Cleaning & Maintenance Update From April 2012

By Darius Helm

One of the most important shifts taking place in the flooring industry, driven by the weak economy, competition from China and the march toward sustainability, lies in a new understanding of what is actually being purchased. The old way of thinking was fundamentally product oriented, but now flooring dealers are starting to see it differently: product is only one element in a transaction that’s much more about service and, ultimately, a relationship.

There’s no shortage of people out there who scoff at the notion. They sell and install floors, plain and simple, they’ll tell you. It’s what they’ve done in the past and it’s what they’ll do in the future, and all this stuff about relationships is nothing more than touchy feely baloney.

So be it. Good for them. They won’t survive, of course, but they’ll leave with their obsolete perceptions intact. The truth is that there’s no room for such rigid traditionalists in the modern world. They’ll be stomped on by the home centers, which will always have the price advantage, and they’ll be floundering in the wake of the retailers and contract dealers that embrace the new way of doing business.

It’s not as though all these forward thinking businesses necessarily desire to shift toward more complex service models. It’s more that they see that the business model has changed and they understand that clinging to the old models will simply drive them to extinction—to do so would be to fight a battle after the war is already lost.

One of the key elements to the new way of doing business is the understanding that revenues go beyond the initial sale of the product. They’re selling the whole lifecycle of the product, the end user’s experience of the product, and in doing so they’re buying a relationship with that consumer that will hopefully extend beyond that initial product and into future flooring purchases.

The simple truth is that professional cleaning and maintenance of flooring products extends the lifecycle of the flooring and also keeps it looking better and performing better. That means a more satisfied client, which translates fairly directly into repeat business.

COMMERCIAL FLOORING CLEANING PROFILES

Just about all types of flooring require professional cleaning and maintenance, but the frequency of the maintenance and the process involved is different for every kind of flooring.

Most of the revenue from professional cleaning and maintenance comes from carpet, both in the residential and commercial sectors, because of carpet’s share of the flooring market as well as carpet’s capacity to trap foreign material because of its high surface area per foot. In a hard surface product, a square foot of flooring means a square foot of surface area. With carpets and rugs, the surface area is vastly higher because it’s the surface area of every single fiber.

On the commercial side, carpet cleaning yields about 25¢ per foot per year, so if a contract cleaner or a contract dealer services a million square feet a year, that translates to $250,000. It’s also worth noting that, while cleaning and maintenance are not big ticket items compared to product purchase and installation, the gross margins are very attractive, maybe around 50% compared to something closer to 10% for installation.

The most expensive flooring to maintain, by far, is VCT, which happens to be the cheapest commercial hard surface flooring on the market. But it needs to be stripped and finished at least once a year, depending on the traffic, and that will run over 50¢ per foot annually, according to most studies. In general, four or five coats of acrylic are applied during refinishing.

Today’s commercial sheet goods generally come with high performance urethane finishes that are both long lasting and hard to strip. Over time, traffic will dull the finish, and buffing and polishing will help maintain the look of the floor. However, sheet vinyl can also be maintained like VCT, with acrylic refinishing.

Of all the vinyl products on the market, none has a lower maintenance profile than LVT. The upfront cost is significantly higher than for VCT or sheet vinyl, but it needs very little in the way of deep cleaning and it generally does not get refinished.

Another resilient product with low maintenance costs is rubber flooring, which is generally buffed and polished. Rubber flooring doesn’t need to be refinished, as it has a natural shine due to its chemistry. However, it’s a floor that is easily damaged if harsh chemical cleaners are used on it.

Like rubber, linoleum has a low maintenance profile, and it’s also sensitive to harsh cleaners. Beyond regular cleaning, maintenance is generally limited to dry buffing, but over time, depending on traffic, it can require repolishing.

Ceramic and porcelain tile probably require the least maintenance of any flooring product. Glazed tiles or unglazed porcelain are just about impermeable. However, the Achilles’ heel of ceramic tile is the grout, which gets dirtier a lot faster than the tile itself. Deep cleaning of the grout should be done once or twice a year.

MAINTENANCE PROGRAMS

There are protocols for the cleaning and maintenance of all flooring types. Flooring manufacturers work with The Institute of Inspection, Cleaning and Restoration Certification (IICRC) and in the case of carpet with the Carpet and Rug Institute to establish standards for commercial cleaning, and the IICRC offers a range of certifications. Since its inception 40 years ago, the IICRC has certified over 120,000 cleaning professionals. Currently, there are 16,713 certified carpet cleaning technicians, 2,128 commercial carpet cleaning technicians, 1,167 floor care technicians and 1,516 stone and marble care technicians.

Most of those certified are independent flooring cleaners. Some are part of nationwide firms like Stanley Steemer, which offers both commercial and residential cleaning for all flooring types, along with other services. According to the IICRC, only about 25% of cleaning professionals are certified, though that’s up from previous years.

In the commercial market, floors are most often cleaned and maintained by either an in-house staff or janitorial contractors. Some are certified but most are not. In recent years, contract dealers have been getting more involved in cleaning and maintenance, as have residential flooring retailers, though at a slower rate.

Some cleaning services are closely associated with carpet mills. For instance, MilliCare, a subsidiary of Milliken, which produces carpets and textiles, has over 90 operations globally, over two-thirds of which are in the U.S. Over the last year, MilliCare has added eight new franchises to its network.

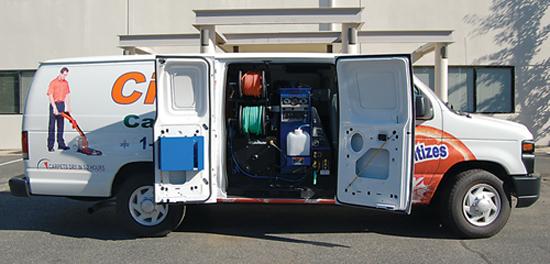

While independent cleaners and contract dealers turn to the IICRC for education and certification, progress with facility managers has been more challenging. It is well known that facility managers as a group tend to be overworked and spread too thin, especially these days, and it turns out that many have a bit of a blind spot when it comes to flooring maintenance. According to one industry expert, facility managers tend to think that if they have a maintenance issue, it’s a product problem. Part of the reason for this is because in-house cleaning uses tools plugged into the wall, maxing out at 25 to 30 amps, and that’s often not enough power to get the job done. Truck mounted equipment produces a lot more power, never mind that specialized equipment is more effective. Too often, facility managers—and this really holds true for anyone without a professional maintenance schedule—wait until carpet looks like it needs to be cleaned, and that can be too late to return the product to its original condition.

CONTRACT DEALER STRATEGIES

The two biggest independent contract dealer groups, Starnet and Fuse Alliance (formerly Resource Commercial Flooring Network), both have been focusing on helping their members add cleaning and maintenance programs. It’s an agenda that has become more critical in the last three years, with the commercial slowdown shrinking dealer revenues and in the face of increased competition for installation projects, including from residential dealers looking to boost their flagging businesses.

Starnet has about 170 contract dealer members representing more than 300 locations in North America, and about 50 of those locations offer floor care programs. The organization estimates that the established floor care providers generate from 10% to 20% of their revenues through floor cleaning and maintenance, going as high as 25% for some members. The program is growing in popularity, with five more members getting into the business in the last couple of months, and more to come. To add focus to these efforts, at the end of last year Starnet hired Eric Boender, a contract dealer for the last 18 years, as director of floor care and national accounts.

Starnet’s research reveals that both product longevity and customer satisfaction were increased with professional maintenance programs, and that the majority of in-house staff and contracted janitorial companies that do the bulk of the cleaning and maintenance in the commercial market tend not to follow established protocols.

The organization developed a sophisticated and efficient program for its dealers, which involves taking a blueprint of the facility with the furniture layout and color coding the flooring in terms of low, medium and high traffic. Heavy traffic areas are cleaned up to six times a year, medium traffic areas about three times a year, and low traffic areas once a year. On average, 65% to 70% of cleaning and maintenance revenues come from carpet care, and hard surface makes up another 25% to 30%, with the balance coming from chair and panel cleaning.

Starnet believes that the maintenance programs help keep end user relationships active between product purchases, which generates a lot of return business when the time comes for replacement flooring. Also, because it tends to lead to end users replacing product from the same manufacturers, flooring producers are very supportive of the program.

The way Fuse Alliance looks at it, their members are service providers, and if they don’t provide maintenance, someone else will. The group has 72 members in 104 locations, and about 25% of those locations have care and maintenance programs.

The group helps its members in a variety of ways. For one, it pays an expert a retainer to work with members to develop floor care business. Also, Fuse has a partnership with XL North, a chemical and maintenance products manufacturer, which also plays a consultative role.

Just last month, Fuse announced the formation of a strategic alliance with Cintas, a multi-billion dollar service company best known for its uniform and apparel business. The firm offers a range of services, including fire protection, restroom services and walk off mats, and more importantly it offers commercial cleaning services.

According to Ron Lee, Fuse’s executive director, “The partnership expands the services available through members, ensuring their customers that their floors will continue to look great long after the installation.”

All of Cintas’ maintenance professionals are employed by the firm, as opposed to contractors or temporary labor, and they follow all the established standards and manufacturer recommendations. Cintas, which uses a patent pending high pressure steam system to deep clean any type of commercial flooring, has more than 70 floor care operations in the U.S.

Fuse’s partnership with Cintas underscores an important point when it comes to contract dealers offering floor care. Both Starnet and Fuse dealers can either do it all in-house, which can be a substantial investment, or they can work with partners. While the long-term return on investment makes going in-house an attractive financial decision, partnering still adds revenues, gives end users the same customer satisfaction and increases the likelihood of return business.

Copyright 2012 Floor Focus

Related Topics:Starnet, Lumber Liquidators, Fuse Alliance, Fuse, Carpet and Rug Institute