Branding Report 2017: Legacy brands discuss brand building in today's market - Nov 2017

By Jessica Chevalier

The age of the Internet has changed a great deal about how business is done in the flooring industry, and one of the most dramatic of these changes relates to the building and maintenance of manufacturer brands. Today, many flooring manufacturers have largely pulled away from all but web-based and in-store approaches to evolve and promote their brands. The reasons for this are many, but with such a rapid sea change, it begs the question: are we, as an industry, putting our best face forward and doing the work necessary to convince American consumers to spend their extra dollars on new floorcovering rather than other home furnishings? We spoke to several of the industry’s most storied brands to learn more about the current approach to brand building.

ARMSTRONG SWIMS AGAINST THE CURRENT

Turn on HGTV, and you’re sure to see plenty of ads for home products. Among them, you’ll catch a few boisterous Lumber Liquidators spots and some bits featuring Empire Today’s bobble-headed mascot-both of which are screaming about discounts-as well as a couple of pieces for Home Depot’s LifeProof flooring brand and, now, three Armstrong “The Floor is Yours” commercials. Like many flooring manufacturers, Armstrong advertised to consumers pre-recession but then pulled back when times were tight and consumers weren’t spending. The new campaign represents the brand’s return to consumer advertising, a strategy that it intends to continue, according to Ebeth Pitman, director of brand marketing for Armstrong. “This is the beginning for us,” she says. “We are looking to build and scale from here. We’re back in the game, and we will be growing this going forward.”

The first of Armstrong’s three consumer ads features 27-year-old Martha King, a Pennsylvanian and champion lumberjack who displays her impressive strength and skill by hacking a log apart atop an Armstrong hardwood floor. The scene is then cleaned up, and King returns to admire the unblemished surface. It’s an impressive display that represents a transition from the typical fodder of flooring ads. “We have taken a look at how to really connect to the consumer on a deep level and have moved beyond typical flooring industry marketing, like kids, pets and room scenes,” says Pitman.

The ads will be presented to the buying public via Armstrong’s partnership with HGTV. “One of the rationales in our partnership with HGTV was placing flooring in the context of the other finishings within the home,” explains Pitman, “trying to insert ourselves into the consumer’s project, not necessarily only the flooring project. In terms of flooring manufacturers, we are really the only ones showing up, and we saw it as a great opportunity. There are no real stand-out brands in flooring in terms of being innovative and exciting with reaching consumers in advertising. It’s a real pivot move for our brand. Years ago, Armstrong was super innovative with marketing, so we are going back to our origins-getting back out there to connect with a new generation.”

The advertising is intended to directly support Armstrong Elevate retail dealers, to which the company will channel qualified leads gathered through the website, and, more broadly, all retailers who carry Armstrong products.

Of this integrated approach, Pitman says, “We know there is no one silver bullet today. We are using HGTV, broadcast and digital, merging traditional and emerging tools so retailers can feel the value from the program. It will be an integrated campaign with many touch-points and levers. We are looking to capture hearts, minds and, yes, wallets, regardless of where consumers are in the purchase journey. A purchase can take months to years to come to fruition. Moving through that process with them and giving them a reason to celebrate at the end-that’s our goal. It’s about building that relationship. Shoppers of today are lacking confidence because of the clutter in the market, and, for that reason, brands are more important than ever. A strong brand inspires confidence.”

SO MUCH TO DO, SO LITTLE TIME

There is a sense of nostalgia related to the “good old days” of brand building among elders of the floorcovering community, days in which the outlets were few and the audience was, or seemed to be, straightforward. Says Bill Storey, who has been with Karastan for 30 years and today serves as senior vice president, “The world has changed so much. When I started, we just had to figure out how to run a great newspaper ad with our retail partners and what size we were going to get.”

The advertising market today is much more fragmented, and that means both a great deal of perceived opportunity and a great deal of work when it comes to sorting it all out. In fact, the interviews conducted for this report leave the impression that even some of the largest players in the industry struggle to keep up with maintaining the many established and emerging channels-put simply, there is just too much to do. Now that Armstrong has its traditional media campaign underway, for instance, it intends to start following up with social media. Says Pitman, “Social media has not been a focus for our business, so we are kick-starting efforts there. We’re looking at using several different platforms, each with a strategic purpose.”

While it is easy to look at the fragmentation in the market as negative, that’s not so in Pitman’s opinion. “Today, we have a very fragmented media, so the question for manufacturers is, how can you manage that?” she says. “How can you create engagement with so many touch-points? In my opinion, it’s actually easier because the ability to target is awesome. You can really dig down into real qualified leads. You’re not just shouting at people, but engaging.”

Pitman explains that consumers today aren’t interested in being talked at as much as they are talked with. “We’re sending out interesting content that allows people to connect with the brand, rather than just product pictures,” she reports. “We see ourselves as a publicist in some ways, linking arms with the consumer, being helpful where consumers are struggling or looking for resources. Knowing their pain points, and understanding the points at which the shopper might be most open to influence. This is the driving force around how we are going to market, specifically with Facebook, but also with Instagram, Twitter, Houzz and Youtube. We believe that video content is very important-people get value from interacting with us in that way. We’re also doing a lot of work with retail sales associates (RSAs), and in-store displays are a big focus for us to help the consumer understand the product benefits in the case of an unassisted sell. Completing the loop is important.”

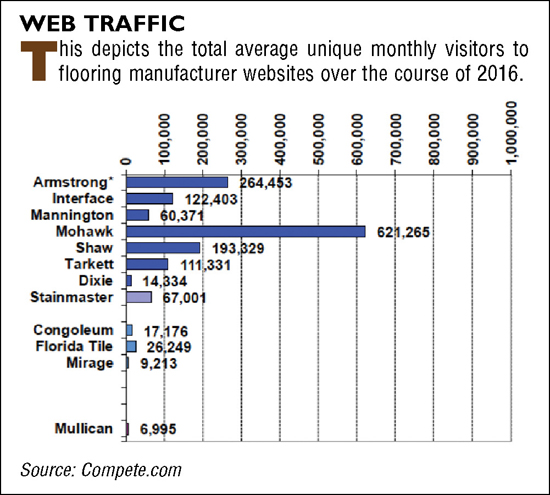

Interestingly, from our research, Armstrong is one of the few flooring manufacturer brands speaking to the consumer via an approach that combines traditional and new media strategies. All the others now focus exclusively on digital media and supporting the brand on the retail floor.

Karen Mendelsohn, senior vice president of marketing for Mohawk, explains the current approach for supporting the almost 90-year-old Karastan brand, “We provide quite a bit of consumer support behind the brand, but that doesn’t always come in the form of traditional advertising, such as a Super Bowl commercial or a radio spot. The support we provide is significant in the digital space, both on Karastan’s website and the retailer’s website. Also, we know that in-store merchandising for Karastan is one of the strongest ways of supporting the brand. In fact, I believe Karastan is one of the-if not the-most well-supported brand in the industry through the co-op advertising that we provide to retail partners. We have very high redemption on our brand programs, and we know that the brand is known by consumers who are in the consideration phase. We believe the brand has pull.”

She continues, “In the past, at one point, we did some consumer shelter print ads. But as digital has exploded and has become the trusted source, that kind of investment doesn’t provide the same kind of brand building that we can get from digital. Our emphasis is on rich content in the digital space.”

Web-based advertising has many benefits. First and foremost, according to Mendelsohn, it allows manufacturers to be laser-focused in their approach, zeroing in on a particular audience in a way that traditional advertising does not allow. “We can be much more surgical and analytical in our investment today,” she says. “Social media advertising takes down barriers, and we see the opportunity in creating consistency between the online and in-store experiences.”

Secondly, web advertising enables manufacturers to change their message at a whim. Amid the Lumber Liquidators’ laminate formaldehyde scandal, for instance, a laminate manufacturer could easily create and post a timely ad to explain how their product is different and superior.

Thirdly, Mendelsohn points out that results are easily quantifiable. Unlike a shelter print ad, for example, one great benefit social media offers is the ease with which it allows users to track its effectiveness via metrics. Clicks represent quantifiable success. With traditional media, conversions are obviously more difficult to track.

This is a significant draw for marketers, explains Brad Williams, vice president of sales and marketing for Mirage, “The biggest thing for me in switching to digital promotion is that everything becomes measurable. With shelter magazines, there is no measure. We knew impression numbers but had no idea how many people really looked at an ad. With digital, we know how many people are clicking. We see whether an ad is bringing them to our website, and we can follow it through-see what pages they visit on the site. Before, I was getting unique visitors to the website but didn’t know where they were coming from.”

Does digital media have the same brand-building benefits as traditional? That’s hard to say, but one thing is certain: while web-based advertising may target the new buyer, it completely misses audiences that are not users of technology, broadly, and social media, specifically-and that includes many Baby Boomers, who are one of the groups with money in their pockets to spend right now.

As of November 2016, 34% of Americans over the age of 65 used at least one social media site; as did 64% of those ages 50 to 64; 80% of those ages 30 to 49; and 86% of those 18 to 29, according to Pew Research Center. While those figures are fairly substantial, it still stands to reason that digital-only strategies are missing a significant piece of the buying market-namely, the 66% of Americans over 65 and 36% of Americans aged 50 to 64 who are not using social media. Among these groups, there is also undoubtedly a significant contingent who have a social media account but use it rarely and therefore are not exposed to its advertising on a frequent basis.

Because Mirage is positioned at the premium end of the hardwood market, it attracts a consumer with a bit more money in their pocket, and, according to Williams, that is often the Baby Boomer. In fact, Mirage’s target customer is 55 to 75-those in the age ranges with the lowest social media use-which makes Mirage’s predominantly online strategy somewhat baffling at first blush. But Williams explains that in engaging online, it is looking at the long game. “Manufacturers today have to have a short-term strategy to boost sales now and a long-term strategy to build the brand for the future,” he explains. “Millennials don’t buy our floors now, but we need to start communicating with them. The big manufacturers in our industry have products in price categories that Millennials can afford, but I don’t. I am much more targeted.” He adds, “The older generations aren’t doing as much transactional stuff online as the younger generations are, but many are still there.”

Regardless of who is seeing what where, no one can argue the fact that the more frequently a consumer comes in contact with a brand, the more likely that brand will be top of mind when it comes time to start the shopping process-and coming in contact with a brand via a variety of forums is even more powerful. That’s nothing that can be measured by metrics or analytics; that’s just how the human mind works.

There is an assumption by many that social media and online advertising is less expensive than advertising on TV or in consumer publications. Interestingly, while traditional media may require more in up-front cost, commanding the many digital avenues available today does require a great deal of man hours, and that can be quite costly.

Mirage’s Williams elaborates, “In my opinion, online promotion costs more. It’s costly to create content. Plus, there are the many different strategies. We need more resources to create that content that we had previously, and that’s more manpower and more dollars in trying to manage it all. The most challenging part is building creative content-keeping it fresh and updated. That’s the part that people struggle with a lot. With print, we might run the same ad for a year, but today, content has to change frequently.”

DOES BRAND STILL MATTER

So what is the value of having a brand in the flooring industry today? The answer to that question may be more complicated than it first seems. After all, the nature of the floorcovering business puts a retailer between the manufacturer and the consumer, and that retailer’s motivations, understandings and performance have a great deal of impact on the outcome of the sale. As we all know, a consumer who walks into a retail store with the desire to look at Armstrong flooring may well be steered by the RSA toward another brand for a whole host of reasons. And that’s why getting real buy-in from retail partners is viewed, by some, as the most critical aspect of the process.

Mendelsohn believes that consumers, as a whole, are interested in the idea of new flooring, but that the nature of the buying process is often a deterrent to closing a sale. “The problem is helping them navigate the complicated process and not abandon it as a result of frustration,” she says. “There are many consumers who are interested in purchasing a new floor, but the brands need to do a better job assisting with the consumer experience, helping retailers provide a consistent online and in-store experience to build trust. That’s where we are putting our time and attention.”

Mendelsohn adds that the benefits of an established brand are many. “There is a huge benefit just in terms of the trust that the consumer has in the purchase process and in the retail experience,” she notes. “There are lots of benefits of having a brand that lives up to its value proposition, most notably a satisfied homeowner who recommends the brand to their friends and family or who may go online and write a review.”

She adds that one of the advantages of having a strong brand is that “it’s harder for a retailer to sell a Karastan-qualified consumer off Karastan,” which supports the notion that speaking directly to consumers is a key strategy for manufacturers.

But what happens when the channel isn’t loyal to the manufacturer? Consumer advertising is expensive, and oftentimes dealers don’t reward the supplier for increasing store traffic through advertising. There is no shortage of privately labeled flooring products in the market today, and these often carry a cheaper price tag and may bring the retailer a higher margin.

That makes the concept of in-store advertising complicated. On one hand, while it seems imperative to have a brand represented visually and with point-of-sale materials in the store expressly because the retailer may not actively sell it. On the other hand, it seems like relying heavily on that approach may not pay substantial dividends if the retailer isn’t backing it up with what the salesperson says in-store. Let’s face it, most consumers, when presented with two seemingly similar options, don’t gravitate toward the higher priced one unless an argument is made for its value. The buying cycle for flooring is long, and, in making a choice, consumers rely heavily on online research and in-store assistance. If the purchase of a branded product ultimately comes down to the consumer’s commitment to or belief in the brand, manufacturers should likely be reaching them via as many avenues as possible.

Williams explains the importance of using brand to create a pull effect at retail. “The push effect is with the sales side, the retailer educating consumers on our brand, but we need that pull effect too, with consumers going into the retailer seeking our brand.” Keep in mind that the “pull” effect may not simply impact a single sale but also the retailer’s thinking about a brand. Williams reports that, with some frequency, he’ll visit a Mirage retailer and find that they have brought in another hardwood line-often a big name company. When he asks them about it, they’ll say something like, “Don’t worry about that. They’ll be gone in two weeks. I brought it in thinking consumers would ask for it but not one has.” This may be anecdotal, but it highlights the impact that consumer requests can have on the retailer’s perspective of a brand’s value.

Storey adds, “The flooring industry is devoid of brands. We don’t have a lot of strong brands. Brands provide instant credibility for the retail sales associate. They make their job easier. Consumers don’t buy flooring often. Recognition makes the process easier, and our job is really to support the retailer in helping them through the sales process, which for flooring isn’t easy. It’s a longer shopping process, and it’s a big ticket. Brand makes a big difference with big tickets.”

LEANING HARD ON AUTHENTICITY

One of the great challenges of advertising today is that brands must reach at least two distinct groups: the Baby Boomers-who may shop and interact online but may also still receive a newspaper and are impacted by traditional advertising-and the digital-from-birth Millennials-who eschew traditional media as well as many of the suburban values of their parents-not to mention the other generations in the market today: Gen Xers-a hybrid of these groups-and the up-and-coming Gen Zers-the oldest of whom are in their early twenties.

Much has been said about the Millennial generation’s purchasing habits and its preference for doing business with brands that, in a sense, have a soul, and Jamann Stepp, director of marketing and product management for US Floors reiterates the point, “Connecting with people is key. Consumers raised on and immersed in digital media have different expectations. They don’t just want to learn about your products; they want to get to know your brand.”

In terms of how this plays out for the flooring manufacturer, Brandon Culpepper of Karastan advises, “You have to understand the heart of your culture and be authentic to that. Don’t get outside of it. Keep it front and center. In the team of people that make up our company-from sales to manufacturing-we make sure they understand what is core about what we’re trying to do and that we’re passionate about keeping the real thing. If we’re passionate about what makes us special, we will be able to look at the consumer and tell the story from the heart. If consumers hear an authentic message about why you’re there and what you can offer, then that is something they can buy into.”

For the nearly 100-year-old Karastan brand, that boils down to living up to the promise of quality that it has long represented and sharing its history. “Where Karastan got its start was proving that it could provide a domestically made rug that was as good a quality as imports from Asia, which dominated the market then,” says Culpepper. “People would go out to buy a ‘Karastan.’”

Of course, as consumer buying habits evolve, the trick for storied brands, like Karastan, becomes how to stay relevant while also staying true to their legacy. “As technology has advanced and consumer behavior has changed,” explains Culpepper, “rugs have become more about floor fashion, and they get changed more often. Price points have come down and looks have gone up at the lower end of the spectrum. Today, you can put a lot of fashion into low price points. Karastan today means best in class. We have a range of price points, but at each, Karastan will be the best quality, the most innovative and on the leading edge of fashion.”

Storey adds, “If the product isn’t appealing to the consumer, the brand will die. We’ve had to change our styling over the years. We are known as a fashion leader, and we try to be on the cutting edge, leading for tomorrow.”

Of course, so much of this comes down to trust. So many consumer brands-both within and outside of the flooring industry-have devalued themselves by compromising their product quality to save a buck. We’ve all had that icky feeling when, for instance, we see our favorite brand on the Walmart shelves or those of another discount retailer. How much more difficult is it for a brand to pull itself up the value chain from a lower position, regaining a prior status or establishing a higher quality reputation that it once had?

Jonathan Witt of Oriental Weavers points out that one way that manufacturers today build their brand is by aligning themselves with another familiar name. “It’s an interesting time for branding,” he says. “In the past, using Stainmaster fiber, for instance, added confidence that the product would last long term-it pulled more weight than a statement from a random manufacturer. In the area rug business, we don’t have that necessity as much anymore because rugs are such a color and design business, and ultimately the rug has to match what you have in your room. The name doesn’t matter. It’s a challenge for us, and in some ways, it makes licensing more important. Our association with Tommy Bahama, for example-consumers associate that name with quality. It adds value and brings some attention to Oriental Weavers. That sort of approach is more our direction today. Pantone, another of our aligned brands, is a bigger name than Oriental Weavers and known to be a color leader, so that’s a driver for selling rugs.”

Pitman points out that an effective brand strategy isn’t just about promotional aspects but the entire package that a brand puts out. “The Armstrong brand is really the sum of everything that we’re doing,” she says. “It’s marketing, but it also represents how we go to market and what it represents in the mind of shoppers. We’re creating a relationship and building a promise. We’re getting to know shoppers and building value. It goes beyond brand building. It’s a cultural movement strategy to accelerate our grip on the market.”

Educating the retailer about a brand so that they can pass that knowledge down the chain to the consumer plays an important role as well, and that is a significant part of the flooring manufacturer’s branding approach. Says Culpepper, “We help our retailers understand our culture, and we do that through a lot of sales training. Giving them a clear idea of what Karastan is about, so that they get excited and relay it to consumers. In the store, we’re also using point of sale tools-from banners to window clings, all kinds of things that put the brand front and center. We also help them with the ads that they are placing-social or printed. The key thing is consulting with them and helping them relay that information to consumers so that they understand the value of the brand.”

Storey points out that RSA education is an ongoing process from which manufacturers can never relent. “Educating RSAs is key, but it is a never-ending process based on turnover,” he adds. “Each territory manager for Karastan has only a handful of accounts, so one of their primary tasks is spending time on the retail sales floor. Karastan runs promotions twice annually, and before each, we spend lots of time educating associates.”

Building loyalty with retailers is key to success, yet it can be challenging, “One of the ways you do it is running promotional periods in the store,” says Witt, “incentivizing both the customer and the salesperson. That’s still part of the mix.”

When it comes to the keys to brand building, Mendelsohn says, “First and foremost, you have to understand the equity of the brand. You have to understand your target audience, and you have to be relentless with consistency in how the brand is executed and supported. All the while, you also have to continue to innovate products that are relevant to the market and in character with the brand.”

Ultimately, Mendelsohn believes that a strong brand provides consumers with a positive feeling that endures long after the sale. “Brands with retail integrity give the consumer peace of mind that they are making a good choice,” she says. “Consumers of flooring are very concerned about making a mistake. The buying process is complex and protracted, only one to three times in a lifetime. A good brand helps provide the consumer with confidence and trust.” And, of course, one of the great benefits of having a strongly branded product that delights consumers who purchase it is the consumer’s likelihood to refer it to family, friends or, with the prevalence of online reviews, even strangers. Referrals are a powerful medium, and consumers take them seriously.

For a relatively young brand like Coretec, created by US Floors, it is tempting to shift with the winds of the market, Stepp notes, but that is a dangerous proposition. “You have to know what’s at the core of your brand and stick to it,” he says. “We have an advantage at Coretec because we’re still a relatively young brand, so most of the key players on our team have been here since the very early stages. We remember why we launched Coretec in the first place-to offer flooring with strength, style and simplicity. While we’ve grown and expanded our offerings tremendously, those core principles haven’t changed. The other half of the equation is understanding the customer and how our brand values align with what they want in a floor.

“Traditional advertising is a one-way street,” Stepp adds, “where brands send messages to mass audiences. Today’s consumers expect to be heard, to be involved in the conversation one on one. That’s why authenticity is crucial. One strategy that we will continue to employ is building on our position as the originators of the category.

“We’re currently migrating to a mobile-first strategy for our marketing communications. We want to be sure all our efforts are readable and engaging on mobile devices. As for social media, again it’s all about connecting with people. We want to share success stories from consumers as well as tips and ideas from professionals-and not strictly about floors. We recognize that floors need to work in harmony with overall interior design, so we definitely want to give our customers as much inspiration and support as we can.”

Witt seconds the value of selling flooring as part of an interiors package. “We have retail partners today who want us to create curated design stories,” he explains. “Bloggers are home fashion influencers today, and if they back a product, people will come, so we court bloggers and show them new product the same way we’d do with the trade media, for instance. You can often get more coverage than you would have traditionally, and you can really generate some true branding. Sometimes we’ll send a rug to a blogger. Sometimes we’ll just put a curated image together and tell a story.

Oftentimes, they are looking to create a whole lifestyle image, and we’re just a piece of it.”

THE LONG GAME

Ultimately, making an argument for the consumer to buy a new floor instead of, say, new kitchen appliances or new furniture is an effort that is incumbent on all in the industry but, realistically, falls to the biggest players. Whether enough of that is being done is up for debate, but that’s a debate that should be had.

Williams believes that when consumers think about renovation, they first consider elements like countertops, backsplashes and components like sinks and vanities. “They think about what will create that ‘wow’ factor,” he says, “ but so often they don’t think of floors as a fashion element.”

In addition, there is a significant inconvenience factor when it comes to the replacement of flooring, and unless the industry makes a strong argument for the advantages-aesthetic, practical or functional-of new flooring, consumers may prefer to dodge that inconvenience or defer it for as long as possible.

The same factor is at work in new construction to some degree, Williams points out. When funds get tight toward the end of the building process, consumers are more likely to look for cuts in broad sweeps, than, say, going through the already-selected faucets, fixtures and minor finishes and making less significant cuts one by one. Making a single across-the-board trim to flooring, on the other hand, may just be simpler. Elevating the industry and increasing consumer education across the board about the features and benefits of the products could help decrease this occurrence.

Copyright 2017 Floor Focus

Related Topics:Mohawk Industries, Armstrong Flooring, Mirage Floors, Lumber Liquidators, Karastan, RD Weis