J&J Industries: 50 Years & Counting - July 2007

By Darius Helm

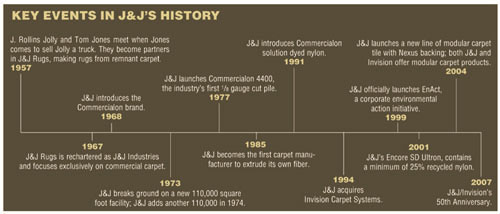

This year marks a significant milestone for J&J Industries as it celebrates 50 years in business and Jim Jolly steps aside as CEO. It’s been 40 years since Jolly joined the firm founded by his father, J. Rollins Jolly, and Tom Jones. It was called J&J Rugs back then and it made residential carpets and rugs. The year he joined the firm, though, it began specializing in commercial carpet, and that’s been the focus ever since.

And what a ride its been for both Jolly and his family owned firm. Sales have been growing steadily in recent years; they topped $170 million last year.

After he graduated from Georgia Tech, where he studied textiles, Jolly briefly worked for Chemstrand, a division of Monsanto, in Decatur, Alabama. Following a two year stint in the Army, he and his wife moved back to Dalton, Georgia, their hometown, and he began working at J&J with Tom Jones.

Jolly became president of the firm in 1986. When Tom Jones died in 1988, he became chairman and CEO as well. In the late 90s, he promoted Jim Bethel to president. Last December, Jolly retired as CEO, passing the reins to Jim Bethel. David Jolly, Jim’s son, was named president and COO.

Last month, we spoke with Jolly about J&J’s achievements over the past five decades, the challenges of today’s business, and where both J&J and the carpet industry are headed.

Q. Looking back, what are some of the key events during your tenure?

A. In 1967, we got into what we called fine gauge tufting. That was what really made commercial carpet at the time. About ten years later, in the mid 70s or so, we moved into fine gauge cut pile. Our company led the efforts in 8th gauge and 10th gauge cut pile, and that gave us a great amount of momentum in the marketplace, till other folks caught up with us.

Extrusion was probably the next thing. We were one of the first companies to move into self extrusion in the mid 80s. Our acquisition of Invision in 1994 was another key. And we reentered the modular business in 2004. We’d been in it for a number of years in the early 90s and were out for about ten years. So that’s been important to us. And the tile and tile backing joint venture we just began with Mannington is key for us.

Q. Since you became president of J&J in 1988, how have your priorities changed?

A. In the earlier years, our emphasis was to build and sustain our company. It began to grow from a smaller company into more of a corporate structure and operation. It had more management strength. And so we progressed along those lines.

In its early history, J&J was much more manufacturing driven, more product and quality driven, and not as focused on the marketplace and customers. So we worked hard over the last few years to become more and more customer focused. I think we’ve done a really good job of making that transition.

Q. What did becoming more customer driven entail?

A. Getting out into the field and listening and staying in touch with customers, finding out their needs and their desires. As opposed to making what you can make, making what they want us to make.

Q. How did that change things?

A. It certainly strengthened our product offerings. We’ve always worked hard on quality and service, so those aspects didn’t change. But I think we were much more in tune with where we needed to be with our customers and the marketplace.

Q. Where do you do your manufacturing?

A. Everything we have is here in Dalton, really, with the exception of our joint venture facility about 20 miles to our south. Everything else is strung out up and down J&J Drive in Dalton and we can pretty well go out and see everything and stay in touch with our people.

Q. Have you considered overseas manufacturing?

A. No. We’re in the process of broadening what we do internationally, but we don’t have anything on the drawing board that speaks to overseas manufacturing. In March, four of our people went to Domotex in Shanghai to try to find out more about the China market. We’ve worked corporately a lot in the past year looking at the whole world—I think it’s really summed up well in Thomas Friedman’s book, “The World Is Flat”—and we’ve spent a whole lot of time trying to understand all that’s going on and how these things are changing the way we all do business.

Q. How has Invision changed since you acquired it?

A. The company we acquired was a real fledgling company, about a year or so old. They had some beautiful designs, a beautiful concept, but they were undercapitalized and they ran into financial problems. That’s the reason they were on the market to be acquired.

So we broadened the line considerably. Putting the lines together under the common sales force really helped us. We had the line for a number of years before we finally made that move, and it’s given us a very broad offering in the marketplace, from the J&J line at one end to Invision at the other end. We cover all the major price points and market areas that are out there.

Over the years, the J&J Commercial line has had a great reputation in the marketplace for quality and value, and Invision is more the boutique line, the designer line. We really are complementary as we go into the marketplace, and we’re able to cover nearly all the ground we need to cover.

Q. Has anyone ever tried to acquire J&J?

A. Over the years we’ve had a number of potential suitors, but after the first one or two we decided we weren’t interested in being a part of somebody else. We wanted to do things our way.

Q. After 2001, when the market went south, what strategies did you come up with?

A. One of the main things we’ve done over that period of time is go back to the modular business. That’s a long term strategy. I used to say we were much more akin to a Japanese company in that we would take a long term view and we were patient. We didn’t have to worry about answering to shareholders every quarter and explaining why you didn’t make more money last quarter and so on and so forth.

We had the luxury of planning with a long term view and that’s what we continue to do. And we went through 2001 and battened down the hatches some as business got tougher, and began to work on our tile business.

Before that, though—and it was a bit unsettling—some mills started going downstream and acquiring contract dealers. When that first happened, we lost a good number of our top customers right off the bat. So we went to other customers and retrenched. But it caused us to have stronger relationships in the marketplace. Every time you have a business downturn, you just sharpen your focus and really try to stay in touch with the marketplace.

Q. Have you been targeting new markets?

A. We’re looking at some. One area that we’re not really represented in is hospitality. Where we’ll end up there, I’m not sure. It’s a little more of a specialized market.

And we’re much more focused on growing our international business. We’ve done business in Europe, we’ve done a little business in and around Japan, and we’ve done business next door in Canada, but we’re not strong in any of those areas.

Q. What market segments do you think are going to be strongest short term?

A. Markets ebb and flow with what gets overbuilt and what the economy’s doing. Hospitality really went down after 9/11 because travel was curtailed so that sector really struggled for a while.

We used to be real strong in the educational market, K through 12. We’re not as strong now. We’re more into the higher education part of that market. K through 12 has been a tough market. I think the carpet industry, unfairly maybe, has lost some of that market to hard surface. So I don’t know that I can give you a good answer to what’s best short term, other than that a lot of these markets ebb and flow.

Long term, the corporate office market is consistently the major market. It’s always been our major segment, and I see that staying strong. We’ve been pretty strong in retail. We’re seeing some of the retail chains going to some hard surface, and some even to painted floors. These things are all in flux and you just have to stay with them.

Q. Where do you think carpet tile will have the hardest time taking share from broadloom?

A. Well, in a nutshell, I’d say the future’s very strong. I mentioned that our tile is growing disproportionately compared to broadloom. I think that will continue. Years ago, when we were in the tile market, the installation was very complicated and required more expertise than broadloom. I think just the opposite is true today.

Also, designers now have some outstanding designs and colors in tile. This bodes well for the continued strong growth of carpet tile. In terms of what markets will be hardest, I think it’s an economic question. Tile typically costs more than comparable broadloom, and, all things equal, will probably continue to cost more.

As such, I think the commodity part of the broadloom business would probably be less sensitive to tile use and tile encroachment, simply because of the economics.

Q. What are your environmental goals?

A. We’re in the process of sorting out where we need to be, where we want to be and how we’re going to get there. It’s something that we’re totally committed to. We’ve had EnAct, our environmental action initiative, for a number of years, and we’ve been working kind of piecemeal back and forth for about ten years in different directions, Now we’re working on an integrated, comprehensive plan to put all this together. I think if you were to ask the question in six months, I or someone else here could give you an exact plan or picture of what we’re committed to.

One of the things we’re just really getting under way is taking back samples when they’re obsolete or discontinued. They don’t have to be J&J samples, either. We’ll take them back and put them in whatever stream we need to here and handle them responsibly.

I think the biggest change we’re going to see in our industry in five or six years is that the network for collecting will really be put together. I don’t think we’ll see any carpet going into landfills in five or ten years.

Q. Where will J&J be in five years?

A. Our strategy is to look to the marketplace. I think we’ll be doing the same business pretty much in the same way, with our commitments to our customers, our employees, our communities, so I don’t see any major changes in terms of where we’ll be in five years.

Q. How will you be involved in J&J in the future?

A. I’ll be retiring at the end of this month. At that point, I will be limited to my role as board chairman. Technically, last December Jim Bethel became CEO and David Jolly became president, and I retained the chairman title. I won’t be day to day active except in my involvement with the board.

We’ve recently enlarged and strengthened our board by adding outside directors. I’ll be involved as board chair over the next number of years.

Q. What are your own plans for the future?

A. My wife Judy and I hope to travel more. We’ve turned over more and more responsibility at the firm. But I’m on the State Board of Regents here, which oversees the 35 public colleges and universities in the state of Georgia. I’m on a couple of different college boards and foundations. I don’t know why I’ve ended up with all these educational things, but it seems I have. And I’ve gotten involved with land and timber. And I want to do more with the church. So those are the things I stay pretty busy with and will continue to.

A couple of months ago, I hit my 40 years at J&J. It’s certainly been a fast 40 years.

Copyright 2007 Floor Focus

Related Topics:Domotex, The International Surface Event (TISE), Mannington Mills