Domotex Asia/ChinaFloor 2014

By Kemp Harr

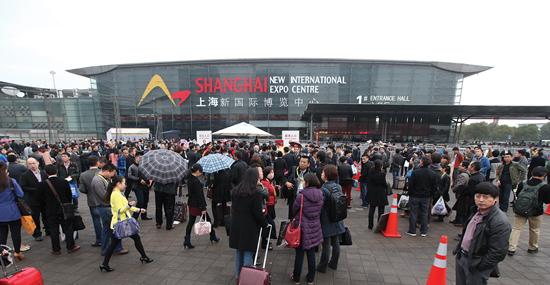

The 16th edition of Domotex Asia / ChinaFloor (DACF) was held in Shanghai at the end of March, and the show’s organizers, Deutsche Messe and VNU Exhibitions Asia, were pleased with the record attendance as this show continues to hold its stature as the largest floorcovering show in the Asian Pacific region.

Deutsche Messe, which owns Domotex Hannover, the largest floorcovering show in the world, has a minority interest in Domotex Asia. While the two shows rival each other in size both in exhibit space and number of attendees, there is a major difference in scope between the Hannover show in January and the Shanghai show in March. Domotex Hannover is clearly a global show and Domotex Asia has a more regional scope. Out of the 42,000 visitors at this year’s Asian show, 75%, or 31,600, came from China. By contrast, the Hannover show had 45,000 visitors and only 43% were from the host country of Germany. The same story holds true for products. In Domotex Hannover, most products on display are from around the world, while in Domotex Asia most are from the Asia-Pacific region.

Over the years, China has grown to become one of the leading sources of floorcovering that is used around the world and, as evidenced by this show, China’s role in this industry continues to evolve. In the early years, flooring produced in China was seen as the low cost alternative and was never perceived to be cutting edge from either a styling or innovation perspective. Today, a greater percentage of the flooring that comes out of China, especially in the hardwood, laminate and resilient categories, is as good, if not better, than what is produced in Europe and the Americas.

At the same time, however, these products—once landed in the U.S.—do not hold the same pricing advantage they once held. In fact, according to a recent study by The Boston Consulting Group, products out of China in 2004 cost 14% less than U.S. produced goods, but today that gap is closer to 5%. And by 2018, the same study predicts that U.S. produced goods will cost less than Chinese products. The two biggest factors in this equation are rising labor costs in China and cheaper energy in the U.S.

There is much talk today about the rising middle class in China and the fact that demand within China by its own domestic consumers is shifting the dynamics of who is buying the products that are produced in China. So as buying habits, product quality and pricing positions continue to evolve, so does the role of this regional flooring show.

One interesting aspect of this show is the absence of ceramic tile products. Tile is the number one flooring surface in Asia and yet it is not represented at this show. This seems odd, considering that China is now the leading producer of ceramic tile flooring (in units) in the world. There is a separate show in Shanghai that focuses on tile but it was held a week later at a different venue.

Several booths at the show were focused on launching the latest innovations, from new locking systems to waterproof cores. This, in itself, was one of the more interesting aspects of the show. At the same time, it’s no secret that Chinese manufacturers have earned a reputation for not honoring the intellectual property protection of foreign patent and copyright laws. As a result of this practice, several of the exhibits in the space were by invitation only and a few had security guards posted at the entrance.

Chinese taste for flooring differs from what we see in the U.S. The Chinese prefer warmer hues of red and yellow and they prefer more pristine finishes in contrast to the rustic looks that are so popular in the U.S. The “European look” to a Chinese consumer would look more like the 14th century Red Velvet era and the “American look” has more of a cowboy motif.

Like most trade shows, the exhibits at DAFC were organized by product flooring category. In the carpet area, it was surprising to see all of the major carpet yarn suppliers with large exhibits all in a row. Side by side were Universal Fibers, Antron and Aquafil—all with impressive booths. It’s worth noting that all three of these brands have manufacturing facilities in Asia.

|

CHINA'S RESIDENTIAL MARKET |

|

Residential flooring in China has not evolved to what we consider customary here in the U.S. or even in Europe. Housing is expensive and builders don't construct homes on a speculative basis. Once a Chinese citizen gains access to a housing unit, they do not put much emphasis or investment in the floors. They often skip the finishes stage and move furniture in right on top of the slab. Those consumers who do buy flooring usually settle on something that doesn't cost much. The channel to market for residential floorcovering is usually through franchise retail stores that carry a manufacturer's brand. Power Décor, for example, which is a major domestic manufacturer, is sold through retail stores that carry that brand name on the outside of the store. It is very rare to find a retailer that carries more than one brand or surface type. There is also no builder channel at this point, since the builder does not provide the finishes as part of the transaction. The culture in China is very family oriented and saving money is part of their value system—especially for the older generation. |

Copyright 2014 Floor Focus

Related Topics:Domotex