Engaging the Consumer: Shaw study holds takeaways to help dealers win at retail - March 2023

By Jennifer Bardoner

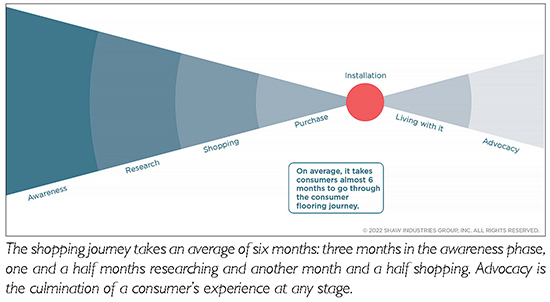

With the average consumer flooring journey lasting around six months, there is a lot of opportunity for retailers to win-or lose-a new customer. Shaw conducted a study last fall that explored the shopping process and what turns flooring consumers on and off, offering insights that can help retailers win more consumers than they lose.

The sample pool represented a broad range of demographics, budgets and desired flooring material. The 1,200+ consumers included in the study were actively shopping for new floors when invited to participate. The only guidance Shaw offered was to point them to a Shaw Flooring Network (SFN) dealer to visit as part of the overall process. Based on the consumers’ online and in-store experiences, Shaw compiled the results into personal “mystery shopper” reports, as well as an informative overview presented at the SFN meeting earlier this year.

Several key themes emerged: Consumers are more appropriately defined by their shopping persona rather than by demographics; and flooring retailers are missing opportunities to connect with shoppers in meaningful ways. The consumers studied spent, on average, roughly three months merely considering the idea of a flooring purchase before truly beginning to research options online, so making the most of the opportunities at each step is critical.

A flooring purchase consists of seven phases: awareness, when the consumer becomes aware that they need new flooring; research, which includes inspiration and retailer search and narrowing of options; shopping, including product visualization and validation; purchase, which involves measuring the space and finalizing the price; installation; “living with it” following installation; and consumer advocacy of your brand.

“It’s very important to note that things like consumer persona type, the specifics of the project, pain points during the process, and other life events can either accelerate or extend that six-month shopping timeline average,” says Heather Yamada, director of research and insights for Shaw. “Additionally, it is critical for retailers to understand that even after a consumer purchases flooring, their journey continues through installation and living with it, with touchpoint opportunities for retailers to improve the overall experience and build advocacy for their brand.”

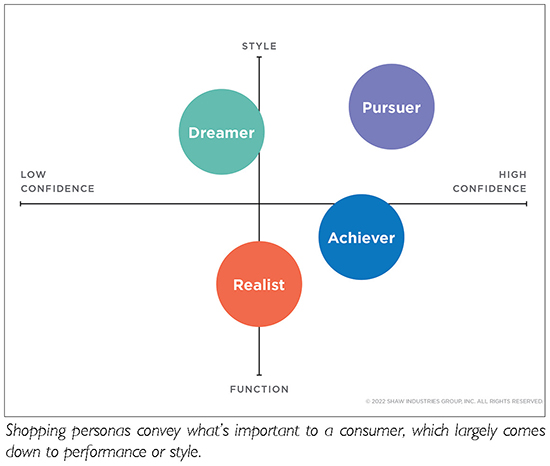

Today’s consumers are accustomed to having infinite possibilities at their fingertips, so they expect options. But they can be paralyzed when it comes to sifting through so many choices. How much confidence someone has, as evidenced in the various shopping personas, determines the number of options they can handle, something Yamada says RSAs generally feel out naturally. Where they fall in terms of function versus design is not always quite as intuitive, but it is an important part of the discovery phase in order to truly hone the sales process.

PERSONAS AND HOW THEY IMPACT PURCHASES

Yamada says one of her key takeaways was the importance of validation at every step of the shopping journey, beginning the moment someone decides they want a new floor.

“Flooring is a big decision, so consumers are looking for those forms of validation to move to the next step,” says vice president of consumer strategy John Stephens, referencing the shopper’s social circle, product ratings and reviews, or a consultation with a retail sales associate (RSA) as some of the ways they gain validation. “I probably underestimated how important that was. They need validation to go from research to shopping and from shopping to purchase.”

But different shopping personas need varying levels of validation as they search for products, and sometimes varying forms-product performance details versus a personal recommendation, for example. The four personas identified by Shaw are dictated by the consumer’s level of confidence with flooring products and whether they give more weight to performance or style.

Of the more than 1,200 shoppers Shaw studied in its recent survey, 56% rated durability as their main priority, edging out style and design for the first time in Shaw’s years of consumer research.

• Achiever (23%): very confident and DIY-minded; wants the best product at the best price and wants to know the details of product function and performance

• Realist (33%): moderately confident and does not want to rush into a wrong purchasing decision; values function and will pay more for quality

• Pursuer (15%): very confident, with a strong sense of style that they won’t compromise for price; will consider DIY

• Dreamer (29%): loves looking at ideas and wants their flooring to represent them, but is afraid of making a mistake and needs help getting the project to fruition in every sense

While those with more confidence need less assistance from an RSA, providing the types of validation important to each persona helps create an advocate for your store no matter where the consumer is in their sales journey-another critical and commonly missed opportunity, says Yamada.

“Advocacy is more than addressing pain points, gaining word-of-mouth recommendations or a positive review,” she explains. “While those are a few ways consumers communicate about their experience, retailers need to assess how they can build advocates throughout the entire consumer flooring journey so even if the consumer pauses in making a purchase, they will return to them when the time is right, or they will return for their next project.”

Key Takeaway: Sales are won or lost based on how retailers make the consumer feel. After their visit to a retailer, less than half of the survey respondents felt confident, knowledgeable, heard and that their project mattered.

Despite being well-informed, consumers still turn to RSAs for a professional opinion. Sometimes it’s because they’re overwhelmed, or because they’re looking for confirmation of their research. And many times, they come in with misinformation. “That RSA is critical, and they’re part of that validation process,” Yamada says. “It’s important to make sure RSAs are educated and do a great job, because they are an important part of that overall satisfaction for consumers.”

While consumers appreciate being able to directly source information from RSAs, they want to do so when they are ready. The consumers studied wanted to interact with an RSA for about half of their time in the store.

THE SHOPPING JOURNEY

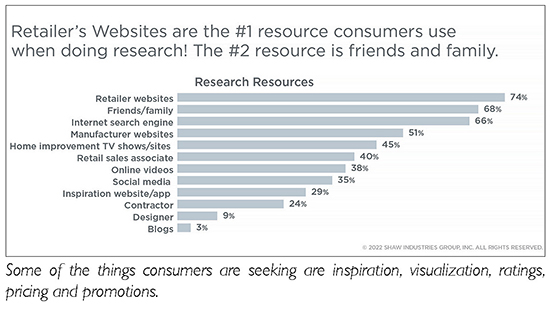

It is common knowledge that a consumer’s decision to purchase flooring now begins online. Stephens suspects that is why the study revealed a dip in the number of stores shopped in person, down from 2017’s average of 3.3 to 2.7-though retailers’ websites were ranked as the number one resource used when researching products.

It is also well accepted that a retailer’s website should be attractive and informative, as it is the first chance they have to engage with the consumer, but several key disconnects emerged amid the study.

Only 25% of the 1,207 specialty retailers’ websites studied were viewed as informative and updated, a theme that carried over to the in-store experience, with shoppers citing a lack of navigational signage and product pricing.

Eighty-five percent of the consumers studied said pricing is the most important feature of a flooring retailer’s website, and those that don’t include it are often eliminated from their purchase journey.

“If you’re not seeing traffic in your store, you know something is amiss, but online you don’t even know they’re not choosing you,” Yamada points out. “Pricing is critical, and consumers expect it. We had consumers tell us they can go to Home Depot and Lowe’s and look up pricing.”

Without pricing, shoppers can’t determine a budget, and flooring is typically just one part of a bigger home remodeling project. “If they can’t figure out a budget, it can be a barrier to them moving forward,” she says, noting, “and we make it confusing as an industry-square foot, square yard, includes installation, doesn’t include installation.”

When presenting the findings to retailers at the SFN meeting, “there were a lot of lightbulbs that went off,” says Stephens, with dealers discussing options like adding dollar signs or price ranges. While Shaw conducted the research to help its preferred partners better understand consumers, it did not offer guidance on how to implement the findings since each retailer is unique.

Key Takeaway: Budget is the number one consideration for flooring consumers, yet pricing is often difficult to discern both online and in-store. Additionally, only 17% of RSAs in the stores visited asked a customer about their budget.

THE BOTTOM LINE

While Yamada reports that most of the shoppers studied found flooring that fit their needs, any number of things could kick them out of the sales funnel. “We talked to consumers where their A/C went out and now their budget for flooring needs to be used for something else,” she says.

With so much out of retailers’ control, it’s important to focus on what they can do to make the entire process as painless and straightforward as possible for consumers, keeping in mind that they are just one part.

“That little bit of investment in each of those shopping stages can pay off dramatically,” says Stephens, explaining that being an advocate at every point in the sales journey creates opportunities with that customer’s entire social network, whether the initial consumer makes it all the way through the funnel or not.

Key Takeaway: Each phase of the shopping process is an opportunity to connect with and offer meaningful support to consumers. Do a self-assessment, putting yourself in their shoes. How can you make them feel empowered, informed and important at each phase in their buying journey?

Based on the key takeaways from the survey, consider the following:

• Does your website closely match your in-store experience?

• How well does your SEO perform? Does your site come up for various search terms?

• Is your website informative and easy to navigate? Does your “About us” section tell your story and your purpose?

• Do you have online reviews that communicate quality, service and satisfaction?

• How can you make pricing easier for the consumer to navigate?

• Do you offer financing or other ways to help make cost less of an issue? Is that easily discernable to consumers?

• Have you optimized the number of product options and eliminated duplication?

• What does your discovery process look like? How do your RSAs determine a buyer’s priorities (style versus function) and level of confidence?

• Are your RSAs trained on both customer service and product features and performance?

• How can you help outfit the consumer with realistic expectations about products and the buying process?

• How can you make customers feel listened to and that your recommended offering is tailored for them?

Copyright 2023 Floor Focus

Related Topics:Shaw Industries Group, Inc.