Fiber: Independent Producer Update - Mar 2016

By Darius Helm

Last year, domestic fiber consumption was nearly flat in units, with commercial fiber slightly more active than residential fiber. However, increases in monomer and raw material capacities, combined with artificially low crude oil prices, have reduced the cost of fibers, and this has helped carpet mills compensate for PET-driven lower carpet prices with improved margins. However, the last few years have seen significant investments in domestic fiber extrusion, and the industry is now sitting on an excess of capacity.

Total U.S. fiber consumption, with all fiber types combined, has been about flat since 2009, averaging 2.15 billion pounds annually. Compared to 2000 through 2006 (which includes the dotbomb recession) where the average annual domestic consumption was over 3.4 billion pounds, consumption in the last seven years is down by about a third.

These numbers are dramatic, but there’s no real mystery to them. They reflect an accounting of the impact of the Great Recession, embodying both reductions in units sold and reductions in face weights. But what’s interesting is how dynamic that 2.2 billion pound face fiber market has been in the last seven years—how much share has changed hands between fiber types, and how much everything from technology at one end to marketing at the other has impacted those shifts in share.

FIBER TRENDS

Over the last decade, polyester (PET) filament has transformed the U.S. carpet industry. It took the lower end of the carpet market away from nylon, arguably slowing the bleeding of marketshare to hard surface flooring, though there’s no way to quantify that. But by pushing carpet prices down and pulling nylon behind it, PET forced residential carpet mills to rethink their strategies. Their first response was the ultra-soft fiber campaign, which was launched about four years ago, most prominently by Invista with Stainmaster TruSoft and Mohawk with SmartStrand Silk—along with Shaw, which developed an ultra-soft Anso Caress nylon 6 as well as ClearTouch PET.

The ultra-soft program was well-conceived, a lush and cozy evolution of broadloom construction designed for the parts of the home where carpet’s share was strongest—bedrooms, dens, upstairs corridors and other private spaces. But its initial momentum has not been sustained. Complaints about vacuuming problems may have held it back to some degree, along with soiling issues and that unmade bed look that comes from latent traffic impressions on soft carpet. These days the refrain is that customers have rebounded from those ultra-softs and have settled at soft-enough, like 7 DPF (denier per filament) nylon, which is not as soft as TruSoft and others but not as coarse as the original Tactesse and Anso Caress soft fibers.

While Invista, Mohawk and others really launched that ultra-soft campaign as a united front, the second campaign clearly has a leader. Invista’s Stainmaster PetProtect program, launched in early 2014, didn’t use new technology or new banks of colors. It used marketing. Invista’s solution-dyed SolarMax fiber, marketed for its fade resistance, was basically rebranded as Stainmaster PetProtect. The solution-dyed cationic fibers are treated with anionic resins, which essentially block any open dye sites and thus prevent staining, and a surface treatment helps prevent pet hair from clinging to the fiber. And Stainmaster’s complete PetProtect program includes a pad with a moisture barrier to prevent spills from seeping through.

The PetProtect program and similar carpet mill programs all use solution-dyed fiber. And the vast majority of the polyester BCF (bulked continuous filament) that has come on the market in the last several years is solution-dyed and naturally stain resistant. So coming from both the higher and lower end, solution-dyeing of nylon and polyester has become a significant trend in the residential market—and it already accounts for the majority of commercial carpet.

In the midst of all these transformations, and all the shift in share from nylon to PET, there is one unconditional success story, a program that has grown in the market for over a decade, and that’s Mohawk’s SmartStrand. The triexta (PTT) fiber is made from DuPont’s Sorona, with 37% bio-based content. It performs well, is naturally stain resistant and has also benefited from savvy multimedia marketing campaigns. And it’s a big program, by some estimates accounting for 8% of the total U.S. carpet fiber market. And Mohawk has continued to evolve the product. Its SmartStrand Silk arguably has the softest hand in the industry, and its SmartStrand Forever Clean, introduced last year, addresses the trend toward pet protection, and anti-soil and anti-stain in general, with a fiber system that uses a “nanotechnology spill shield.”

One more noteworthy trend is finer total deniers. Invista, for instance, has come out with an Antron Lumena with an 895 denier. These finer denier products are less efficient to twist, and this has put pressure on existing twisting capacity. Universal Fibers, for instance, has used up its internal capacity and is looking for strategic partnerships for more twisting.

|

BIO-BASED NYLON BREAKTHROUGH |

|

Two Iowa State University engineers have come together to develop a new process for producing bio-based nylon 6,6 by combining a genetically engineered strain of yeast and an electrocatalyst to turn sugar into nylon. The new hybrid technology results in much higher conversion rates than earlier processes, offering many advantages that should appeal to fiber producers: the reaction takes place at room temperature; it uses a cheap, abundant metal instead of much pricier metals like platinum and palladium; and the other compounds in the process are derived from water. |

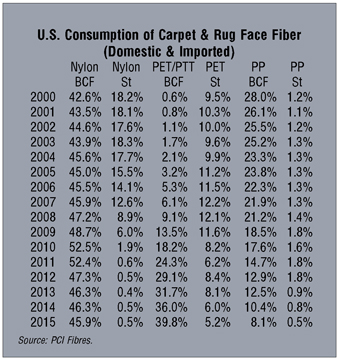

FIBER BY THE NUMBERS

The biggest part of the market is nylon BCF, which includes both nylon 6 and nylon 6,6. Last year, nylon BCF was almost flat with the previous year, at 1.005 billion pounds, up from 1.003 billion in 2014, according to PCI Fibres. However, share fell a bit, from 46.3% in 2014 to 45.9% last year. And nylon staple, which is 1% of the size of nylon BCF at 10 million pounds, was also flat, as was marketshare.

The fastest growing fiber type is polyester BCF, which includes PET and PTT—both use purified terephthalic acid (PTA) as their main ingredient, though the resulting polymers are substantially different. That category was up over 11% in volume compared to 2015, from 781 million pounds to 870 million. Share rose 3.8% to 39.8%. Polyester staple, which is an eighth the size of BCF, was down to 113 million pounds to from 130 million, with share going from 6.0% in 2014 to 5.2% last year.

Polyester staple has continued to lose ground, though it has received a boost in the last few years in nonwoven automotive carpet, which has taken share from nylon BCF automotive carpet among many vehicle manufacturers due to its lower cost.

While polypropylene is used in some carpet face fiber, it mostly goes into machine-made area rugs. Last year, polypropylene BCF went from 225 million pounds to 178 million pounds, and share fell from 10.4% to 8.1%. Polypropylene staple lost a third of its volume, falling from 18 million pounds to 12 million pounds, barely bigger than nylon staple.

SHIFTS IN POLYESTER SUPPLY

Until recently, BP was the only U.S. based supplier of PTA, which is used to make PET and triexta. However, in November BP agreed to sell its Decatur, Alabama PTA plant to Indorama, a Thai chemical firm and the world’s largest manufacturer of PET resins. BP still has PTA production in South Carolina.

Also, Italy’s M&G Group is building a huge PET resin plant in Corpus Christi, Texas, where it’s also building a PTA facility with more capacity than it will need. So now there will be an abundance of domestic monomer and resin capacity for PET fiber production, and the market will be more competitive.

At the same time, anti-dumping judgments against bottle resin producers in China, India, Oman and Canada were passed at the end of last year, with China receiving the stiffest penalty at over 100%. Bottle resin is the type of PET used in carpet fiber. This has already impacted import volumes, with China more or less exiting the market.

NEWS FROM INDEPENDENT PRODUCERS

The leading independent producer, and the market leader in nylon 6,6, is Invista, which goes to the residential market with its Stainmaster brand and to the commercial market with Antron. According to the firm, 2015 was a growth year, despite a flat residential carpet market.

On the residential side, the main focus for the last couple of years has been on PetProtect, the solution-dyed SuperiaSD fiber system introduced at Surfaces 2014. In 2014, most of PetProtect’s growth came from the home center channel—Lowe’s, specifically—but last year saw the most growth in the specialty retail channel. And the firm expects both channels to post growth this year.

The firm currently has eight mill partners—nine, if you count Dixie Home and Masland as two—and a total of 115 PetProtect products on the market, 40 of which are new this year.

Invista also takes PET carpet fiber, produced to its specifications, under its Stainmaster brand to both the home center and specialty retailer channels. The program has been going for a couple of years, and according to the firm, it’s gaining traction with independent retailers, thanks in part to expanding the offering into the Stainmaster Flooring Center channel. However, at least for now, most of the growth is with Lowe’s Stainmaster Essentials program. Simply Stainmaster is how it’s branded to specialty retailers.

Last year, Invista introduced two new low-luster residential nylon fibers, one Luxerell and one TruSoft. Luxerell is a medium soft fiber and TruSoft, a 4 DPF product, is Invista’s softest fiber. A third of last year’s new introductions used the new fiber systems.

PetProtect currently comes in 33 solution-dyed colors, with more to come later this year. Globally, PetProtect has not yet created much of a buzz, though it has been well received in Australia.

On the commercial side, Invista had a fairly good year, with increased activity in the hospitality, institutional and healthcare markets. Much of Invista’s commercial focus has been on revitalizing its Antron Lumena solution-dyed program. Lumena has been around for about a quarter century. As tufting gauges have increased, the firm has developed finer denier yarn systems. A couple of years ago it came out with an 895 denier Lumena in 105 colors, and this year it’s introducing 23 more. That’s on top of the 200+ colors in Lumena’s 1245 denier portfolio.

One of the leading independent fiber producers, both globally and in the U.S., is Aquafil, a privately owned company with half a dozen facilities in Europe, Asia and North America, including its Calhoun, Georgia operation, which includes both extrusion and carpet recycling. Last year was a growth year globally, with business flat in the U.S. while Europe beat all expectations. The firm focuses its business on the commercial market, andthe bulk of its products are nylon 6. It also makes fiber for automotive carpet.

While Aquafil is known for its premium Econyl nylon 6 brand, a 100% recycled content fiber, with half of that from post-consumer sources, Econyl actually only accounts for a third of sales. However, in the U.S. most of Aquafil’s revenues come from Econyl. Post-consumer Econyl content comes half from fishnets and half from reclaimed carpet—a lot of which is sourced from U.S. carpet reclamation.

The firm is currently launching a new Econyl product called StayClean, with stain resistance both from solution-dyeing and a stain resistance treatment. Other projects are in the works, with details to be revealed later this year.

Universal Fibers, another commercial specialist, also reports a fairly strong 2015. The firm makes a wide range of fiber types, with facilities in the U.S., Europe and Asia. It’s headquartered in Bristol, Virginia, producing mostly nylon 6,6 and 6, along with PET and triexta. The firm makes the fiber for J+J’s polyester Kinetex product. Another big piece of the firm’s business is automotive carpet fiber, and it also does some residential business, mostly in accent yarn. Last October, H.I.G. Middle Market, an investment affiliate of H.I.G. Capital, acquired Universal Fibers. Commenting on the acquisition, Marc Ammen, CEO of Universal Fiber Systems, said, “We have invested in each and every one of our facilities, and this will further our momentum.”

The firm has also retooled its approach to sustainability, developing a five-vector approach: social equity, material content, certification, impact and chemical transparency. Over the last year, the firm switched certifying bodies, and now works with Green Circle Certified. It has already audited its domestic facilities and is currently working on its facility in China. And last year the firm added to its Refresh nylon 6,6 offering, coming out with Refresh 75 with 10% post-consumer content and 65% post-industrial content.

In addition, Universal is also refocusing on product development and innovation, including investing in new equipment.

Pharr Yarns has a complex operation, producing various standard and specialty fibers for its extensive network of partners through its yarn facilities in North and South Carolina. The firm makes every type of fiber, though it mostly focuses on nylon and PET. And since its acquisition of Phenix Flooring at the beginning of last year, more than half of what it runs now goes into Phenix residential carpet. Phenix manufactures both nylon and polyester carpet. Last year, Pharr stopped producing wool yarn, and it’s not doing much triexta either.

Pharr is also the largest processor of Invista’s Stainmaster PetProtect yarns, and it makes Stainmaster’s PET as well. And it makes a lot of accent yarns and other specialty products for the big mills, along with meeting the standard face fiber needs of many of the smaller mills, both in the U.S. and abroad.

This year, Pharr is investing in forecast and planning technologies to maximize operational efficiencies and optimize its execution of its diverse portfolio of yarns. The firm serves the global market, exporting about 15% of its product.

Pharr does space dyeing on Belmont machinery, and last year the firm replaced its earlier generation of Belmont and knit-to-knit technology with two new state-of-the-art Belmont machines with full eight-color capability, offering customers improved styling and versatility.

Ascend is one of a handful of nylon 6,6 producers in the world, and along with Invista it pretty much controls adiponitrile, a key nylon 6,6 ingredient. About half of Ascend’s sales are in the U.S., and it also sells to Europe and Asia. Most of its business is in the commercial market, but demand for residential fiber has been growing, and the firm developed a soft BCF nylon a couple of years ago with multiple dye levels and lusters to serve that market. Also, its Ombre platform of nylon with variable dye affinities along its length, a commercial product, now also goes to the residential market.

Ascend doesn’t make solution-dyed fiber. It produces white dyeable fiber with multiple dye levels, along with polymer for solution dyeing and staple, which is sold in bales. It also sells specialty fibers like its No-Shock antistatic fiber. Its staple fiber is largely used in saxonies and velours, and as the nylon component of 80/20 wool/nylon Axminsters.

Last year was about flat for Ascend, with Europe up, Asia down and the U.S. flat in units. The firm reports that it has been expanding its offerings in both staple and BCF, including lusters and dye levels, to serve the growing market in Europe. It’s also focused on new product development. All of Ascend’s production is in the Southeast, in South Carolina, Florida and Alabama.

Zeftron is a business unit of Shaw Industries with outside fiber sales, producing nylon 6 for a range of carpet mills. Over the last year, it has added colors to its solution-dyed portfolio: seven colors in its metallic looking Reflective Elements, introduced last October; nine in its Designers Select collection of contract neutrals; and seven in its Brilliants collection, whose main market is hospitality.

Because the firm supplies a lot of smaller mills that aren’t vertically integrated, service is paramount, and Zeftron works closely with its mill partners, tailoring its efforts to their specific needs. And that includes helping with launches, PR and marketing efforts. It will even develop custom colors for mill partners.

In addition to its solution-dyed offering, Zeftron also produces white dyeable nylon. Most of its product goes to the commercial market. Production facilities are in Dalton.

DuPont serves the carpet market through its Sorona PTT polymer, which Mohawk turns into SmartStrand residential fiber. Sorona is produced in Kinston, North Carolina, and since 2007 has featured 37% bio-based content. Sorona is also made in Yuhua, China, serving the Asian market, though Mohawk’s SmartStrand business accounts for the vast majority of Sorona production. Overseas carpet mills using Sorona include Fletco, Balta and Lano in Europe, Voxfloor and Shanhua in China, and Godfrey Hirst in Australia. Godfrey Hirst is the only mill making residential Sorona carpet other than Mohawk, which has an exclusive North American licensing deal to produce residential carpet made from Sorona.

In the U.S., commercial Sorona fiber has not really taken off. Mohawk has scaled back its already modest program, and most mills are reluctant to produce carpet from it due to the cost of production—its premium price and the cost of fiber treatments.

DuPont is in the midst of a merger with another chemical giant, Dow, which should be completed in the second half of this year. Then it’ll take a year or so to split the new entity into three units: specialty products, agricultural and material sciences.

|

A GREEN POLYESTER PARTNERSHIP |

|

Two Dutch firms, DSM and Niaga, have partnered to produce a fully recycleable (face fiber to backing) PET carpet. DSM is a global science-based company—in fact, it was the firm that built Shaw’s Evergreen Nylon Recycling plant in Augusta, Georgia, back when it was still owned by Honeywell. Niaga is focused on sustainable materials solutions. |

Copyright 2016 Floor Focus

Related Topics:Mohawk Industries, Masland Carpets & Rugs, Shaw Industries Group, Inc., Universal Fiber Systems, The Dixie Group, Phenix Flooring