Innovation: Valinge Wood Fiber Floors - June 2011

By Darius Helm

Every few years, someone comes along announcing a game changer in the flooring industry, and all too often even the good ideas don’t live up to the initial promise. However, when Välinge’s Darko Pervan makes such pronouncements, it may be worthwhile to sit up and take notice. After all, Pervan was the central figure behind the invention of laminate flooring at Sweden’s Perstorp back in 1977, and as head of Välinge he was also behind the first glueless locking system in 1995. Both inventions did in fact transform the flooring industry, so he has a solid track record.

Välinge first previewed its wood fiber flooring (WFF) technology in the U.S. market at Surfaces 2009, and what was most notable back then was the toughness of the wear surface, with Taber tests indicating that it outperformed not just standard laminates but glazed porcelain as well. The product replaces the surface paper layers with a wood dust mixed with binders and aluminum oxide, all ground up as fine as talcum powder. In addition, the product can be floated or glued down.

Back then, the biggest limitations were in design. The product, though heavily textured, only offered limited visuals—not very memorable. As such, it would have had limited application in both the residential and commercial markets.

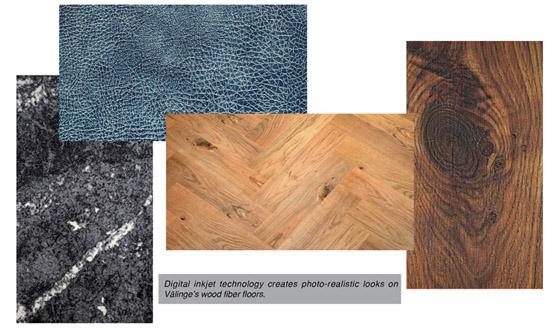

Things have changed. A recent tour of the Välinge operation in Viken, Sweden immediately revealed that breadth of design is no longer a barrier. In fact, by integrating digital inkjet technology into the production process, wood fiber flooring now offers design definition on par with the best the flooring industry has to offer. During the tour, editors from the U.S. and Germany had the opportunity to examine under a microscope a wood look WFF printed from a photograph taken less than two hours earlier, and its precision and accuracy were impressive.

So digital inkjet technology has helped WFF achieve cutting-edge aesthetic capabilities. Any look and texture is achievable, including in-register designs, and on top of that it’s easily customizable. Its closest competition is glazed porcelain, but in a faceoff WFF would hold the advantage, since it offers a more wear resistant surface and greater dye penetration—and of course it’s warmer underfoot. Porcelain’s advantage would be limited to applications in wet areas.

Over the last few weeks, Floor Focus has reached out to key figures in several of the leading laminate firms to get their impressions of the new technologies. While a few expressed skepticism about the design capabilities (largely because they were unaware of the digital inkjet capabilities), most were concerned about the cost—of the technology, of the licensing, and of the operating expenses.

However, according to Välinge, the cost of the system is one of the biggest advantages. A single powder scattering machine, which requires about two feet of space on the production line, costs about $70,000. The cost of creating a complete system, with two or three scattering machines—for easy changeover or to create products with multiple colors in different layers—along with an automated powder delivery system and digital inkjet technology would (loosely speaking) probably run from run about $700,000 to $1 million or so, with digital inkjet technology accounting for perhaps half of the total investment.

In addition, it’s only the middle of the production line that needs to be modified, and in fact it can be modified to handle both powder and traditional paper systems. Tarkett’s European laminate facility has already started production of the powder based products, having modified its equipment to run with both powder and paper. Other powder technology licensees include Kronotex and Meisterwerke.

In terms of operating costs, Niclas Håkansson, Välinge’s executive vice president of research and development, claims that, though a full-blown system with very deep embossing and extreme wear properties exceeding AC6 will cost more to run than a standard direct pressure operation, the use of digital inkjet technology to eliminate paper layers on top, “make the calculation even more attractive.” In addition, the firm is working on an innovation to replace the paper layer on the bottom.

There’s also another factor to consider. The value of a wood fiber floor that makes full use of the complete system—with deeper texture than laminate flooring, greater durability and enhanced visuals that are also easily customizable—far exceeds the value of any laminates out there. Pervan believes that WFF would be best positioned, at least initially, to target price points in the intersection between high end laminates and glazed porcelains.

Perhaps most significantly, this is a product suitable for a broad range of commercial applications, markets that traditional laminate flooring has never been able to successfully penetrate. Glazed porcelain with digital inkjet technology is hugely popular right now, but on the commercial side it’s not as prevalent in heavy commercial applications, leaving a large swath of the market potentially available to wood fiber flooring.

While Välinge anticipates large scale adoption of the technology among both newcomers and existing licensees of its other technologies, it is also prepared to offer full scale production for clients within its own facilities. The firm’s new 180,000 square foot support and R&D facility includes an 86,000 square foot production area. In addition, the firm owns a huge tract of adjoining land and is prepared to build a large scale production facility to produce WFF for partners or, if necessary, to go to market directly. If the firm does not find a U.S. licensee, it is also prepared to build its own manufacturing facility in the U.S.

In late April, Välinge Invest AB, which is owned by the Pervan family, bought all of Nordstjernan Invest AB’s shares in Välinge Flooring Technology. The Pervan family now has a 60% share and controlling interest of Välinge International AB, which had revenues of $84 million last year and pre-tax profits of $33 million. The balance is owned by Kronotex and Kronospan. A new board of ten members is being assembled. The firm will hold its 2011 Expo in September in Viken, Sweden.

Copyright 2011 Floor Focus

Related Topics:Tarkett