CARE Report: Carpet reclamation is a challenge, but recycle rates are expected to climb - June 2018

By Beth Miller

The Carpet America Recovery Effort (CARE), the organization formed 16 years ago to minimize the amount of carpet that ends up in the nation’s landfills, has been working furiously to meet its goals despite ongoing headwinds.

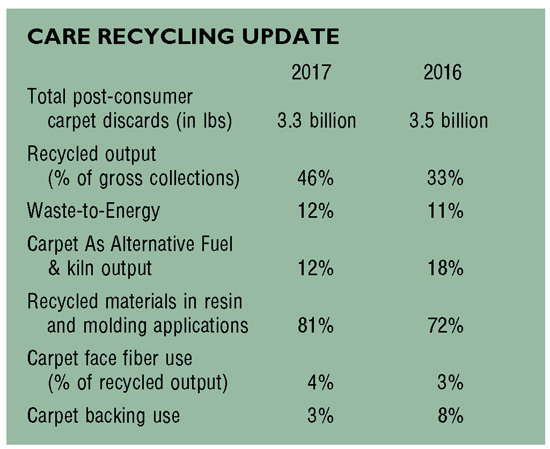

CARE recently held its annual conference where it released its latest report. To date, the total amount of post-consumer carpet diverted from landfills equals five billion pounds. Of that total, 394 million pounds were diverted in 2017, down 19% from 489 million pounds in 2016.

In 2016, California’s Carpet Stewardship Program’s recycling goal was 16% of total post-consumer carpet discards, though CARE fell short at 11%. But in 2017, CARE improved, rising to 14%, while the rate for the rest of the U.S. saw a 70% decrease-the national average is 5%. However, CARE is optimistic that the recycling rates will climb due to an improving economy, rising oil prices and new technologies that will allow it to grow new outlets for post-consumer face fiber.

California’s state-wide recycling rate for all products-batteries, mattresses, paint, electronics, etc.-reflects a drop as well. Bob Peoples, executive director for CARE, reports that California has experienced approximately a 50% rate each year for several years, but in 2015, the rate dropped to 47%. In 2016, it dropped to 44%, and he anticipates it will see another decrease for 2017. Peoples says, “They are facing all the same headwinds in the global recycling world that CARE is facing on the carpet side.”

CARE’s annual report reflects the challenges it has faced as well as its efforts to meet its goal-with some declines and some gains. CARE manages three operations: the California Carpet Stewardship Program, the Voluntary Product Stewardship Program and CARE Core Operations. CARE’s total budget between all three operations comes to approximately $30 million for 2017, with California’s recycling fees contributing a large portion of the total.

In 2011, the California Carpet Stewardship Program was launched. Falling under this program is California’s AB 2398 law that requires CARE to increase the tonnage of diverted post-consumer carpet on an annual basis in order to remain compliant. To support this program, a $0.25 fee, originally only $0.05, is assessed on every yard of carpet sold, to be funneled into subsidies for processing and recycling. To date, the assessment funds total $52 million. CARE submitted a new plan in March that could increase this fee to $0.40 per square yard. According to Peoples, these dramatic increases to fund the program are “driven largely by the level of subsidies we have to pay but also additional program costs around education and outreach, technical support, collections, and around the grant program that we administer as part of our plan as well.”

According to the 2017 report, the California Carpet Stewardship Program invested $16.5 million in subsidies, grants and other incentives to support recycling efforts in California. Further contributing to the program goals was $2 million worth of grants awarded in 2016-to support capital investments and product testing-that increased California’s recycling capacity by roughly 30% and created over a dozen new jobs. Additionally, three new pilot subsidies were adopted-for carpet tile collection, Tier 2 nylon 6 recycled products and commercial broadloom. Additionally, the number of CARE-supported drop-off sites grew to 44 in 2017, up from 33 in 2016-a 30% increase. However, it was also reported that Carpet As Alternative Fuel and kiln subsidies have been discontinued.

The Voluntary Product Stewardship (VPS) Program began in January 2015. Funds from the VPS Program help offset the costs incurred by collectors, sorters and entrepreneurs (CSEs) throughout the other 49 states, who “accept and manage all applicable post-consumer carpet, regardless of polymer type or primary materials or construction.” The program completed its second year in 2016 with a budget of $4.5 million. It was renewed for 2017 with a budget of $4 million. The VPS Program is funded by members of the Carpet and Rug Institute. Despite the VPS incentivization program, demand for recycled materials is down across the rest of the United States, while California is paying hefty subsidies on all components of carpet to get them recycled. Peoples admits, “Those subsidies are so high today that people can afford to bring [recycled materials] from the West Coast back to the East Coast and still have a neutral cost of material. That is adversely impacting recyclers all around the rest of the United States.”

CSEs, facing a shift in demand for recycled fiber material, have had to be more selective in the material that is accepted by their facilities, causing a reduction in the total gross collection. More specifically, the decrease in demand for nylon 6 combined with a decrease in price for recycled polyurethane foam pad has dried up the revenue stream that typically offsets the losses experienced during the collection and sorting of carpet.

Data from VPS participants (covering all states except for California) reveals that reclaimed nylon 6 stood at 45% output (shipped and sold by collectors) in Q1 and dropped to 36% in Q4. Nylon 6,6 was at 25% in Q1 for output and dropped to 23% by Q4. CARE reports that the demand will most likely continue into 2018, but the amount of material in the waste stream will continue to decline.

PET, however, was up three points from 2016 at 24%. CARE reports that “there is still no economically viable option for polyester fiber.” This is something CARE is working on, but it is worth noting that under the AB 2398 program, a subsidy is being offered for non-nylon material, which has increased the amount of PET collected. In Q1, PET was at 21% output and grew to 26% by Q4.

CARE’S CHALLENGES AND SUCCESSES

Over the last few years, CARE and CalRecycle have struggled to establish assessments and subsidies for California due to uncontrollable variables, from falling crude oil prices to limitations in recycling technology to a reduction in recycled material outlets. However, rising housing prices and declining unemployment rates are just some of the indicators that the U.S. economy is recuperating following the 2009 recession. A healthy economy is certainly a necessary ingredient that could lead to gains in recycling rates for CARE.

Low crude oil prices over the last few years have impacted demand for recycled materials by lowering the price of virgin materials. The good news-for those in the carpet recycling business-is that oil has been rising over the last year or so. According to Peoples, the cost of oil needs to be in the $80 to $85 per barrel range in order to see an increase in demand for recycled materials. It currently stands at just over $71 a barrel.

Then, there is the complexity of the components that make up carpet products. The more durable products on the market today are considerably more challenging to disassemble to prep for recycling. According to Peoples, residential carpet tends to have higher face weights so there is more fiber to harvest. There’s not as much adhesive on the backing so it’s easier to separate the backing from the face fiber. Commercial carpet, on the other hand, is quite often loop pile, which means the face weight is lower; therefore, the yield per square yard is lower. Commercial broadloom is glued down and can pull up the subfloor when removed, which can cause issues with recycling. “The glue gums up the recycling equipment,” says Peoples. “There’s a lot of loop in commercial carpet, and that can result in very long ropes that can wrap around the machines and cause a lot of damage.”

Carpet tile is generally 100% recyclable, which CARE recognizes as an opportunity to increase recycling rates. There’s a good track record of recycling carpet tile through manufacturer programs. Peoples estimates that carpet tile makes up approximately 65% of commercial flooring and must be handled differently from broadloom. He adds, “Commercial tiles have to be stacked and palletized and shrink-wrapped to be shipped back. So you want to consolidate that material in order to cost effectively ship it back to the manufacturing operation-the majority of which is on the East Coast. It’s ironic that less than 3% of all the recycling that took place in California in 2017 was tile related, despite the fact that it is so easily recycled once you get it back into the system.”

Carpet backing continues to be problematic when it comes to recyclability. “Broadloom is to a large extent all latex back with calcium carbonate and mixed with the residual polypropylene mix that’s used for the primary and secondary-there’s very little value for that,” says Peoples. This type of backing is not recycled in the rest of the U.S. According to Peoples, “In California, what we are trying to do is increase the rate of recycling and increase the yield of recycling or the efficiency with which we recycle a square yard of carpet. We have put a subsidy on the use of the calcium carbonate in applications.” According to the CARE report, the PC4 (post-consumer calcium carbonate) subsidy, added in 2015, “significantly increased recovery and use of PC4 carpet backing in the manufacture of recycled products totaling over 10.5 million pounds in 2017, up 337% from 2.5 million pounds in 2016.”

The subsidy started with $0.07 per pound, then moved to $0.12, and today CARE pays $0.17 per pound for the use of calcium carbonate in value-added applications, like the production of rubber mats. Peoples says, “We’d love to see it go into the backing of carpet, but no one’s been able to technologically figure that one out yet because of the demands of mixing it with the latex. It’s also expensive to put it in a form that is capable of being placed into the back of carpet. Technically, it can be done, but to do it economically, it’s not reasonable.”

CARE’s DoubleGreen marketing program, designed to encourage the use of California-derived post-consumer carpet content along with additional post-consumer content material, was expanded in 2017. This program is an opportunity to push products that had little to no value in the recycling stream, like calcium carbonate. Combining items like recycled tires with calcium carbonate to produce rubber mats is one example of how this program works.

All of these components are competing with other plastic products for an outlet. A couple of years ago, China started up three very large-scale caprolactam plants-caprolactam is the basic building block of nylon 6. This new capacity then entered the global market and depressed the price of caprolactam, resulting in a drop in the price of nylon 6. “It made it even more difficult for recovered nylon 6 to compete,” says Peoples. “For one short period of time, the price of virgin nylon 6 chip was less than that of recycled nylon 6.”

In addition to the caprolactam plants, China created the National Sword program, which is designed to stop the flow of waste materials into China. While CARE sees relatively little carpet going to China, other plastic commodities are now being forced to compete for some of the outlets that carpet was trying to service.

CARE FACES FINES

CARE recently came under fire for its lack of compliance for years 2013, 2014 and 2015 despite the fact that California is struggling to maintain its other recycling efforts. CARE’s retroactively applied fine began at $3.25 million. CARE attempted a negotiation but was unsuccessful. The case then went in front of an administrative law judge who ruled that the fine would be $1.25 million. According to Peoples, the judge found no negligence on the part of CARE, so CalRecycle accepted the decision. It was discovered that the wrong fines had been applied, so the director of CalRecycle adjusted it down to $821,250 to be in line with statutory fine levels.

The program has been found uncompliant for 2016 as well. However, the determination was made in September 2017, and CalRecycle has yet to impose a fine. Peoples explains, “I am now making a case that we are compliant in 2017 because we’re up 27% versus 2016. So, we’re making good progress, and because of all the work that we’ve done over the last two or three years, we now expect some pretty significant capacity growth in the second half of 2018 and in 2019. I fully expect our recycling rates to continue to climb as a result of that.”

Another law was passed in October 2017, AB 1158, that places a mandatory recycle rate of 24% by the first of January 2020. In anticipation of this new law, CARE requested permission to implement its second round of grants in August 2017. CalRecycle declined to approve the request, which means that CARE is unable to issue grants to build new capacity for recycling carpet. CARE moved forward with implementing the process to facilitate the grants while awaiting approval for a new plan. If a new plan is approved that would allow the grants to move forward, Peoples says, “I’m prepared to tell CalRecycle that we will meet or exceed the 24% target. Personally, I think we’ll do that. But we can’t do it if the plan is not approved, and the grant program is not allowed to go forward.”

LOOKING TO THE FUTURE

With such heavily impacting changes happening in a short amount of time, Peoples sees the next four to five years as the time for the global recycle commodity marketplace to work hard to figure out how to place recycling infrastructure in Europe and North America.

Currently, recycling operations have been put into motion or are in the works to accommodate both types of nylon as well as PET. Aquafil’s Phoenix, Arizona recycling center was completed in 2017 with a second plant slated to launch in California late in Q4. It is designed to separate carpet completely as well as reclaim nylon 6 to ship to its depolymerization facility in Slovenia to turn it into new Econyl nylon 6. The company plans on recycling 16,000 tons of post-consumer carpet per year.

Another California operation, XT Green, anticipates starting operations in late 2018 or early 2019. The facility, located in Rancho Cucamonga, was scheduled to open in early 2018, but ran into delays, in part because subcontractors are in short supply in the state. In phase one, it will recycle nylon carpet, both commercial and residential, expanding into PET carpet later on. Recycling rates are anticipated to be as high as 90% in the first phase of recycling with an annual capacity of 40 million pounds of post-consumer carpet. This will include calcium carbonate as well. XT Green’s patented technology will process the carpet underwater for a more complete deconstruction process.

Star Chemical has developed a proprietary PET depolymerization technology. According to Peoples, the firm is awaiting final pre-manufacture notice approval from the EPA in order for production to begin, and it already has commercial capacity in place and plans to expand over the next few months. Production is expected to begin this summer.

Loop Industries plans to open a new plant in South Carolina in late 2019 for the depolymerization of PET. According to Peoples, “Their Canadian operations have been run on a pilot plant scale with excellent results. It is novel technology that operates at room temperature using a proprietary catalyst/solvent system. It looks to be a very cost-effective platform.”

Copyright 2018 Floor Focus

Related Topics:Carpet and Rug Institute