FEI Group's 20th Anniversary - Aug/Sep 18

By Kimberly Gavin

Flooring dealers have many good reasons to join a group-rebates, purchasing power, programs and merchandising, to name a few. But the reason that tops the list for members of the builder-focused FEI Group (formerly FloorExpo) is the value they get from sharing ideas. It’s not just that they are on the same team; it’s the culture of openness that encourages them to share their most closely held practices. And that, members say, leads to real value, bottom-line contribution and business efficiency they could not get alone.

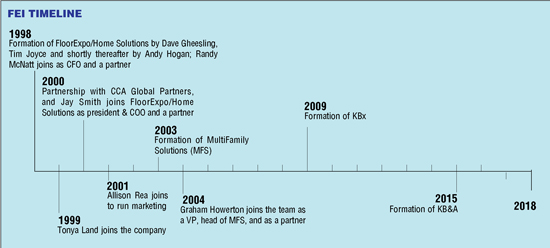

FEI was founded in 1998-by Dave Gheesling, the current CEO; Tim Joyce, who is no longer with the company; Andy Hogan, vice president and chief product officer; and Randy McNatt, CFO-to serve a market that was untapped by the rising tide of buying groups in the 1990s, the residential contract market. Companies in this realm are large, deal with national players and often serve multiple markets, providing flooring and installation services to homebuilders, property managers and general contractors, often across state lines.

What started as a focus just on flooring branched out into cabinets, countertops and other kitchen and bath products. Today, FEI Group has four divisions: Home Solutions focuses on single-family new home construction; MultiFamily Solutions targets apartment/condominium construction and replacement; KBx services cabinet and countertop dealers; and Kitchen & Bath Alliance (K&BA) serves decorative plumbing and hardware showrooms.

MEMBERSHIP OVERVIEW

In total, the membership breaks down like this: Home Solutions has about 50 member companies serving approximately 125 metro markets; MultiFamily Solutions has approximately 50 members covering 150 metro markets; KBx has 30 members with 110 showrooms; and KB&A has about 40 members with 120 showrooms.

The company is always willing to add new members, provided it’s the right fit. Many of the members overlap in territory and markets. “New membership is something we are always evaluating,” says Gheesling. “If we were in the business of selling geography, it wouldn’t work. We are mainly interested in good, quality competitors.” No rock-bottom pricing strategies to gain marketshare; high service levels required.

Most members come by word of mouth either through members or suppliers. “We are not always looking for the biggest, but we want the best,” Gheesling says. “The culture is one where we check our egos at the door.” The key is the willingness to share and be open with the group. And it’s as much the intangibles they look for as the balance sheet.

Founded: 1998

Headquarters: Marietta, Georgia

Affiliate programs: Home Solutions, MultiFamily Solutions, KBx, KB&A

Team:

Dave Gheesling, CEO

Andy Hogan, VP and CPO

Graham Howerton, VP

Randy McNatt, CFO

Jay Smith, President

Allison Rea, Director of Marketing

Tonya Land, Executive Assistant

GENESIS OF THE GROUP

FEI Group came about both in response to industry events and to fill a void in the market, Gheesling explains. A major event, perhaps the major event, was Shaw Industries’ move to buy contractors and retailers in 1995. Interface and DuPont announced similar moves in the commercial flooring markets. “There was a lot of consolidation,” Gheesling says.

Groups and affiliations were proliferating at this time, but no one had targeted the residential contract market. There was a need, as well, for this group of companies-for these regionally based, smaller companies that were trying to communicate with national companies on the supply and customer side. That was proving difficult. What the residential contract market-both single and multifamily-had in common was size and market focus. “They were and continue to be substantially larger than other channels,” Gheesling notes. They were also focused on serving the new home construction market, a market with its own unique challenges.

“As manufacturers were getting bigger and consolidating, the [residential] flooring contractor community needed to have a vision together,” Andy Hogan says. Thanks to industry consolidation, profits were being challenged, and that was a “call to action.”

“The biggest piece was that communication had become difficult for these companies,” says Gheesling. “You had large national manufacturers and large national home builders capable of communicating on that level. Our members were not capable of doing that.” Nor were they talking to each other. That was something FEI set about to change.

Initially, the idea of gathering larger builder dealers into a group was not without some skepticism, and Gheesling admits the challenge of it also fueled him. “There was a belief that it was laughable, if not impossible, to bring these players together,” he recalls. “Personally, I love hearing that something is impossible.”

Gheesling quickly discovered that the opposite was true. “The notion that the egos were huge and wouldn’t work together was completely false,” Gheesling says. “The quality of the people we began meeting in 1998 is beyond my reach for words. They work hard; they play hard. There is great integrity and intelligence and a real family mindset-since day one.”

Gheesling and his team met with a handful of companies in 1998 and all signed up. Concurrently, FEI set about creating the programs that would make it indispensible to the membership. To that end, in 2000, the group formed a strategic partnership with CCA Global Partners that exists to this day. The two companies collaborate where it’s possible to maximize efficiencies and economies of scale.

FEI also went about the task of adding new members to grow critical mass. At first the effort was focused on single-family. But soon the membership caused the group to branch out and MultiFamily Solutions was born in 2003.

Thank a member for that expansion. Redi Carpet, based in Stafford, Texas, now has 25 locations in 17 states and Washington, D.C. Two additional locations will open next year, according to Brian Caress, CEO. The company employs 427 and will do over 375,000 installations this year. When Redi Carpet joined FEI in April 2000, there was only the Home Solutions division. Redi’s president, Jerry Hosko, got in touch with Gheesling to discuss expansion. The matter idled until 2002, when Redi reopened the discussion. In 2003 there was an exploratory meeting with five prospective members. They all agreed to join.

Caress says, “When we joined, I was the general manager of our Houston branch. One question our customers regularly asked was: Can you service us in the fill-in-the-blank market?” At the time, Redi had only five branches. He adds, “From my perspective, joining the group was an opportunity to be part of an organization with a national footprint. While it didn’t actually exist yet, we envisioned being a part of a network of contractors working together to exceed our customer’s expectations. It turned out to be that and so much more.”

NAVIGATING THE RECESSION

It’s impossible to talk about the residential construction market without eventually coming around to what happened in 2008. The housing bubble burst, costing many companies their existence and others a significant portion of business that took years to recover.

“I think that was a moment that’s indicative of what’s important to us,” says Jay Smith, president, who joined FEI Group in 2000. “In one moment we watched a third of our business go away. We didn’t like it, but there was no hesitation in getting down to work and moving forward. I look back on it with fondness. It made us more resilient as a company.”

Hogan believes that moment made FEI Group more valuable than ever for the members. “Their business was off 50% or even more,” he says. “So cutting costs, procurement efficiency, best practices, buying well-all of that became more important. In certain terms it redefined what we did for them. They all saw the value of the group even more.”

That’s about the time that Nonn’s Flooring, based in Middleton, Wisconsin, joined the group. “Home Value/Drexel had just filed for bankruptcy,” recalls Adam Nonn, CEO and president. “They had been the main supplier in our market.” Nonn’s was a potential member for Home Solutions and MultiFamily Solutions (and the KBx division), as they cover all markets.

“We thought we knew what we were doing, but you don’t ever know what you don’t know,” Nonn says. “When I looked at the other members-some larger-and thought, ‘They are getting something out of it. What am I not doing?’” The opportunity to talk to some of the best in the business, especially in such tough times, convinced Nonn it was the right decision. “In 2009 what we were going through was crazy,” he notes. “It was great to talk openly and candidly about what was going on.”

BEYOND FLOORING

The addition of KBx in 2009 gave a formal program for countertops and cabinets that many members were either already doing or adding to their mix to offset declines from the housing recession. In 2015, FEI created KB&A to add plumbing and accessory products and programs to the mix.

Kitchen Art of South Florida, today a $50 million business with 81 employees, joined FEI Group in 2008. The company had benefited from sharing best practices, as well as access to key suppliers and rebates, says Jeff Collamore, CEO. “I am constantly surprised by the value of the information I receive through the network,” he adds. “The level of knowledge and professionalism is amazing and priceless.”

Benefits for Collamore’s company include the rebates as well as the access to key suppliers. That’s the financial benefit anyway. “The access to top players is even greater to advancing our company,” he says. “The FEI/KBx Group offers such a rich environment of top kitchen and bath professionals in our industry. Another proof that if you believe, surround yourself with like-minded people and bring positive energy to the table, it will drive high-performing results.”

MEMBER BENEFITS

Doug Chadderdon, CEO of Great Floors, based in Coeur d’Alene, Idaho, has been a member for over a decade. “You can’t have a conversation about being part of a group without talking about rebates and the monetary side,” he says. “And they exceed our expectations. But of the four reasons to join, that’s fourth.”

Chadderdon continues, “They’ve added top-line growth for us. They’ve put us in touch with national accounts that have become repeat customers.” Great Floors has 21 locations and can service three states.

Another benefit is access to information. “We have updates on what’s happening in the industry within hours, long before it hits the trade press,” he adds. “To be more nimble, we have to have information as early as possible to make adjustments. But maybe the most important is networking. None of us have all the answers. Together we make better decisions.”

Larry Barr, president and CEO of Floors, Inc., based in Southlake, Texas, and co-CEO of Artisan Design Group-a consortium of ten companies across the country-was a part of the second tier asked to join in the late 1990s, perhaps the eighth or ninth member, he recalls. “I know that information is the key to success, and we would rather be on the inside than the outside,” he says, adding that they were already part of another group, but quickly realized the potential for this one when dealing with national business.

“At the time we were an upstart $40 million company and thought we owned the world,” Barr recalls. “It was a mild shock to see that there were people doing more volume than we were.” He also saw that he was in the company of the likes of Tim Coleman of Coleman Floors, among other industry giants. “We were ready to write the check, right then,” he adds. Today, Floors, Inc. is a $100-million-plus company that includes the new construction market, several retail stores and a new multifamily operation.

“I learned quickly that the benefit was the networking,” Barr says. “We already buy well and get rebates,” But sitting in the same room with others that share the same triumphs and challenges, something else starts to happen. “We travel with them, we drink with them, and we break bread with them. It’s a family, and the family makes you money. We pick up ideas whether other companies are smaller than we are or larger. We have made more money getting ideas from the group than we would have on our own.”

“I was looking to be a part of something that would allow me to interact with other dealers,” says Nick Freadreacea, president of The Flooring Gallery, which is headquartered in Louisville, Kentucky. The company has five locations serving markets from Columbus, Indiana to Louisville. He joined in 2000, as soon as he bought the company.

“I also wanted someone I could trust and feel was ethical in business,” says Freadreacea, who was left with a bad taste from a prior group experience. “I could tell right away that they were a completely different deal. Their goals and approach to doing business was completely in line with what I wanted our company to be.” He felt FEI was focused on growing the business and not just buying the latest sample display each season.

For Redi Carpet, being part of FEI has made the company a better operator, Caress notes. Around 2006, FEI began offering a program called Project Multi-Facet, which included 85 best practices for multifamily flooring contractors. “There were numerous practices we implemented that increased our efficiencies and made an immediate impact on our bottom line,” Caress says.

MultiFamily Solution’s national accounts program has helped Redi Carpet grow revenue and the account base. Caress adds, “We work directly with other members to help each other secure smaller regional and local opportunities for growth through referrals in markets we don’t service.”

Chadderdon also lauds the national accounts program. “It’s a very big deal,” he says. “It’s not easy to garner the faith and confidence of a national account. All of us in the membership work hard to fulfill those commitments. I can’t go to Pittsburgh and meet directly with that customer, but I can service him in Seattle.”

In addition, FEI’s commercial insurance program has saved Redi Carpet a substantial amount of money with no reduction in coverage or benefits. A forklift program has reduced costs by an additional 15% over what Redi had negotiated on its own.

Nonn reports a lot of benefit from the group’s supplier list. “We deal with the larger ones and we get a lot of access to the company; you know who you are dealing with,” he says. And a new program called Site Photos has made a huge impact on his business. The company uses the program for all deliveries. Photos taken upon delivery are geofenced and timestamped. They are also using the program for job completion to make sure the work is done. “It’s one of the unique ones,” he says. “It works well.”

While the programs are important, it’s more than that keeping the members engaged and happy. “It’s not any one program,” says Barr, “but the voice of the collective we benefit from the most. There is a buying advantage, but everyone buys within pennies of one another, even though the industry would like you to believe otherwise.” When issues come up, changing terms, for example, FEI Group’s management is on it. Barr adds, “They bring collective discussions. They have your back.”

“FEI puts on a spectacular convention where the focus is on learning more about the business as well as product introduction,” Freadreacea says. “They also have regional meetings that are a huge benefit for a more localized position. But if I had to narrow it down to a couple of specific things, I would say their consumer credit program and builder-finance programs. They are second to none in the industry and provide both money savings and protection from collection.”

“The biggest surprise is how open the membership is to helping each other,” Freadreacea says. “You are not the only company having constantly changing issues to deal with.”

“Being part of a group where you can openly discuss ideas and issues with your peers always provides a new perspective and helps us all grow,” Caress says. “Whether it’s a phone call with another member, attending a regional MFS Meeting or participating in FEI’s national conference, we always walk away with more than we walked in with.”

WHAT MAKES FEI GROUP UNIQUE?

While FEI Group has things in common with most any group, it also stands apart in several ways. “We’ve been in other groups before,” says Nonn. “The thing that makes this one better is truly the people and the members of the group. If you look at the top 100 largest dealers, half of them are FEI guys. To put all of them in a room and see what they are doing is something pretty special. Every meeting I get five to eight different things that help me run my business better. That’s the most important thing.”

Mark Tucker, vice president of Shaw Industries’ builder and multifamily division, says FEI’s careful selection process distinguishes the group. “They are very selective in who they pick and go through a detailed background check,” he says. “They just don’t let anyone in-on purpose. They will go into a market and say no more than yes. It’s quality over quantity.”

Tucker adds that members’ willingness to share information also sets them apart. “You and I know that when you get competitors in a room, they tend to compete. But these guys share and really work as a group.”

Doing business with FEI Group pushes manufacturers on both a product and service level, suppliers say. “They have 100 influential members that are independently owned and operated,” notes Keith Ziegler, North American sales manager for Contract Sales at Bravo Services. “They limit their sources of supply and are very deliberate about who they align with, both from a supplier and member standpoint.”

The group’s strength is that it drives the specification in a lot of markets. Ziegler notes that it’s important for a supplier to be active in their “house business” or non-specified business, which is “still the king in today’s flooring contractor segment.”

“The beauty of FEI is that they allow each individual company to still operate as an entrepreneur while having the support of a national organization,” Freadreacea says. “When they look to add a member, it is not only for the volume the dealer will bring, but their knowledge base and their ability to make an impact on the other members.”

A genuine family feel is one of the group’s strengths, notes Dan Butterfield, vice president for Dal-Tile’s builder/multifamily channel. “FEI leadership has the very best interest in each of their members and vendors to succeed in this ever-changing industry,” he says. “I’ve always believed that one’s own success comes from taking a genuine interest in one’s customer’s best interest. When they’re successful, we’re successful. That’s a core value we find within FEI Group’s entrepreneurial spirit.”

Notes Great Floors’ Chadderdon, “The talent, energy and intellect at FEI is without question the best of all the groups. A lot of guys just want to scalp the vendors. These guys want to build value for everyone.”

INDUSTRY CHALLENGES

One of the reasons for joining any group is the ability to have help when times get tough or challenging issues arise, and not just from management, but also from the membership. FEI Group is no different in that respect.

Labor is a great example. “With unemployment at record lows, finding sales, administration and operational help is a challenge,” Caress says. “But even more difficult is maintaining a sufficient base of qualified independent contractors, especially at the high point of our business cycle.” The shortage is nationwide and Caress doesn’t see it improving, “unless we can find a way to increase installer income and attract a new generation to the trade.”

Labor is an issue for all segments in the flooring business, but this segment is sensitive not only to its labor, but labor for other trades as well. “The lack of quality trades ahead of us is our biggest issue today,” Floors, Inc.’s Barr says. “Crews are getting older. No one wants to work as hard.” If the drywall doesn’t get done, the flooring can’t go in on time.

“Today it’s a shortage of bodies,” Chadderdon says. “In the 80s, there were plenty of carpet installers, but then hard surface happened.” It was more a matter of “I don’t install that,” as the product mix changed. Now, Chadderdon says, it’s just a shortage of people to install anything. “That continues to affect our top line,” he adds. Great Floors has established an in-house apprentice program to train its own installers. “We have to take control of the issue or we will be victims.”

Price increases remain a challenge as well, according to Caress. “While I understand and support the need for occasional price increases, the way the manufacturers go about implementing them wreaks havoc on our business,” he says. Multiple increases in a calendar year are difficult to manage. Caress would like to see a single annual price increase before the selling season begins. “This would allow our customer to better budget for their flooring needs and save an enormous amount of work for our dealers and our team.”

Consolidation of end users is a big challenge for the segment, notes Bravo’s Ziegler. “National/production homebuilders are getting bigger and large property manager companies continue to expand their footprint,” he says. “As they get bigger, they get smarter.”

The strengthening of this segment is putting more pressure on manufacturers to produce quality, innovative products. Ziegler adds, “The same pressure is put on flooring contractors to ensure quality service of installation with minimal call-backs. Doing things right the first time still holds true in a margin-squeezed environment.”

FEI Group helps members with these challenges, he believes, by creating and continuing a standard of excellence for flooring contractors. “Their sharing of best practices within the group feeds the supplier community,” says Ziegler. Those expectations extend to manufacturers. “Servicing a Floor Expo member comes with certain pressures that makes us a better supplier,” Ziegler adds.

LOOKING TO THE FUTURE

The guys who started FEI were in their thirties. They are now in or approaching their fifties and things look a little different, they admit. In another 20 years, they will be in their seventies, but they expect to be creating opportunities for their membership. “Our foot is on the gas pedal,” Smith says.

“What does our customer look like?” Hogan asks. “What does the property manager look like? What do homes look like? How will that impact the flooring contractor?” For example, 20 years ago, no one would have thought LVT would be emerging as such a massive, dynamic category. In other words, things are always changing. And FEI expects to change along with them.

Looking ahead, expect to see FEI Group taking its expertise to new areas. Barr hints at new directions. “We are taking the same model and putting it at play in different arenas,” he says.“There is no end to the opportunity.”

Early on, FEI Group defined the core values the company lives by, according to Dave Gheesling, CEO.

• First class for coach

• Inspect what you expect

• Listen

• Leadership is action, not position

• I’m outside the box

• Teamwork wins

• Under commit and over execute

• Physically fit before mentally fit

Copyright 2018 Floor Focus

Related Topics:Daltile, Redi Carpet, Artisan Design Group, The International Surface Event (TISE), Shaw Industries Group, Inc., Great Floors, FEI Group, Interface