VCT in a kitchenette. Because there’s a requirement to use American manufactured goods in stimulus projects, the tile will come from a company like Crossville or Daltile rather than from one of the European manufacturers.

Conway says his firm tries to secure three to five bids from flooring contractors, but it doesn’t necessarily go with the lowest bid, simply because it wants to ensure quality work. Brasfield & Gorrie isn’t necessarily familiar with the flooring contractors it signs on for projects. “We try to do business with companies that are financially sound and have a strong likelihood of being in business through the life of the project,” Conway says.

Brasfield & Gorrie hasn’t historically focused on the government sector but has put renewed emphasis on it recently and now has a dedicated government business development specialist on staff. “What we found is that you can’t just put on a new hat and call yourself a government contractor. It’s been a learning curve. We send in RFPs and they go through a committee that grades them. They’ll give you feedback on what they marked down and we have needed that feedback.” The process for winning a bid is a very lengthy, drawn out, expensive process, he notes. “You have to spend money speculatively in order to get the work.”

Governmental work

Most of the government specialists we spoke to aren’t counting on stimulus money to make much difference in their revenues. Grove anticipates that most of his work will come through the usual channels. His firm has a staff that has been dedicated to securing government work for many years. For example, he said his firm does a lot of marketing and mailings to embassies, and Commercial Carpets of America has secured a lot of work through the base realignment program. CCA ships product overseas and often has to rely on local installation, which can get pretty tricky.

“There is a ton of work and planning to get done,” Grove says. “There are a lot of moving parts. If you’re short a box of floor base, it’s a lot harder to take care of.”

A lot of his local Washington, D.C. work requires working through general contractors, something he would prefer not to do. Grove said he’s not expecting a lot of new construction this year and he sees the military work slowing down. More work is likely to involve retrofits.

“Some other government sectors like the Department of Agriculture and the Department of Interior are looking at their budgets and may do office renovations,” Grove says. “Most of that is public bid work.”

CCA worked on a school project last summer that got some stimulus money, but it was almost after the fact. The project mostly entailed upgrading the HVAC, but in the process, a lot of flooring had to be replaced.

Grove says the commercial market, even for government work, has gotten more competitive recently because of inexperienced commercial contractors looking for work. “They have muddied the waters for those of us who do commercial work exclusively.”

Design considerations

Designing office space for the federal government can be a little different from the private sector. In a standard private project, a tenant will typically do a fit-out according to its own budget and desires.

“With the federal government you have two clients,” says designer Mary Petrino of Gruzen Samton in Alexandria. “You have the GSA and then you have the tenant who’s going to occupy the space.”

Government projects are often given a lump sum that has to be used by a certain time, which can present a lot of constraints, says designer Amy Fabry of HOK’s Washington office. “You get a little more creative and spend money where it makes the most sense,” she says.

Also, any new construction over 10,000 square feet has to be LEED silver certified and there is a big push for use of sustainable materials in general. Petrino also notes that carpet in a private sector job might be replaced every five or seven years, but carpet in a federal office building is sometimes down as long as 20 years. While she likes carpet tile, she said a government agency can’t necessarily buy a lot of extra tile for swapping out because it doesn’t have storage space. In high use areas she likes to use ceramic or linoleum, and likes cork as an alternative to bamboo and hardwood because it wears better.

“We need to be on top of our game,” Petrino says. “We need to have predictability of color trends.” Designing for a federal building that draws a lot of public traffic also requires design that is similar in some ways to a healthcare setting for safety. For example, changes of level become a major consideration for those who use walkers or are in wheelchairs.

“We realize we are spending taxpayer money and we’re very conscious of the implications,” Petrino says. “We’re trying to get the government the best value for the dollar and we are concerned about good, timeless design.”

Petrino says much of her firm’s government work comes through its past performance. “GSA has a design excellence program and we are recognized for our work under that program,” she says. “It is an uphill battle for a new firm.”

Copyright 2010 Floor Focus

Related Topics:Mohawk Industries, Crossville, Daltile, The American Institute of Architects